Go to Source

Author: Kevin Reynolds

Go to Source

Author: Kevin Reynolds

Go to Source

Author: Kevin Reynolds

Go to Source

Author: Kevin Reynolds

In the wake of the Securities and Exchange Commission’s lawsuit against Ripple, crypto market-making firm B2C2 halted the trading of XRP with U.S.-based counterparties on Thursday, The Block has learned.

As one of the largest market-making firms in the crypto market, B2C2 operates in the U.S. through B2C2 USA. The unit, which launched in 2019, engages with B2C2’s U.S. counterparties and previously alerted clients in a memo this week that the firm “may take further actions regarding trading in XRP products.”

“We will promptly notify clients of any future developments,” the company said at the time.

Up until Thursday at 3 p.m. EST, U.S.-based clients could trade XRP normally with B2C2. That said, it did require clients looking to close XRP positions to execute their trade by voice. Non-U.S. clients can still trade XRP with the firm but are required to pre-fund all short trades.

The move follows similar actions by trading firms like Galaxy Digital and Jump Trading, which both halted their XRP market-making.

SBI Holdings, which announced its acquisition of B2C2 earlier this month, has a unique relationship with XRP and Ripple. SBI is one of Ripple’s leading investors and took part in the firm’s $200 million Series C.

In January, SBI said it would give shareholders the option to receive XRP as a stock benefit.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Quick Take

- The sudden departure of most of Findora’s founding team was due to concerns about two individuals who are still with the company, The Block has learned.

- Findora’s recent announcement of an “eight-figure” raise ahead of its ICO was at least partially year-old news.

- It’s not clear who exactly is behind a forthcoming ICO.

This feature story is available to

subscribers of The Block Daily.

You can continue reading

this Daily feature on The Block.

Go to Source

Author: Wolfie Zhao

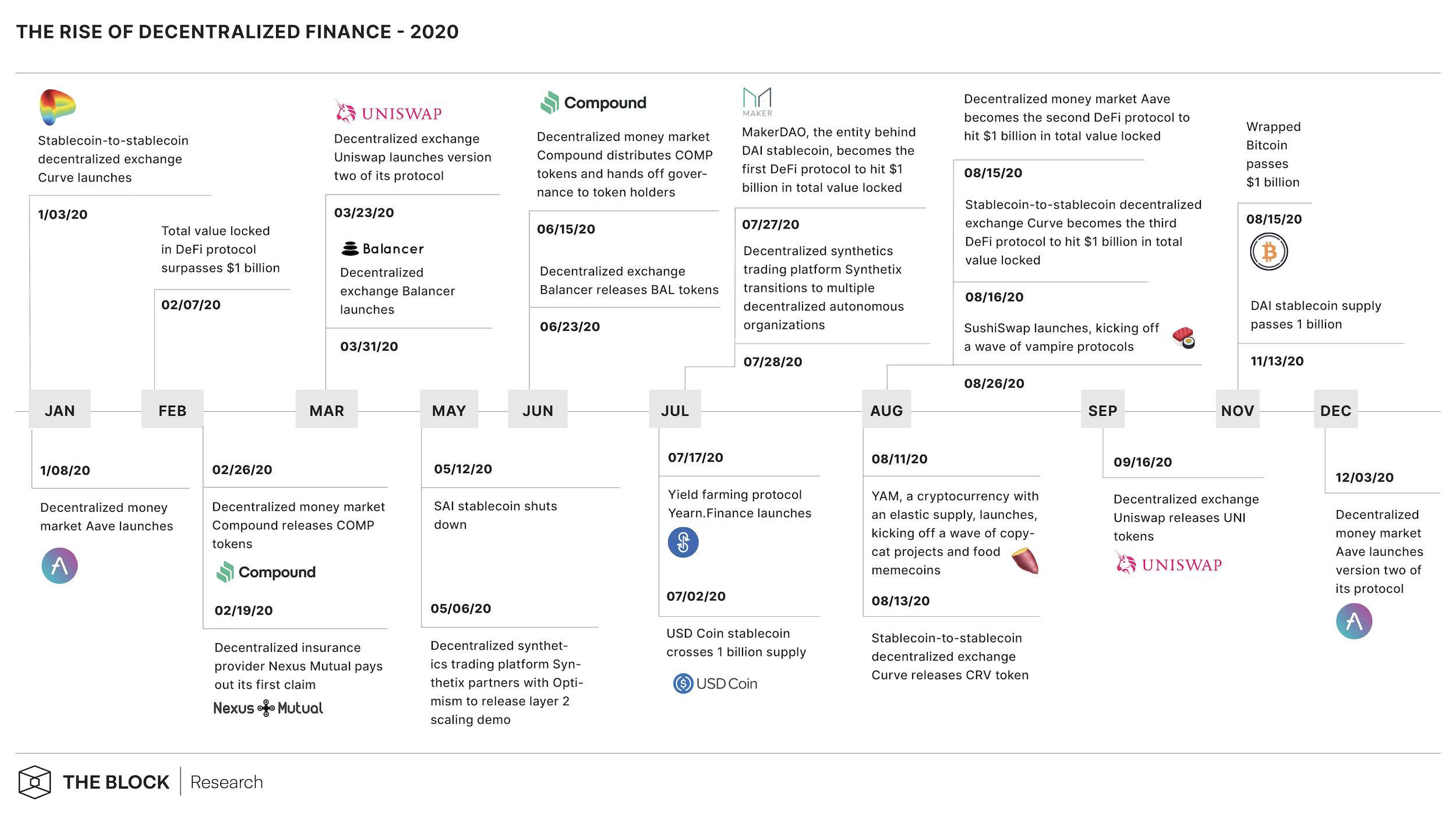

2020 was a year of notable events, and the same is true for the decentralized finance (DeFi) ecosystem. In 2020, DeFi saw the shut down of the SAI stablecoin, the yield farming trend take off, and multiple DeFi projects cross $1 billion in total value locked.

Here are some of the most important things to happen to decentralized finance this year.

- UNI token launch: On September 16, the leading decentralized exchange Uniswap launched its own governance token UNI. At various points, Uniswap’s volume rivaled centralized exchanges like Coinbase.

- SushiSwap ushers in “vampire mining”: SushiSwap launched as a fork of decentralized exchange Uniswap in August. SushiSwap incentivized Uniswap liquidity providers with its own governance tokens to take liquidity away from Uniswap. Vampire mining was born.

- Compound distributes COMP tokens to users and hands over control of its protocol: June 15 marks the day the decentralized money maker Compound circulated its COMP token and gave governance control over to its users.

- Yearn.Finance started a farming craze: Yearn.Finance launched on July 17, establishing a protocol to find the best returns in the DeFi universe by investing deposited funds through different DeFi protocols. Yield farming mania commenced.

- Wrapped Bitcoin passes $1 billion: Wrapped Bitcoin (WBTC) is an ERC-20 token pegged to bitcoin. It lets bitcoin holders access the Ethereum-based DeFi ecosystem. August 15 was the day wrapped bitcoin supply broke $1 billion.

For more insights from the 2020 market, check out The Block Research 2021 Outlook Report.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov

Go to Source

Author: Mance Harmon

Go to Source

Author: Kevin Reynolds

Bitcoin has jumped above $25,000 for the first time, setting new price all-time highs.

Data from Coinbase shows the price of the world’s largest cryptocurrency by market capitalization has increased by more than 2% over the past 24 hours to break above $25,000.

It’s changing hands at $25,241 as of press time.

Meanwhile, bitcoin’s market capitalization is now above $467 billion, according to data from CoinGecko.

In early trading hours on December 26 UTC time, bitcoin’s price briefly touched the exact level of $25,000 for a few times on Coinbase but was quickly rejected.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao