IRS clarifies that buying and holding crypto doesn’t require 1040 reporting

A new clarification from the Internal Revenue Service (IRS) indicates that buying and holding cryptocurrency with government-issued money does not need to be reported on the 1040 form.

Last December, the tax authority announced it would move its crypto question to the top of the 1040 form. Putting the question front and center means crypto holders are less likely to be unaware of their tax obligations. The question asks “At any time during 2020, did you receive, sell, or otherwise acquire any financial interest in any virtual currency?”

At the time, some tax professionals pointed out that the wording of the question required further clarification. Some said it was unclear if buying and holding qualified as “transacting” in crypto. Now, the IRS has clarified that it doesn’t qualify as such.

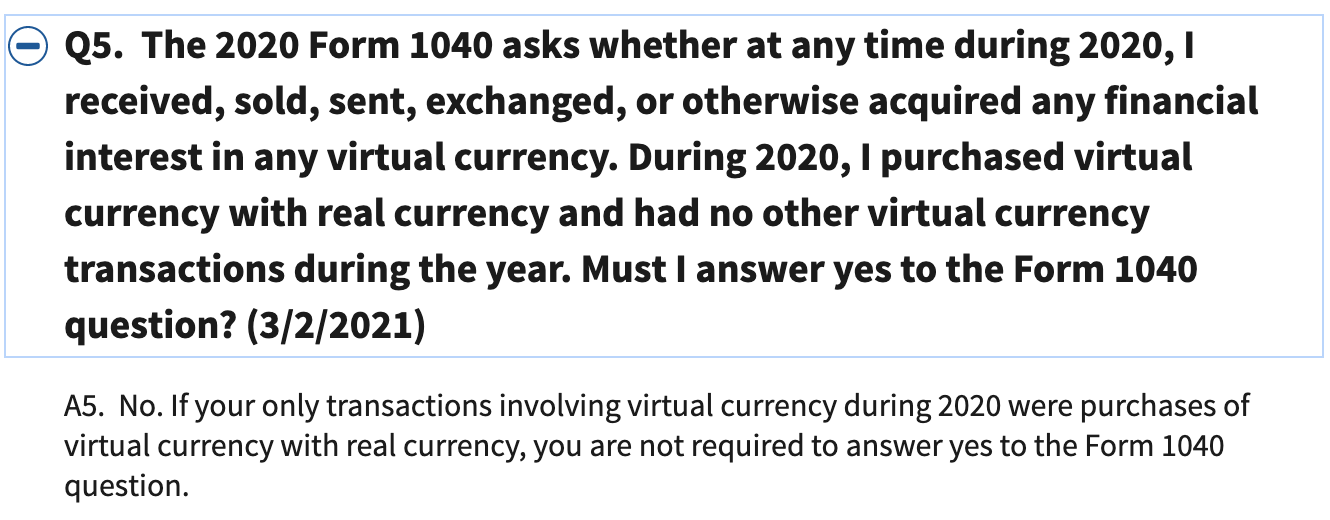

The IRS updated its frequently asked questions (FAQs) yesterday, addressing questions related to virtual currency reporting. Question five clarified those who only buy and hold:

Source: IRS

This suggests the IRS is only interested in using the question to call attention to crypto transactions that could constitute taxable events. Buying and holding does not, since selling, converting, or transferring are what trigger taxable events.

The other FAQs expand on questions related to calculating gain and loss, hard forks and charitable donations in crypto.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely