A proposal: Do nothing with Uniswap’s liquidity incentives

To recap: Uniswap’s initial liquidity mining rewards ran from September 18th to November 17th. 20 million UNI were distributed to liquidity providers for four trading pairs (5 million UNI each) — ETH/USDT, ETH/USDC, ETH/DAI, and ETH/WBTC.

At the current UNI price, the distributed amount is worth about $70 million.

To put this in perspective, 20 million UNI is 2% of the UNI supply after four years and 13.3% of the initial supply. The initial supply at launch was 150 million UNI, distributed to traders and liquidity providers who had previously interacted with the protocol.

The rest of the distribution is as follows:

- 350 million UNI will be vested during the first year to the community treasury, team, investors, and advisors. In the second year, that number will be about 250 million, then 150 million in the third year, and finally 100 million in the fourth year.

- After the initial release schedule, there will be 2% ongoing inflation in perpetuity.

The community treasury will retain 43% of tokens intended for community grants, community initiatives, and liquidity mining programs. The treasury currently has 137.7 million UNI, an amount worth approximately $500 million.

Source: Uniswap.org

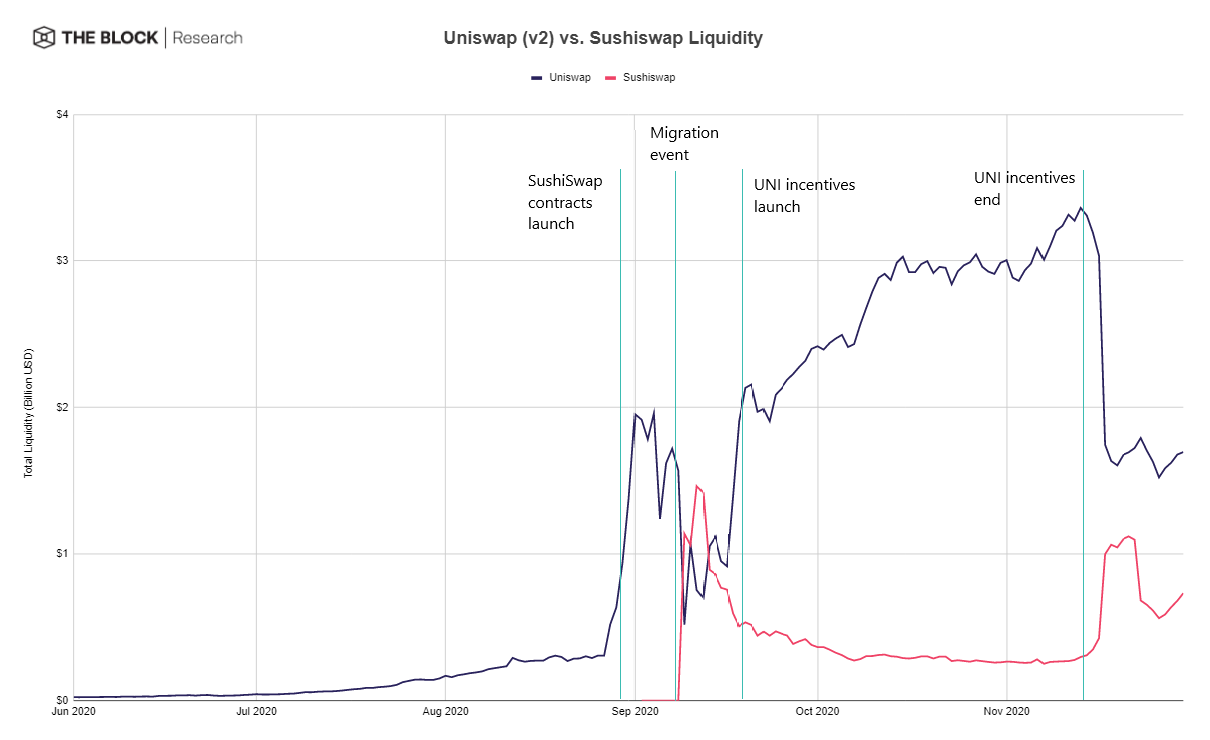

The initial UNI launch can be seen as a direct response to the parasitic behavior of other protocols, namely SushiSwap. In late August and early September, SushiSwap (mostly a clone of Uniswap) launched a “vampire attack,” giving Uniswap liquidity providers an incentive to migrate over in exchange for tokens.

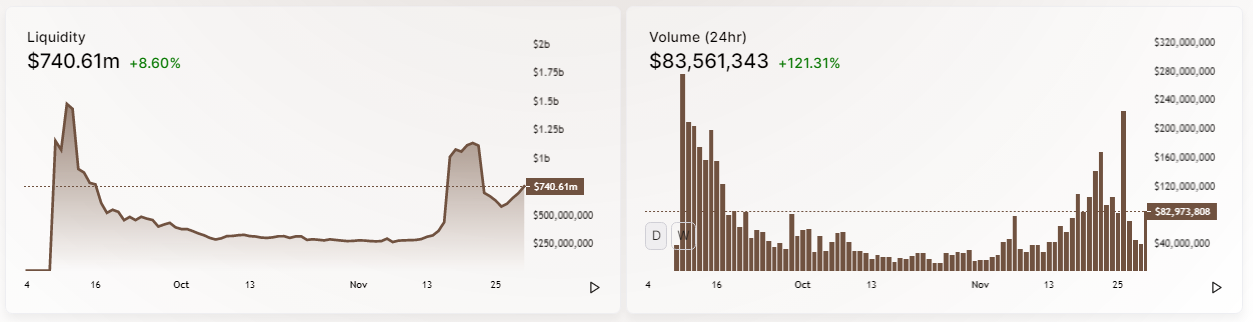

Due to SushiSwap’s liquidity incentives, Uniswap’s liquidity began to build up in anticipation, growing from $300 million to $1.96 billion. Note that Uniswap’s liquidity started increasing because of another protocol’s parasitic behavior. After migration, Uniswap’s liquidity to $518 million on September 9th — a 73.6 percent decrease. Conversely, liquidity on SushiSwap grew from practically zero to $1.4 billion in a week.

This proved that liquidity providers are mercenaries that will follow short-term incentives. If the yield — whether subsidized and sustainable or not — is better elsewhere, liquidity will migrate.

If the (or at least a) goal of the UNI token was to stop the liquidity migration, it seems to have worked. In a few days around when liquidity mining started, Uniswap more than doubled its total liquidity to over $2 billion.

Source: The Graph

Additionally, Uniswap distributing 400 UNI to every address made it one of the most distributed tokens immediately. 90,000 addresses — provided they did not immediately sell — automatically owned more than $1,000 worth of UNI or 0.00004% of the protocol.

Source: Etherscan

A third benefit is that many new liquidity providers were incentivized to learn about Uniswap and provide liquidity to the protocol. These liquidity providers made money on their initial investment and now better understand the risks and benefits of providing liquidity to an automated market maker (AMM). After the rewards, these liquidity providers are more likely to stick with the protocol (data on this later).

Community plans

With liquidity mining rewards finished, the obvious question remains: what to do next? The Uniswap community controls a large treasury worth $500 million and can allocate funds towards the continued growth of the protocol.

Any governance proposal requires 4% or 40 million UNI in favor, and a majority vote, to pass. 10 million UNI are required for a proposal to be submitted.

Source: Dune Analytics (lsquared)

There are two primary proposals right now for continuing the distribution:

- Continuing the rewards at similar levels per pool, but only for the ETH/WBTC and ETH/USDT pools. This was suggested by Robert Leshner, the founder of Compound. It’s worth noting that Compound has the fourth-most UNI delegated to them at 13.2 million UNI — enough to submit proposals.

- Cutting the rewards by half, but keeping the same pairs. This is being driven by some active community members. This proposal is the most prominent and has been the focus of discussion community calls. These have been the primary venue for community governance.

The primary arguments for continuing the distribution are:

- Liquidity mining is useful for distributing UNI to the community, further decentralizing ownership and governance.

- UNI is distributed to users who provide value (i.e., provide liquidity) to the protocol. This aligns future ownership with valuable users.

- The incentivized pools will remain among the most liquid decentralized exchange (DEX) trading venues, leading to competitive prices.

Right now, the community member-driven vote has passed an initial temperature check and then a consensus check on the Uniswap snapshot page. The initial temperature check is meant to determine if there is sufficient interest in changing the status quo (at the moment, no liquidity mining rewards), and the consensus check establishes a discussion around a formal proposal.

With these steps passed, a formal governance proposal will be submitted. There will be a seven-day voting period, and after a two-day timelock, the code in the proposal will execute. Currently, the proposal that will be voted on is under development.

Trade volume analysis

First, it’s worth noting that the data is more than noisy.

The liquidity mining rewards ended just ten days ago and it’s hard to reason about the long-term implications of the departed liquidity. DEX volumes have fluctuated wildly during Uniswap’s liquidity mining period, and it’s hard to project what could have happened vs. what did happen.

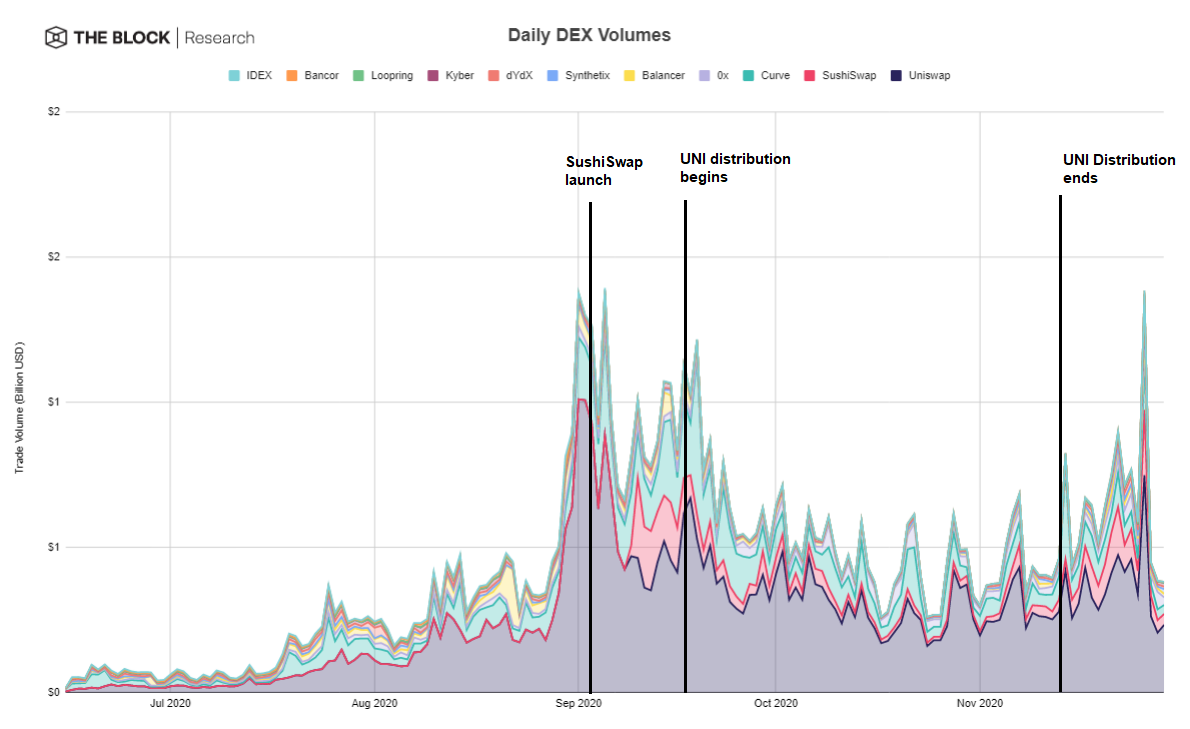

DEX volumes saw a surge starting from the final week of August, and peak activity ran through the first week of September. During this period, DEXs had an average of $842.3 million in daily trade volume. After that, the trendline has been down (except for an outlier event on October 26th due to a hack). The lowest seven-day period since was the 18th through the 25th of October at $434.9 million.

Since the final week of October, volumes have climbed steadily but remain 22.5% below the peak numbers since Uniswap’s liquidity mining ended.

Source: Dune Analytics (hagaetc)

To put this into context in the Uniswap timeline, peak volumes happened two weeks prior to liquidity mining started — and much of the liquidity mining period was during a downturn in volumes. In the two weeks before liquidity mining ended, the average daily volume was $294.6 million. Since then (in two weeks), it has been $363.3 million.

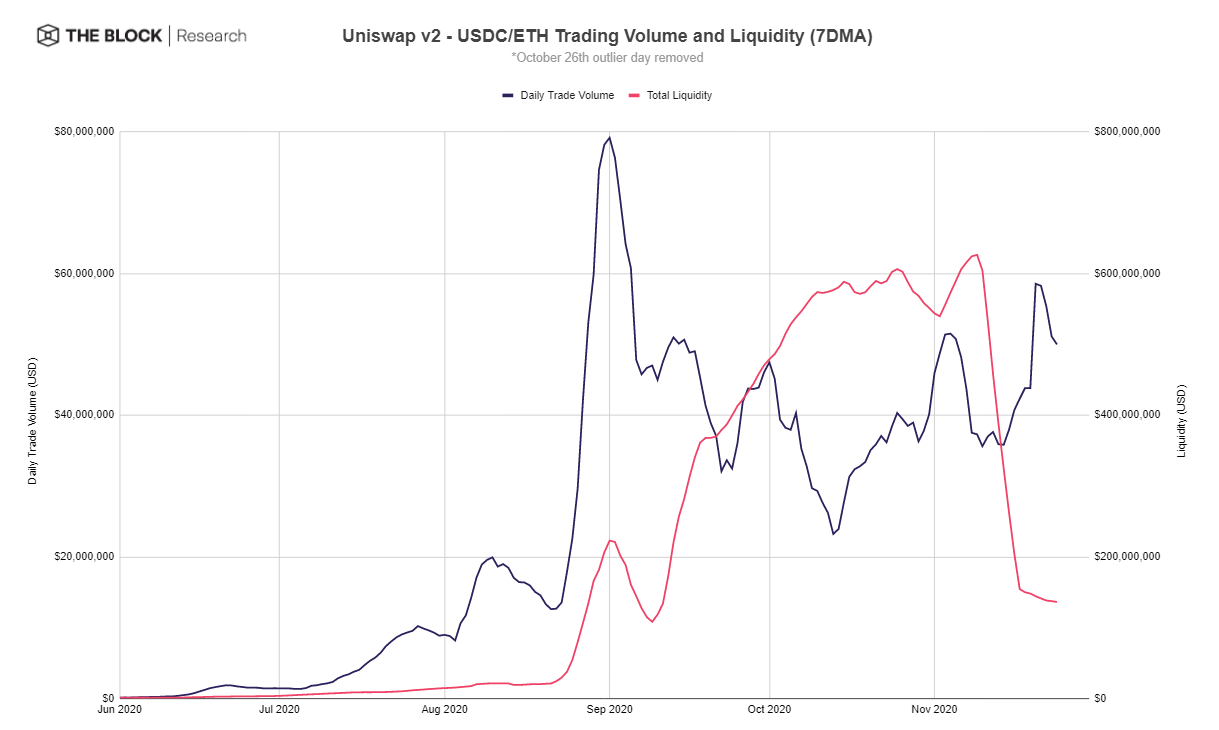

Over two weeks prior to the distribution, liquidity quickly grew from $300 million to $1.9 billion, and volumes increased alongside that growth. This coincided with the trade volume peak and the most active time in liquidity mining.

It’s worth noting that as liquidity increased, volume decreased and vice-versa. Uniswap’s trade volumes are (at least in the short-term) trending up.

Source: The Graph

A similar effect can be seen on the pair-specific volumes for the USDT, USDC, DAI, and WBTC pairs that received subsidies. This does not mean that the additional liquidity does not help, but it does hint that liquidity mining is not required to support existing or even higher volumes.

Source: The Graph

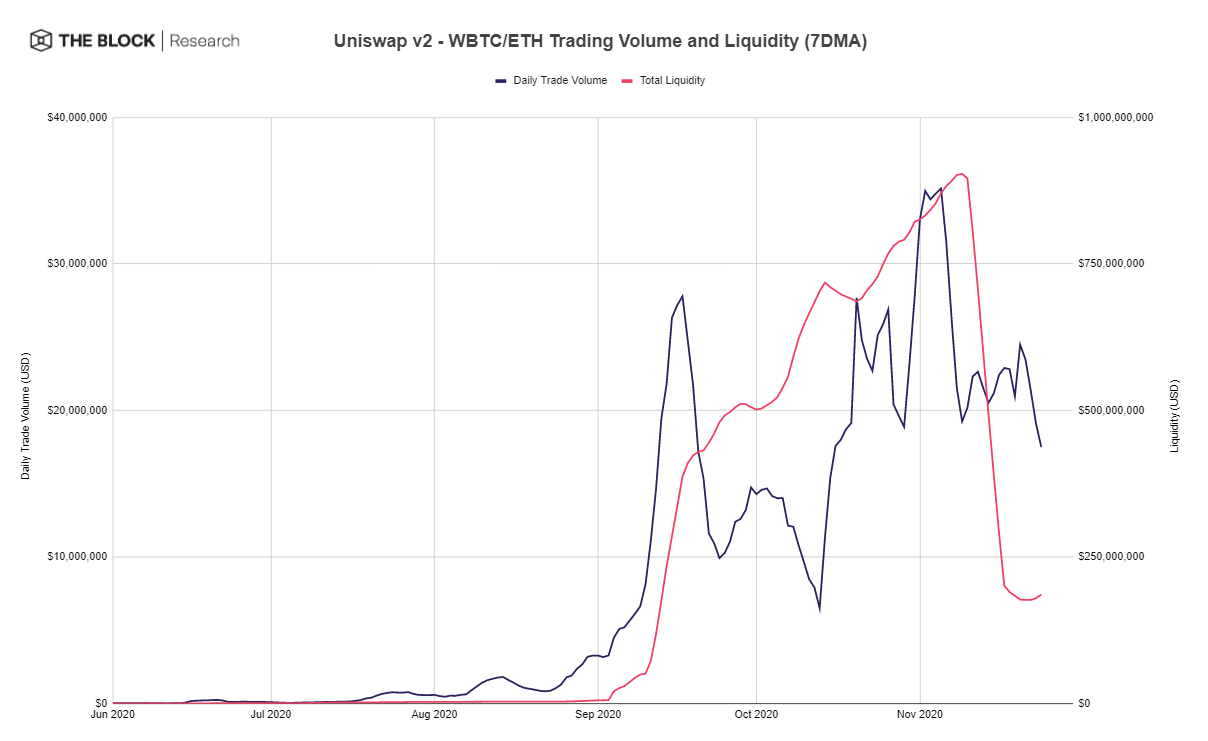

The WBTC/ETH pair has seen the highest correlation between liquidity and trade volumes, but at least for the first fourteen days since the rewards ended, volumes have stayed on-par with the trendline.

Source: The Graph

Some impact from the liquidity mining can be seen from the chart below. If you look at the share of trade volume from the subsidized pairs within Uniswap, there’s a material change from ~37% to ~50% after the liquidity mining rewards started.

This would indicate that the pairs might have received some extra volume due to the additional liquidity. Since the subsidies ended, the market share for the four pairs in question has remained relatively steady.

Source: The Graph

Meanwhile, the share of liquidity that came from the subsidized pairs grew more notably, from 30% to 75%. If extra volume was achieved, it required an outsized amount of liquidity.

Source: The Graph

The volume data can be noisy, and it’s hard to separate what would have been organic growth from the impact of liquidity rewards. However, trade volumes peaked before liquidity mining and the trendline has been up since they ended.

A simple test for the effectiveness of liquidity mining rewards is to look at the impact on market share.

Here, Uniswap has not lost any ground. The month and a half before, during UNI rewards, and in the two weeks after — the market share remains the same.

A counterpoint to Uniswap’s metrics is to note that, by contrast, SushiSwap’s trade volume and liquidity seem to be directly correlated. SushiSwap has grown to be the third-largest DEX by volume, achieving an 11.8% market share in November.

Source: SushiSwap Vision

To tie the volume analysis together, the most charitable interpretation is that UNI rewards had a minor impact on overall trade volumes. Based on the data, market cycles seem to affect volumes much more than incentives.

This leads to the first major criticism of the liquidity mining rewards. First, the actual market share and volumes were not impacted by the program. This has happened in multiple ways:

- The market share of Uniswap itself compared to other protocols is unchanged.

- A minor relative volume increase required incentives, which massively changed the share of liquidity for specific pairs. For $65.4 million, the reward can barely be seen from the charts.

Uniswap’s strength in numbers

A bigger picture argument against subsidies is that, due to the immediate drop in liquidity, it does not seem like token rewards produce defensible network effects. Liquidity providers are mercenaries who will chase the best yield from wherever they can, whether it comes from Ponzi-like economics or from sustainable cash flows. The moment the incentives disappear, the liquidity is gone.

Additionally, large liquidity miners tend to sell quickly instead of becoming long-term holders. This can be seen from the relative price performance of UNI, compared to other projects during the liquidity mining period. For large capital, UNI distribution is wasted marketing spend.

Source: SushiSwap Vision

Endlessly trying to out-gift every other protocol with tokens is a losing game. If DeFi grows outside of the current crypto bubble, the competition will only increase — it’s likely SushiSwap’s vampire attack is not the final or most aggressive iteration of such behavior we will see. There simply has to be more ways to build sustainable advantages for protocols.

To be fair, there’s actually a counterpoint in the data against this.

The number of liquidity providers has doubled since the rewards started. Capital has fled, but many users have not. The average liquidity provider is now smaller, suggesting that the whales have left. This has some value — probably more than just the precise dollar figure each user is currently contributing.

Source: Dune Analytics (danrobinson)

The chart above supports the idea that many users got into Uniswap liquidity provision because of the incentives and have probably since learned a lot about how to interact with the protocol. Arguably, for now, most potential liquidity providers that would have been interested have been attracted — perhaps this strategy works again later on if the number of DeFi users has jumped.

There’s a broader point to make here, which is that Uniswap’s strength is in numbers. Uniswap has by far the most users among crypto protocols today and is on a completely different planet from the other protocols.

Uniswap had 5.8 times the trade volume as Curve in the past week, but 69.8x more users.

Source: Dune Analytics (hagaetc)

Uniswap has come a long way in providing levels of liquidity that are comparable to centralized exchanges. For example, according to Coingecko on a USD(T/C) to ETH swap, $2.9 million market order will cause a 2% slippage. On Coinbase Pro, a 2% market move requires just $385,000.

To counter, there are markets where it’s currently difficult for Uniswap to compete (potentially at least until v3 arrives), no matter how much liquidity. A 1 million USDC to DAI trade causes 2.8% slippage and incurs 0.6% in fees. On Curve, there’s virtually zero slippage on the same trade. This is because of how the Curve optimizes for swaps between assets that are price-stable to one another (e.g. stablecoin to stablecoin swaps). While this brings some structural risks, it also has benefits.

Additionally, for very large trades for the major assets, OTC desks will still be able to quote the best price.

Most Uniswap trades are small enough that slippage does not play a role. Based on 60,000 ETH/USDT trades, the percentage of trades over dollar thresholds were:

- $100k, 0.73%

- $10k, 7.4%

- $1k, 35.1%

- $100, 81.3%

Source: The Graph

Conclusions

One can look at the charts all day, and the conclusion is that it’s hard to say what the value of liquidity mining rewards is and will be.

Based on the historical data, it’s not obvious that a $20 million per month subsidy is justified at this point if gaining volume and market share is the goal. Total value locked is a vanity metric, and what matters is the number of users and volume.

The community treasury will have 460 million UNI at the end of the four-year vesting period, and spending 5 million of that implies a 92-month runway. To be fair, that’s not an insane spend either.

In addition to the competition, the value-add of UNI rewards is that it’s meant to align valuable users (liquidity providers) to grow the protocol, and overall distributing ownership makes for a more decentralized base.

If the goal is a decentralized ownership distribution, it’s likely that we should look further into the future before rewarding users of the protocol. After all, the crypto and DeFi community is made up of primarily a small group of hobbyists. Front-loading the distribution now is actually antithetical to the goal of broader distribution.

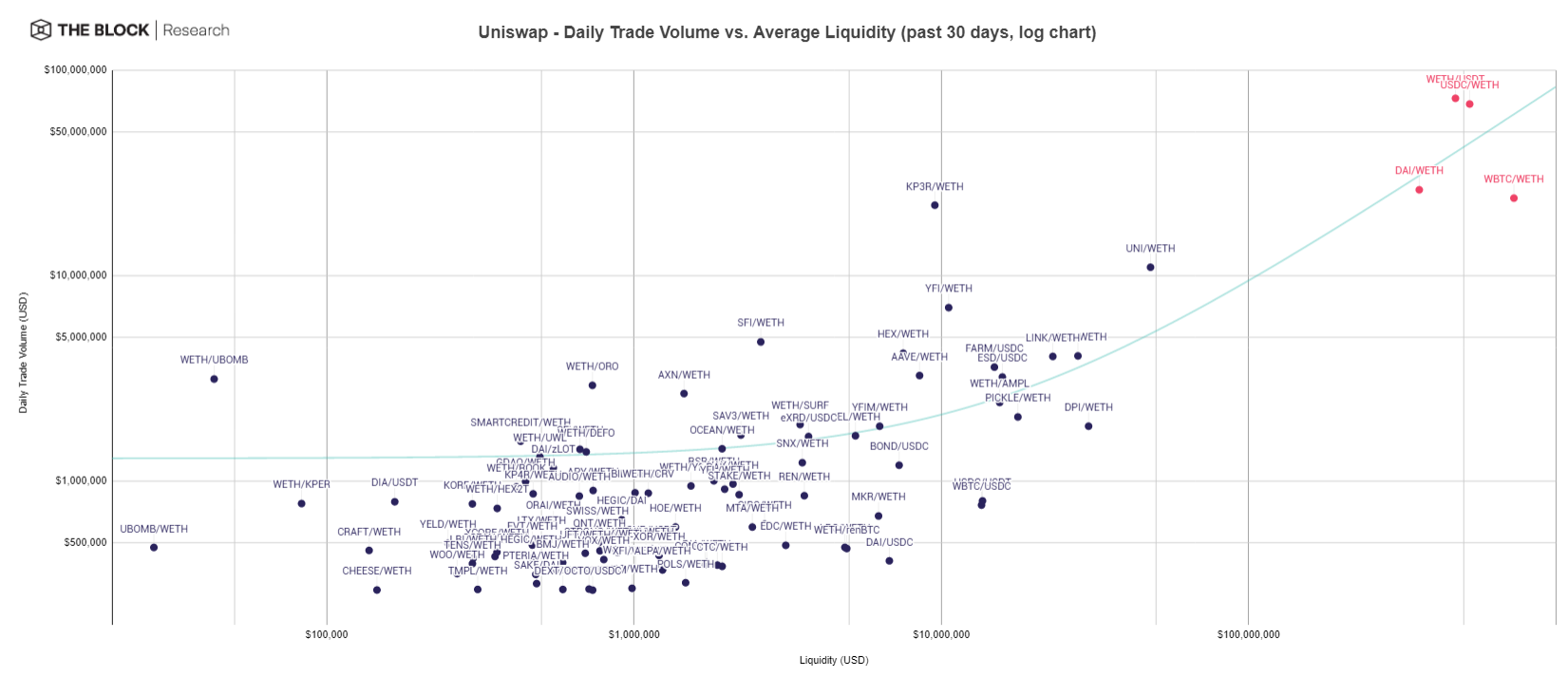

Anchoring the rewards to four pairs also carries some downsides. The UNI rewards don’t scale with the demand and there’s an artificial cutoff point. The tradeoff with introducing new tokens is that it creates governance conflict. In essence, UNI token holders are picking out “winners” from the available tokens.

It’s easy to see how that would end up in a holy war, and any programmatic attempt at gauging demand could be manipulated via wash trading.

Source: The Graph

The chart above should be taken with a grain of salt, but roughly pairs that are significantly above the trendline, having (potentially) more demand compared to current liquidity being offered. Based on this analysis, it could be argued that subsidizing AAVE or YFI pairs could be more helpful.

Even below the line, subsidizing the trading pair for a token like WBTC arguably has strategic value. If this is the case, there should be a better case for it than anecdotal evidence that it’s required and that the subsidy will actually work.

Overall, the future strategy for how to spend the treasury rewards should be centered around building sustainable advantages (network effects). The open question is that what those may be — in terms of treasury management, it may be prudent to hold other assets besides UNI, and $20 million per month would be quite the war chest if there are useful new tools and development ideas to fund.

The crux is that spending $20 million per month on liquidity mining (where the value retained afterward is questionable) compared to aiming the money at long-term moats is a waste. As an open problem, the community should consider the potential impact of intelligently investing its treasury. For example, by issuing grants to build products for institutions to better participate in DeFi, integrations to applications, developer, and analytics tools. If we just left this as a $1 million open bounty for the best ideas people come up with in January, that by itself could produce 10x the return on investment.

The Uniswap community could literally run a $1 million-per-month developer grant program to build applications on Uniswap, and be spending 1/20th the amount. Compared to this, liquidity mining can be considered an expensive customer acquisition program and excessive marketing spending in general. Uniswap itself began with a $100k Ethereum foundation grant.

To conclude, doing nothing should not necessarily be seen as a negative. Uniswap is seeing positive volume growth recently without it and its market share is not decreasing. Doing nothing just means allocating resources when there’s a better reason to do so.

At this point, we don’t even know what the protocol will look like when v3 launches — this is information that will surely change the analysis on where to allocate resources. It’s possible that the v3 upgrade does more to boost Uniswap’s value to large traders than anything available via liquidity mining. Unlike subsidies, that advantage remains.

There’s no rush to burn the money now. If Uniswap is successful, it will be a decade-long journey to the finish line, and during that time, there will be plenty of parasitic competitors to thwart, reasons to incentivize specific pools, and opportunities to fund.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Mika Honkasalo