Go to Source

Author: Danny Nelson

Go to Source

Author: Muyao Shen

Go to Source

Author: Daniel Kuhn

The Financial Conduct Authority has told unregistered crypto firms to close down and return funds to investors, in line with a schedule laid out by the regulator at the start of 2020.

On January 8, the UK watchdog warned that crypto businesses that had not applied to register with the FCA by December 15, 2020, or that had withdrawn an application, must cease crypto activities before January 10.

In an email sent to companies and obtained by The Block, the FCA wrote that businesses “should consider all the relevant issues carefully and, where possible, return any money or cryptoassets” that fall under the scope of anti-money laundering rules.

The email stated:

“Any existing cryptoasset businesses carrying on cryptoasset activities within the scope of regulation 14A of the MLRs by way of business in the UK is required to be registered with the FCA for anti-money laundering and counter-terrorist financing purposes by 9 January 2021. If you are an existing cryptoasset business that is still carrying on cryptoasset activities in the UK and fall within either of the categories mentioned in the bullet points above, you are required to cease such activities before 10 January 2021.”

The FCA took over as the anti-money laundering and counter-terrorist financing supervisor of UK crypto companies on January 10, 2020, warning at the time that firms would have to register with it by the same date the following year. It recently extended that deadline to July 9, 2021, after placing some 90 companies on an interim register.

The FCA said in its email that it expects crypto firms to communicate the situation to customers, as well as to “provide them with any alternative options that are in their best interests.”

“You should seek your own legal advice on how to do this. You may be committing a criminal offence from 10 January 2021 if you continue to provide services involving cryptoassets. If so, you are at risk of being subject to the FCA’s criminal and civil enforcement powers,” the regulator added.

Earlier today, the FCA issued a stern warning about the “very high risks” faced by consumers who invest in cryptocurrencies.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Ryan Weeks

Go to Source

Author: William Foxley

Go to Source

Author: Tanzeel Akhtar

Go to Source

Author: Lyllah Ledesma

South Korean gaming giant Nexon has denied that it plans to acquire crypto exchange Bithumb, as local media outlets claimed last week.

“NEXON Co., Ltd. has not invested in Bithumb and has no plans to acquire that company,” Nexon spokesperson Jeff Brown told The Block in an email Sunday. “We cannot comment on the investment plans of other companies.”

Last week, there were reports that Nexon was preparing to acquire Bithumb for around 500 billion won (~$460 million). Nexon is the owner of crypto exchanges Bitstamp and Korbit.

Bithumb has been seeking a buyer since 2018. At the time, Bithumb looked to sell itself to BK Global Consortium, but that deal didn’t go through because BK chairman Kim Byung-Gun couldn’t pay the entire acquisition amount of $345 million. Last September, Bithumb was reportedly looking for an acquirer at a price tag of up to $604 million, but that deal didn’t come to fruition.

Uncertainties around Bithumb could be a reason. The exchange and its chairman Lee Jung Hoon were recently under investigation by the Seoul Metropolitan Police Agency. They were accused of pre-selling Bithumb’s native token BXA for about 30 billion won (~$27.5 million) to investors and then not listing the token, which has allegedly led to investors’ losses. Lee was also charged with evading property abroad.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

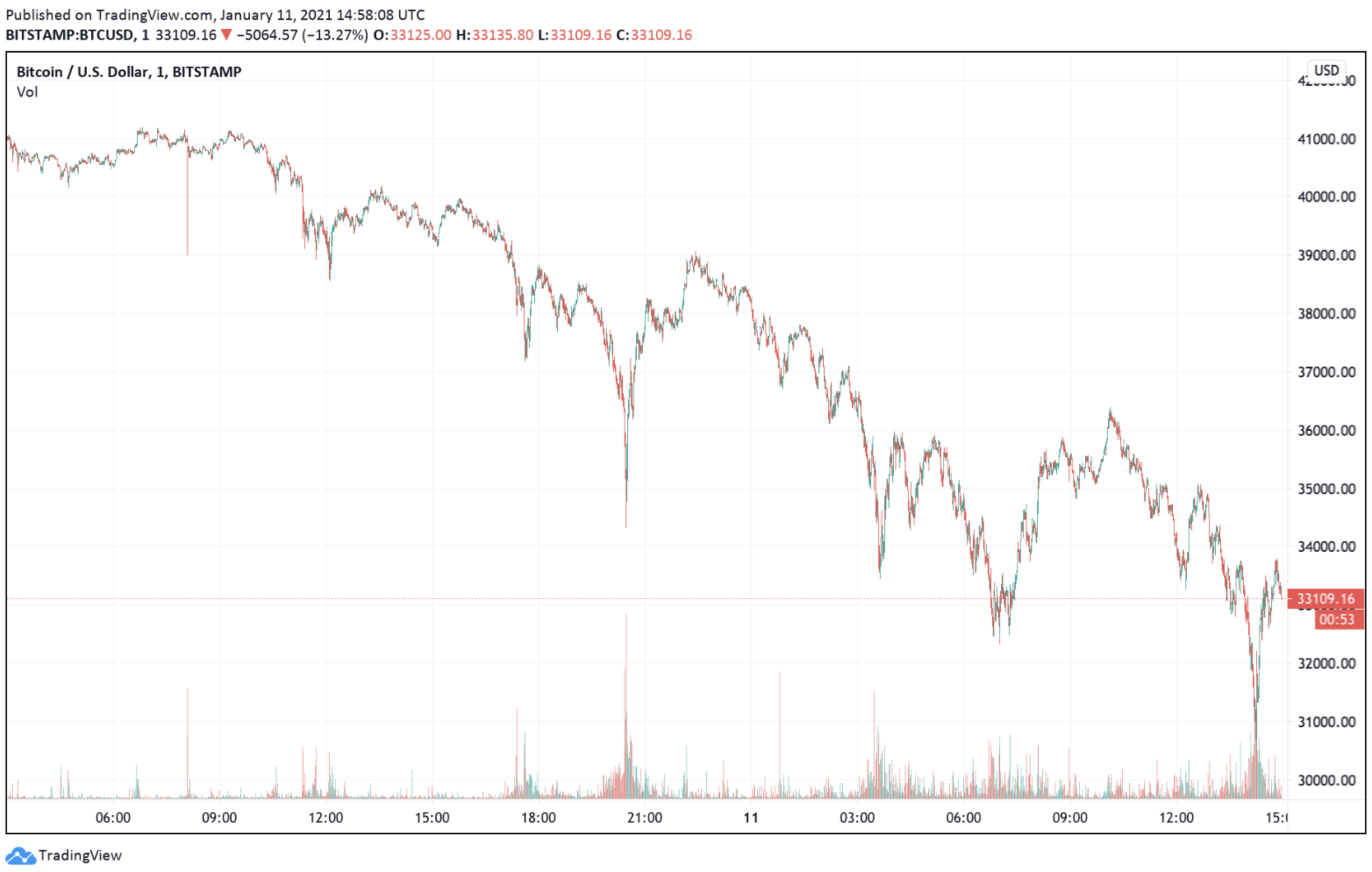

Bitcoin’s historic rise came to a halt over the weekend — but the industry’s largest trading desks aren’t too concerned.

After soaring to all-time highs near $42,000, the price of bitcoin briefly dropped below $31,000 on Monday in a move that market-making executives say was driven by a flurry of liquidations. Coinbase saw a low of $30,251 before recovering, and at press time, bitcoin is trading at roughly $31,100.

Data collected by The Block Research shows that liquidations of bitcoin futures long positions topped $1.47 billion on Sunday. Additional data from ByBt shows that liquidations over the last 24-hours stand at nearly $2.9 billion.

The recent price action — as well as the liquidations — are laid out on the charts below:

Buying of the dip

The mix of liquidations and low liquidity during a weekend trading session contributed to the downward price action, according to FTX chief executive Sam Bankman-Fried.

“The good news is that there’s unlikely to be a lot of pain in the industry,” Bankman-Fried said in a message to The Block Sunday evening. “Prices are still up a lot.”

Indeed, Robert Catalanello of trading firm B2C2 said that the firm saw a lot of buying over the $40,000 level “when there was limited follow through people decided to lock in profits.” He added that recent selling does not look like “panic selling by any measure.” Fresh capital continues to sit on the sides and has quickly bought up some of the major dips over the last 24 hours.

“There is a lot of money waiting for a dip,” said Rich Rosenblum of GSR, another trading shop. “While the market is trading like its game over the last 24 hours, we are basically unchanged over 7 days.”

In Rosenblum’s view, such price swings to the downside are to be expected given the historical circumstances.

“Heavy volatility is to be expected in a market that has rallied 400% in a few months, and is partly driven by retail trading with 125X leverage,” he told The Block.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Go to Source

Author: Zack Voell