Go to Source

Author: Nathaniel Whittemore

Quick Take

- The Bitcoin community has expressed broad support for Taproot, a planned privacy-oriented upgrade to the protocol.

- But the community still lacks a detailed activation plan for Taproot.

This feature story is available to

subscribers of The Block Daily.

You can continue reading

this Daily feature on The Block.

Go to Source

Author: Mike Orcutt

Go to Source

Author: Wolf von Laer

Go to Source

Author: Colin Harper

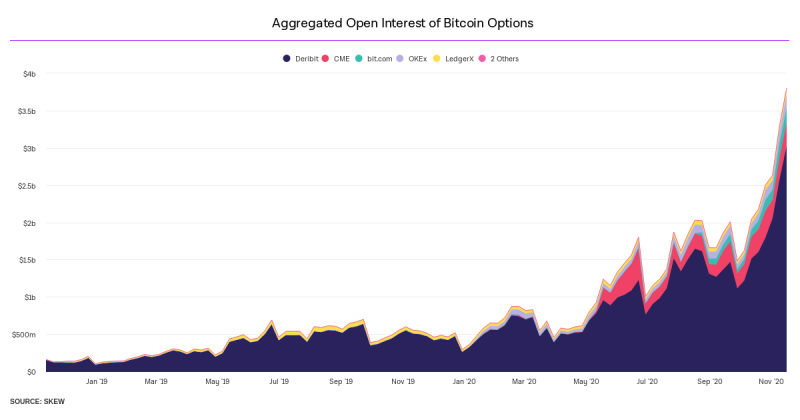

The aggregated open interest on bitcoin options reached $4.53 billion on Nov. 22, having grown $1.13 billion since Nov. 15.

That’s nearly a 25% increase in a week, according to data from The Block Research.

In addition to Bitcoin, the aggregated open interest on Ethereum options reached $780.05 million. Ethereum option open interest jumped $221.09 million, or 39.5%, in a week, according to The Block Research.

Open interest on crypto options has been rising steadily since October, setting all-time highs in the months prior.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov

Go to Source

Author: Daniel Kuhn

“Drop gold.”

Crypto enthusiasts will remember that slogan from an ad campaign Grayscale ran last year to woo investors to its suite of crypto funds. Now, more than a year later, it appears that investors are heeding the recommendation of the crypto asset management firm.

Michael Sonnenshein, a managing director at firm, said that 2020 has been a year marked by “unprecedented capital inflows for the Grayscale business.”

“On the heels of 2019, which was a record year for us, the momentum has carried into 2020,” he told The Block. “In Q3, the firm raised over $1 billion and we are pleased to share with you that we are seeing that momentum only increase — two-thirds of the way into Q4.”

The inflows into Grayscale’s funds are striking juxtaposed with action in the gold market, according to a group of analysts at JPMorgan in a report published Friday.

“What makes the past five weeks flow trajectory for the Grayscale Bitcoin Trust even more impressive is its contrast with the equivalent flow trajectory for gold ETFs, which saw modest outflows since mid-October,” the analysts wrote, adding:

“The contrasts lends support to the idea that some investors that previously invested in gold ETFs, such as family offices, may be looking at bitcoin as an alternative to gold.”

The contrast isn’t surprising to Sonnenshein, who said that Grayscale made a bet that money would rotate into bitcoin as a result of shifting preferences.

“Going back to the Drop Gold campaign, we took a look at generational investment preferences and we are now seeing the beginning of this wealth transfer,” he said.

Recent gold ETF outflows have been underpinned by a decline in the metal’s price since midsummer. After a roaring rally that brought the price of bullion above $2,000 earlier this year, the price of gold has fallen by about 10% since the market’s August peak.

Optimism tied to an upcoming vaccine is said to be playing a role. Also, inflation — which is believed to be a tailwind for gold — appears to be less of a concern among Wall Streeters. Indeed, Goldman Sachs wrote in a note to clients that it viewed a dramatic rise in inflation in the next couple of years to be “unlikely.”

Analysts at Macquarie expect things to get even worse for gold.

According to reporting by the Financial Times, analysts at the bank say the bull market for gold has come to an end and expect the price of the commodity to fall to $1,550 per troy ounce by next year, a 17% decline from current prices.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Go to Source

Author: Bradley Keoun

Go to Source

Author: James Cooper

Quick Take

- Institutional spot exchange LMAX Digital is seeing record volumes as interest soars

- LMAX Digital has the second-highest monthly volume of all exchanges that support fiat currencies

- Its average trade size is more than three times higher than the trailing Bitstamp

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Larry Cermak