Go to Source

Author: Michael Kapilkov

Go to Source

Author: Nathaniel Whittemore

Go to Source

Author: Sandali Handagama

Quick Take

- Disclaimer: The Block Research team has, is, and will be experimenting with the various protocols, projects, and applications mentioned in this series. The projects mentioned in our reports are not recommendations from our team and should not be misconstrued as investment advice. Many projects that appear in this series are highly experimental and, as such, will come with risks. Readers should evaluate their own risk tolerance before experimenting with these projects.

- At the request of various The Block Research members, we are experimenting with a weekly digest that summarizes recently launched projects and applications that our research team found interesting.

- This week’s digest looks at BadgerDAO and SynLev

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Steven Zheng

Go to Source

Author: Omkar Godbole

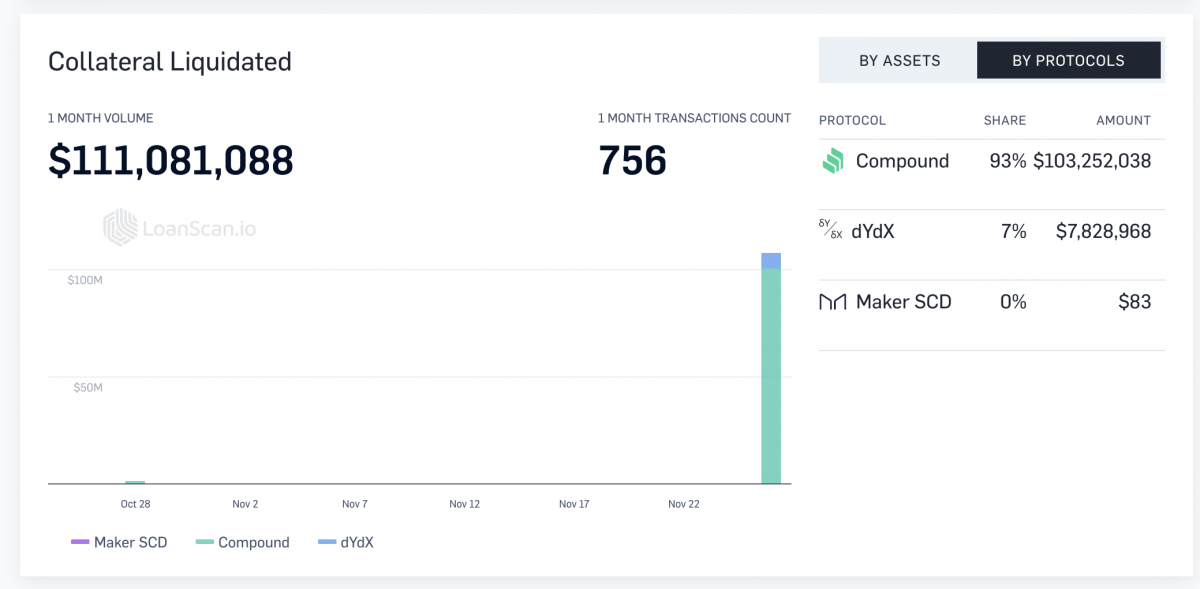

A small price increase in the DAI stablecoin earlier today led to massive liquidations at decentralized finance (DeFi) protocol Compound.

The protocol witnessed $103 million worth of liquidations, according to tracker LoanScan. Market conditions also led to liquidation at DeFi protocol dYdX, which liquidated about $8 million worth of funds. Together, both the protocols liquidated more than $110 million worth of collateral.

How exactly did DAI’s price increase lead to the liquidations? Compound allows users to borrow funds, including DAI. In all cases, a borrowed amount should always be lower than the collateral provided. In other words, all loans should be over-collateralized.

In today’s case, the liquidations occurred because the DAI price increase led to under-collateralized loans. In other words, the increased DAI price also increased the value of DAI borrowed, as compared to the collateral provided.

To put things in perspective, say, for example, a Compound user initially borrowed 1,000 DAI at $1 DAI, i.e., a total of $1,000. But the DAI price increased to $1.3 during a loan period, so the user’s borrowed amount increased to $1,300. But if the user has less than $1,300 in collateral, Compound would consider this loan as undercollateralized and allow any other user to liquidate it.

The Compound liquidations ended up affecting the so-called yield farmers of its COMP token. One yield farmer, for instance, lost $46 million.

It is worth noting that such massive liquidations at Compound have occurred for the first time. In previous cases, the highest single-day liquidations at the protocol have been smaller. In July 2020, for example, Compound witnessed $6.3million worth of liquidations, according to LoanScan. As for dYdx, it saw liquidations of about $8.6 million in November 2019, according to the tracker.

Previously, other DeFi protocols such as MakerDAO and Aave have also witnessed liquidations due to market conditions. MakerDAO, for instance, liquidated $15 million worth of DAI in March during the Black Thursday event, and Aave liquidated $20 million worth of Chainlink (LINK) tokens in August of this year.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Kevin Reynolds

Go to Source

Author: Daniel Palmer

Go to Source

Author: Daniel Palmer

OKEx has seen net crypto outflows worth more than $110 million within hours after it reopened asset withdrawals.

According to data from on-chain analysis firm CryptoQuant, the first batch of outflows – 2,822 bitcoin – incurred within 15 minutes after the crypto exchange reopened customer asset withdrawals at 8:00 UTC on Thursday. And 83% of the first batch went to non-exchange wallets, CryptoQuant CEO Ki Young Ju said in a tweet.

The bitcoin outflows increased to more than 4,000 bitcoin, worth around $68 million, before 9:00 UTC.

But the exchange has since then seen notable bitcoin inflows, which has again increased OKEx’s bitcoin reserve to the same level before withdrawal opened, CryptoQuant’s data shows. The new inflows, Ki told The Block, were not internal transfers but user deposits.

In addition, the firm’s chart below shows OKEx has seen continuous net outflows of crypto stablecoins worth more than $110 million since the withdrawal reopened. A majority of the stablecoin outflows – in $50 million – incurred within one hour after withdrawal reopened and has increased thereafter.

The outflows also came around the time when bitcoin’s price started to drop by over 10% and reached around $16,350 before it bounced back to over $17,000.

OKEx stablecoins netflow. Source: CryptoQuant

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao