DAI price increase led to a massive $103 million worth of liquidations at DeFi protocol Compound

A small price increase in the DAI stablecoin earlier today led to massive liquidations at decentralized finance (DeFi) protocol Compound.

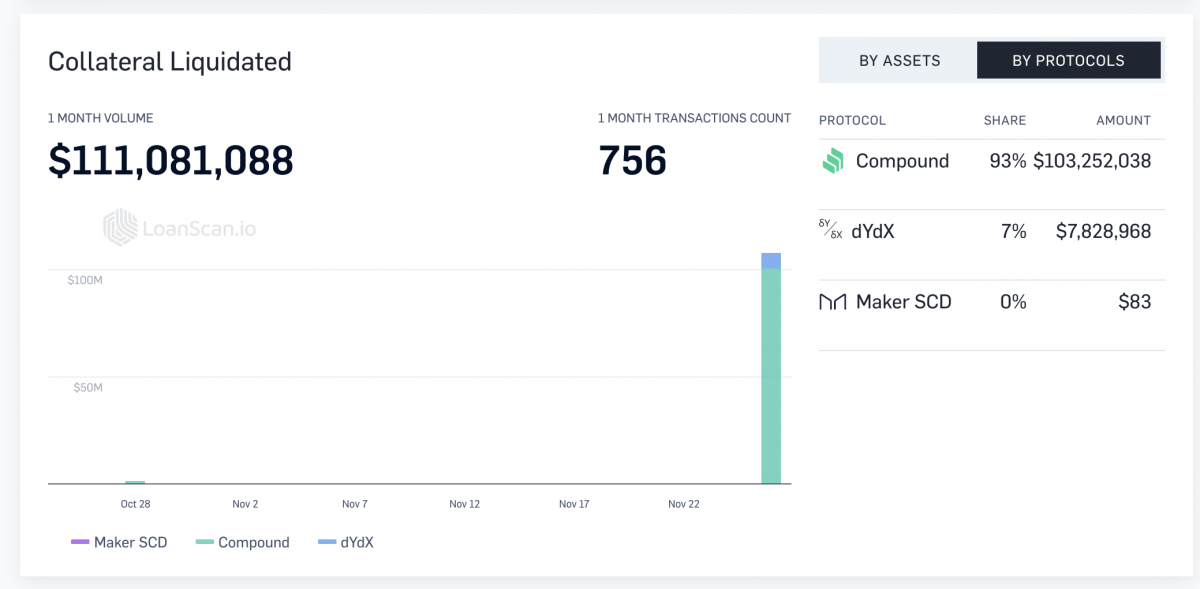

The protocol witnessed $103 million worth of liquidations, according to tracker LoanScan. Market conditions also led to liquidation at DeFi protocol dYdX, which liquidated about $8 million worth of funds. Together, both the protocols liquidated more than $110 million worth of collateral.

How exactly did DAI’s price increase lead to the liquidations? Compound allows users to borrow funds, including DAI. In all cases, a borrowed amount should always be lower than the collateral provided. In other words, all loans should be over-collateralized.

In today’s case, the liquidations occurred because the DAI price increase led to under-collateralized loans. In other words, the increased DAI price also increased the value of DAI borrowed, as compared to the collateral provided.

To put things in perspective, say, for example, a Compound user initially borrowed 1,000 DAI at $1 DAI, i.e., a total of $1,000. But the DAI price increased to $1.3 during a loan period, so the user’s borrowed amount increased to $1,300. But if the user has less than $1,300 in collateral, Compound would consider this loan as undercollateralized and allow any other user to liquidate it.

The Compound liquidations ended up affecting the so-called yield farmers of its COMP token. One yield farmer, for instance, lost $46 million.

It is worth noting that such massive liquidations at Compound have occurred for the first time. In previous cases, the highest single-day liquidations at the protocol have been smaller. In July 2020, for example, Compound witnessed $6.3million worth of liquidations, according to LoanScan. As for dYdx, it saw liquidations of about $8.6 million in November 2019, according to the tracker.

Previously, other DeFi protocols such as MakerDAO and Aave have also witnessed liquidations due to market conditions. MakerDAO, for instance, liquidated $15 million worth of DAI in March during the Black Thursday event, and Aave liquidated $20 million worth of Chainlink (LINK) tokens in August of this year.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri