Fidelity’s director of global macro: bitcoin is ‘worth considering for inclusion in a portfolio’

Given the current economic backdrop, investors might want to start considering adding bitcoin to their portfolio, argues Jurrien Timmer, the director of global macro at Fidelity Investments.

In a note titled “Understanding Bitcoin,” Timmer — a 26-year veteran of the asset management giant — said that bitcoin could be seen as a form of “digital gold” and could offer protection against inflation.

“In my view, some investors may wish to consider bitcoin, alongside other alternatives, as one component of the bond side of a 60/40 stock/bond portfolio,” he said. Fidelity oversees over $9.8 trillion in total customer assets.

The statement adds to an ongoing wave of support for bitcoin from big-name investors, like Paul Tudor Jones and Anthony Scaramucci, who see it as a gold-like asset. The essay also reflects the growing chorus calling for the end of the traditional 60/40 portfolio allocation.

“In a 60/40 stock/bond world, gold and bitcoin are poised, in my view, as potential disruptors to the 40 side of the allocation,” Timmer said.

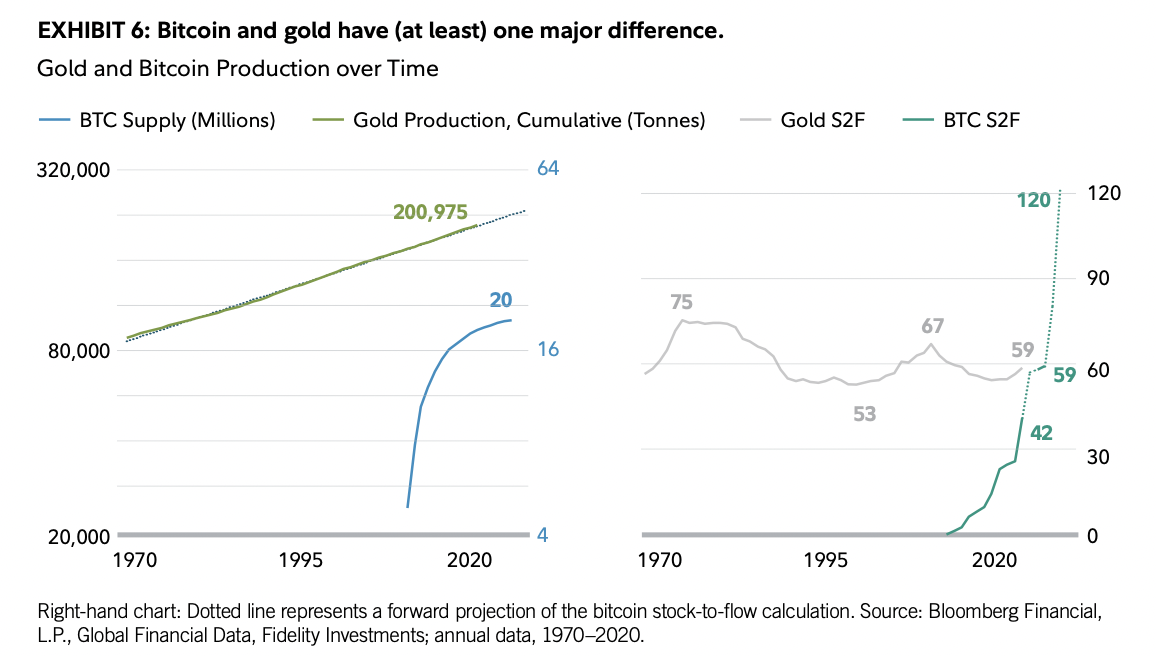

Timmer also highlighted Bitcoin’s limited supply as a unique attribute relative to gold.

“We know that bitcoin’s supply growth is flattening. Note how the production of gold has been quite steady throughout the years: No asymptote here!”

Source: Fidelity

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro