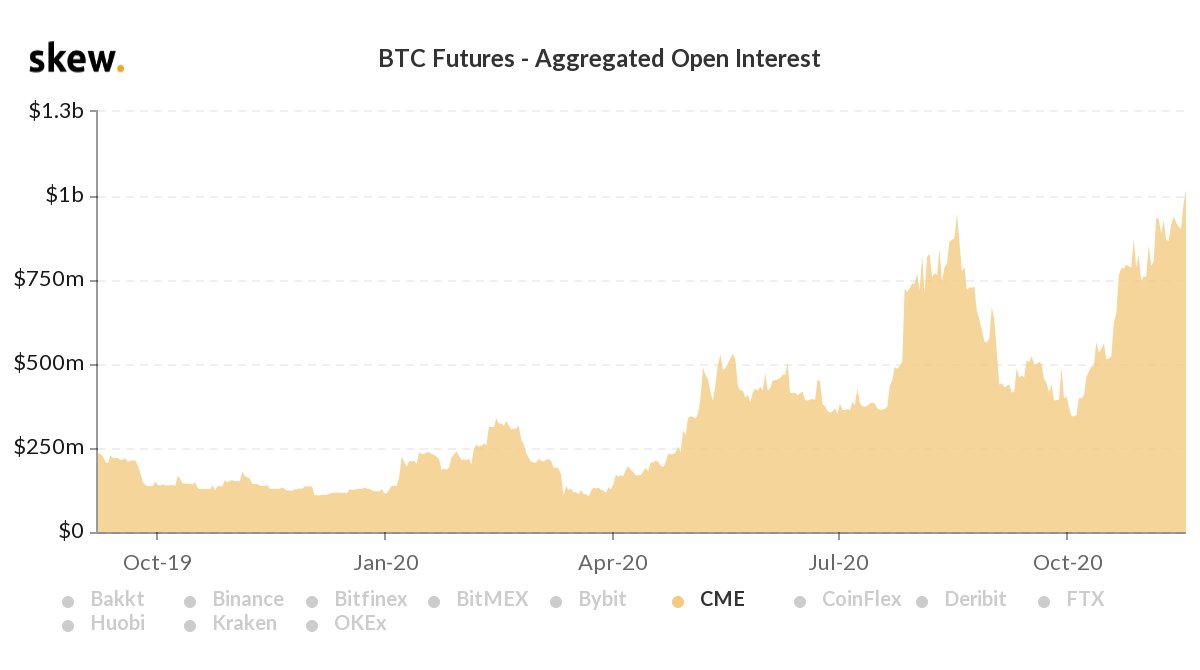

CME bitcoin futures cross $1 billion in open interest, touch a new all-time high

CME Group’s cash-settled bitcoin futures have hit an all-time high open interest of $1 billion.

The milestone comes as bitcoin price continues to surge around $18,000 levels. The spike in the open interest, or the value of outstanding derivative contracts that are yet to be settled, suggests that more money is flowing in the market, and traders expect a near-term rise in bitcoin’s volatility.

The futures also had a higher average of total large open interest traders in October than CME Aussie Dollar contracts, CME 1 and 3-month SOFR contracts, and CME Brazilian Real contracts. That record itself can be counted as a “resounding success in its own right,” Todd wrote at the time.

Earlier this year, CME also began trading in bitcoin options. Aggregate open interest in the bitcoin options market is also growing, touching $3.8 billion on Monday.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri