Go to Source

Author: Doreen Wang

Go to Source

Author: Zack Voell

Go to Source

Author: Sandali Handagama

Go to Source

Author: Sebastian Sinclair

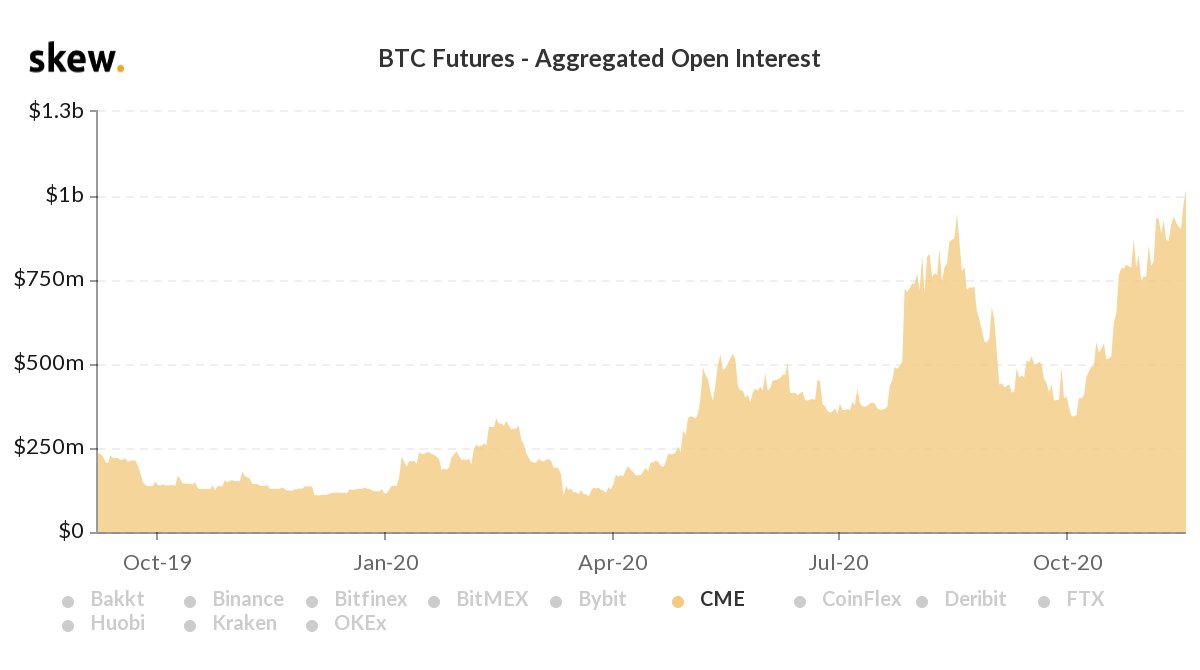

CME Group’s cash-settled bitcoin futures have hit an all-time high open interest of $1 billion.

The milestone comes as bitcoin price continues to surge around $18,000 levels. The spike in the open interest, or the value of outstanding derivative contracts that are yet to be settled, suggests that more money is flowing in the market, and traders expect a near-term rise in bitcoin’s volatility.

The futures also had a higher average of total large open interest traders in October than CME Aussie Dollar contracts, CME 1 and 3-month SOFR contracts, and CME Brazilian Real contracts. That record itself can be counted as a “resounding success in its own right,” Todd wrote at the time.

Earlier this year, CME also began trading in bitcoin options. Aggregate open interest in the bitcoin options market is also growing, touching $3.8 billion on Monday.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Quick Take

- ‘Fiat Freeway’ is a weekly column providing the latest updates on central bank digital currencies (CBDCs) and Stablecoins.

- Pieces thus far have focused on the ECB’s ‘digital euro’ initiative and the Fed’s classification of CBDC literature to date.

- This week’s column starts with an overview of Norges Bank’s third CBDC report, which considers the potential impact CBDC issuance would have on bank funding markets and overall financial system stability.

- Lastly, a look at Norges Bank Deputy Governor Ida Wolden Bache’s presentation on CBDC and real-time payments at ‘Finance Norway’s Payments Conference.’

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Mike Rogers

Quick Take

- A compilation of The Block’s coverage of U.S. specific CBDC developments in 2020

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Ryan Todd

IBC Group, a Dubai-based boutique investment firm, is staking $10 million worth of ether (ETH) to support the Ethereum 2.0 launch.

The firm has partnered with Canada-based staking service CanETH for the initiative. Specifically, IBC will stake a total of 21,984 ETH, in three tranches, for 687 validators.

Khurram Shroff, chairman of IBC’s board, said the firm is “very excited” for Eth2, i.e., when the network transitions from a proof-of-work system to a proof-of-stake mechanism. The ETH lockup “shows our confidence in ETH2 and dedication to the beacon chain,” said Shroff.

Eth2 is expected to go live on December 1, with the launch of Beacon Chain, when at least 524,288 ETH is staked in the Eth2 staking deposit contract.

So far, however, only 101,216 ETH has been deposited in the contract. ETH holders are probably waiting to deposit until the last days to avoid opportunity costs. In other words, ETH holders have little incentive to lock their ETH now when they can utilize it for other activities, such as lending to earn yield or use it as collateral for trading.

Eth2 stakers can withdraw their stake only when Ethereum fully transitions to a proof-of-stake system, or once the Ethereum mainnet becomes a shard, which is expected to happen sometime in 2021.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Omkar Godbole

Go to Source

Author: Daniel Palmer