Go to Source

Author: Daniel Palmer

United Overseas Bank, Singapore’s third-largest bank by total assets, appears to be developing a crypto custody solution.

The bank has opened up a position for “VP — Crypto Security Administrator” to get expert advice on how to design a secure solution for “managing crypto keys.”

The job includes managing the installation of a hardware security module (HSM) — a dedicated hardware device to protect cryptographic keys, setting up a “centralized” key management solution, and maintaining crypto keys, among other responsibilities.

Applicants should have a clear understanding and experience of HSM devices, encryption standards, cryptographic key generation and management, and payment network standards, including tokenization, per the job requirements.

The position suggests that UOB’s crypto custody plans are still in their early days. There are also currently no other crypto-related open positions at UOB. The bank declined to comment to The Block when contacted.

Rival plans

The job comes as UOB rival DBS, Singapore’s biggest bank, is preparing to launch its own crypto exchange and crypto custody solution. DBS’s plans were leaked last month via a now-deleted webpage, which The Block first reported at the time.

A DBS spokesperson said at the time that the bank’s crypto efforts are still work in process, and it is awaiting regulatory approvals. UOB might have to go through similar approval processes if it ever decides to enter the crypto space.

A number of established financial institutions and banks have been looking into offering crypto custody services, including JPMorgan, Citi, and Standard Chartered. JPMorgan could offer crypto custody services via a “sub-custodian” or a third-party specialist firm, sources familiar with the situation recently told The Block.

Sources at Citi at the time said the bank had conducted internal testing related to digital asset custody. Standard Chartered, on the other hand, is building a crypto custody solution for institutional investors via its Singapore-based venture arm SC Ventures.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Omkar Godbole

Go to Source

Author: Daniel Palmer

After centuries of advertising a smorgasbord of financing products and advisory services to wholesale customers, investment bankers will soon offer up a menu of blockchains.

That is the vision of Jean-Marc Stenger, chief executive of Société Générale’s enterprise blockchain unit Forge.

“We have, I would say, a natural preference for public blockchains,” said Stenger, in an interview with The Block.

“Because we really think that’s where we will find the maximum interoperability, the ability of multiple players to interconnect with the protocol.”

His comments come roughly a month after Société Générale announced a partnership with Ethereum software firm ConsenSys, which will focus on central bank digital currency (CBDC) issuance and management, among other things.

Forge has been working closely with Banque de France to experiment with CBDCs. The pair issued a €40 million tokenized bond that was settled using CBDC in May.

Forge hopes the use of security tokens will improve liquidity, shorten settlement times, and cut costs. As The Block reported in May, the tokenized bond was fully subscribed by Société Générale, which simultaneously paid the issuer – the bank’s covered bond vehicle Société Générale’s SFH. Payment was made in digital euros issued by the Banque de France on a blockchain built by the central bank’s “in-house blockchain team.”

Société Générale has also experimented with issuing securities using Tezos and will be leveraging other networks for “forthcoming issuances,” according to Stenger.

“One of the key hypotheses we took when we started this development is to make sure that we remain a bank. We are not turning ourselves into an IT provider or something like this,” Stenger continued.

“There is still an uncertainty on what will be the blockchain protocol that will basically win the race and impose itself in the future. You have a few protocols that are leading the pack.”

One of those is Ethereum, but there are least “five or six other protocols” in contention, Stenger added.

Forge began as the product of an internal innovation programme at Société Générale roughly three years ago but has recently been transformed into a separate – albeit wholly-owned – subsidiary of the bank.

Like many blockchain initiatives undertaken in wholesale financial markets, one of the biggest challenges facing Stenger and his team is to convince the wider market to embrace a bold new method of transacting.

SDX, the digital assets exchange developed by Six Group in Switzerland, has sought to spur on adoption of the project and of digital assets more generally by bringing in strategic investors.

Stenger, on the other hand, is hopeful that engaging in open source initiatives might do the trick.

“We do think that there is a need to be more open than what we were previously; the way to be more open is not necessarily to open the capital of this subsidiary,” he said.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Ryan Weeks

Go to Source

Author: Omkar Godbole

Go to Source

Author: Daniel Palmer

Crypto assets worth more than $4.2 billion have been seized by Chinese police during the massive PlusToken Ponzi scheme crackdown, according to a new court ruling.

In a November 19 judgment made public on Thursday, the Jiangsu Yancheng Intermediate People’s Court has detailed the breakdown for the first time of all the crypto assets seized by Chinese police related to the PlusToken case.

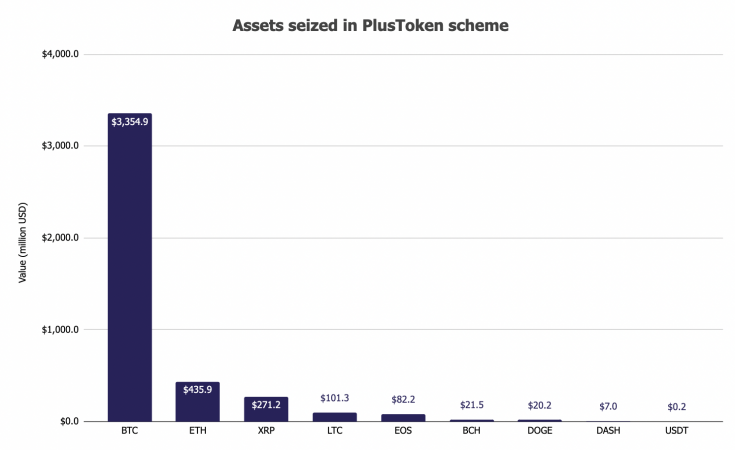

A total of 194,775 BTC, 833,083 ETH, 1.4 million LTC, 27.6 million EOS, 74,167 DASH, 487 million XRP, 6 billion DOGE, 79,581 BCH, and 213,724 USDT have been seized by Chinese law enforcement from seven convicts during the crackdown.

These assets, at today’s prices, are worth over $4.2 billion in total.

Breakdown of the values of seized crypto assets at today’s prices.

As part of the ruling, the court said “the seized digital currencies will be processed pursuant to laws and the proceeds and gains will be forfeited to the national treasury.”

However, the Yancheng Intermediate People’s Court doesn’t elaborate on how much of the seized crypto assets have been or will be “processed” or via what method exactly.

The PlusToken criminal case was initially ruled on September 22 by a lower-level district court in the city of Yancheng in China’s Jiangsu province.

Local media reported at the time that the masterminds behind the crypto Ponzi scheme swindled more than 2 million people for more than 50 billion yuan, or $7.6 billion.

But details of the initial judgment were not disclosed publicly as several convicts of the case had filed appeals to a higher level court.

The Yancheng Intermediate People’s Court has denied the appeals and sided with the district court in the November 19 final judgment and disclosed details pertaining to the criminal case.

According to the latest ruling, the PlusToken operation officially started in May 2018 and advertised a non-existent crypto arbitrage trading platform. It promised users attractive daily payouts but would require them to deposit at least $500 worth of crypto assets in order to participate.

Between April 6, 2018 and June 27, 2019, the pyramid scheme lured in over 2.6 million members across 3,293 layers, the court said.

During this period, the scheme absorbed more than 314,000 BTC, 117,450 BCH, 96,023 DASH, 11 billion DOGE, 1.84 million LTC, 9 million ETH, 51 million EOS, and 928 million XRP.

At the lowest prices between May 1, 2018 and June 27, 2019, these crypto assets were worth at least more than 14.8 billion yuan, or $2.2 billion, the court said. They would be worth over $11 billion at today’s prices.

A total of 15 people have been convicted so far, according to the ruling. They are sentenced to between two to 11 years behind bars with fines between $100,000 to $1 million.

The seized crypto assets aside, the court said one convict had successfully laundered more than 145 million yuan, or $22 million, worth of cryptocurrencies into Chinese yuan.

The police identified the trails of about $19 million of those laundered funds, which were spent by the convicts or their families on purchasing luxury cars, two dozens of real estate properties in China as well as insurance polices in Hong Kong.

The Block reported previously that Chinese police have ramped up efforts in recent years cracking down internet-based criminal activities, some of which may have also used cryptocurrency to defraud victims or launder proceeds.

These events have therefore led to a wide bank account freeze issue since this year for China’s over-the-counter trading desks and users who are taking collateral damage.

Read the full judgment below:

PlusToken case by Wolfie Zhao on Scribd

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao

The Facebook-led Libra Association is reportedly targeting the launch of its first stablecoin in January of next year.

The Financial Times reported the news on Thursday, citing “three people involved in the initiative.” According to one of the persons, the first stablecoin would be dollar-backed, while other planned single-currency and multi-currency stablecoins would be launched later.

The actual launch date of the dollar-pegged stablecoin would depend on when Libra gets a payment services license from the Swiss Financial Market Supervisory Authority, FINMA. The license could be granted in January, the three people said. Libra applied for the permit in May of this year.

Facebook’s other subsidiary, Novi (formerly Calibra), is also preparing to launch its digital wallet for Libra. The wallet is “ready from a product perspective,” one person involved in Novi told FT, but initially, it would not be globally launched.

Novi is first targeting “half a dozen high-volume remittance corridors” including the U.S. and some Latin American countries, per the person. For the U.S. launch, Novi would need a license in each of the 50 states. The company has received a license in many states but is still waiting on “as many as 10,” including a New York BitLicense, according to the person.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Sebastian Sinclair