Go to Source

Author: Nikhilesh De

After bitcoin’s price fell from its highs above $40,000 this past weekend, investors were left arguing about whether that drop to almost $30,000 was an inevitable market correction or a sign of something more sinister.

Indeed, liquidations across futures venues soared to more than $3 billion as crypto exchange Coinbase reported persistent technical issues. But Galaxy Digital’s Mike Novogratz isn’t particularly worried.

“I am positive this is not November 2017,” he said on this week’s episode of The Scoop. “Listen, the market got way, way overbought. It was overbought by every statistic, every metric you can look.”

In spite of a fallen price, Novogratz said the real thesis of the past few months was adoption. More people have heard the bitcoin story, according to Novogratz, and a price correction won’t meaningfully undercut that progress. There are still institutions waiting to buy, he said.

“The bitcoin-as-a-hard-asset story remains intact,” Novogratz added. “This is a wash-out, a position wash-out. I don’t think it will be long-term damaging. $30,000 should hold.”

He went on to highlight institutional firms that “haven’t filled their coffers yet that continue to want to buy.”

“Insurance companies, asset managers, big institutions haven’t bought bitcoin yet and they want to,” said Novogratz.

During this week’s episode, Novogratz explains how he and Galaxy Digital are navigating the market correction, as well as:

- Why this price drop won’t scare off institutional investors

- The impact of the macro background and fiscal spending under a Joe Biden-led administration

- The businesses he’s most excited about, particularly in the decentralized finance space

- How he’s viewing Bakkt and Coinbase’s plans to go public

- His advice for new market entrants.

Listen to this week’s episode on Apple, Spotify, Google Play, Stitcher or wherever you listen to podcasts.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

Go to Source

Author: Danny Nelson

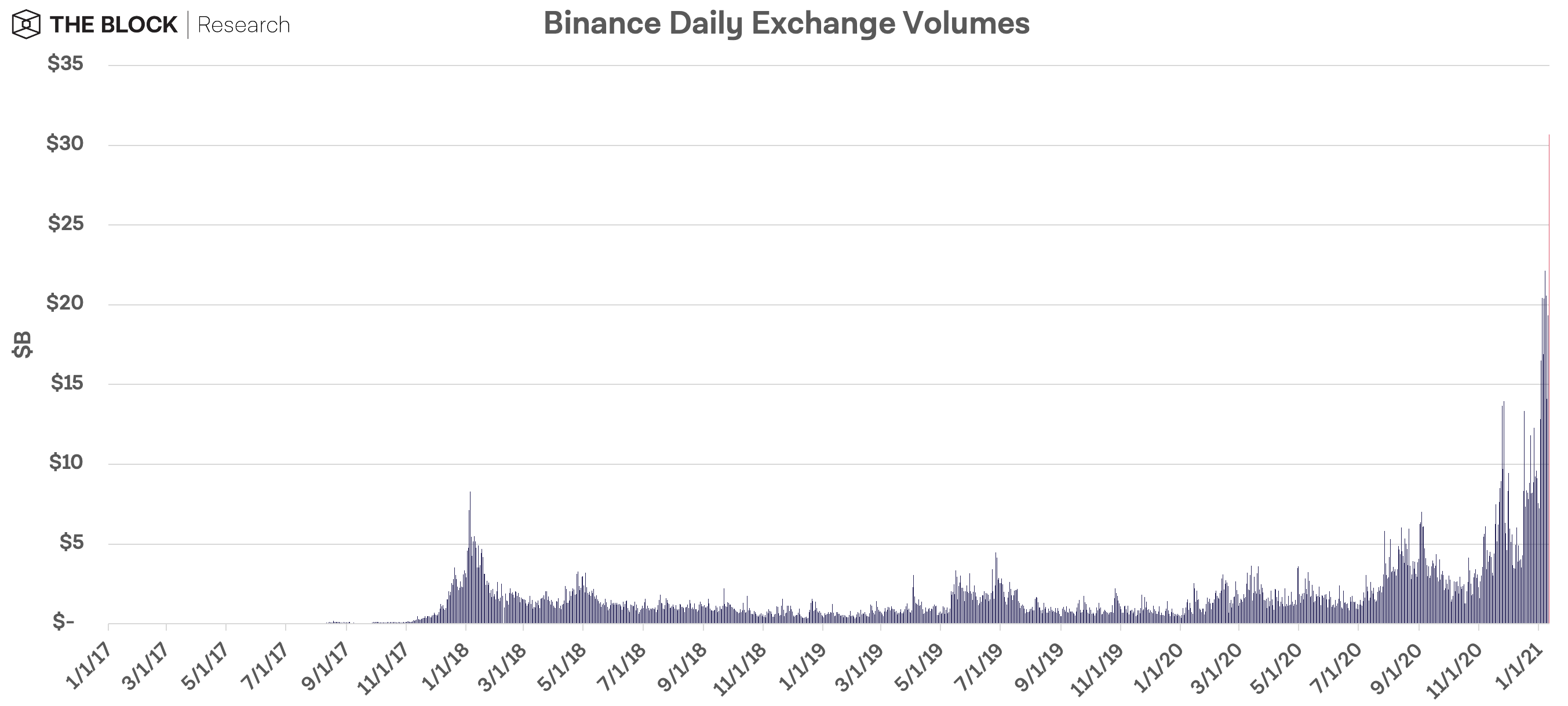

Cryptocurrency exchanges Coinbase and Binance broke their all-time highs for volume on Monday, according to data compiled by The Block.

Coinbase reached $9,56 billion in daily exchange volume — about a 57.9% increase from its $6.05 billion previous peak in January 7, 2021.

On the same day, Binance reached $30.66 billion. That’s roughly 38% greater than the exchange’s last high of $22.1 billion on January 7, 2021.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov

Poolin, the second-largest bitcoin mining pool, has launched an ERC-20 token backed by its bitcoin hash rate capacity in an effort to bridge proof-of-work (PoW) mining and yield farming.

The token is called pBTC35A. As the name suggests, each unit represents 1 terahash second (TH/s) of hashing power owned by Poolin at a power efficiency of 35 Joule per TH. In an experiment to connect proof-of-work mining with decentralized finance (DeFi), Poolin has also launched a protocol called Mars.

Users who stake pBTC35A or the trading pair of pBTC35A against USDT in one of the two liquidity pools on the Mars Protocol can receive rewards in the form of the Mars governance token as well as Wrapped BTC (wBTC). The calculation is based on the amount of bitcoin that the underlying hash rate can mine at the network’s current difficulty after deducting a set electricity cost and Poolin’s 2.5% fees.

The mining pool said that, at this stage, it is selling up to 50,000 pBTC35A, which is equivalent to 50,000 TH/s of computing power backed by the newest bitcoin ASIC miners hosted at Poolin’s facilities.

“By setting just two parameters, power efficiency (35 J/TH) and electricity cost ($0.0583/kWh), pBTC35A helps standardize bitcoin hash rate and provides a benchmark for the pricing of bitcoin ASIC miners in the future,” said Kevin Pan, co-founder and CEO of Poolin. “Since the power efficiency ratio and electricity cost are given, it’s also more transparent to calculate the corresponding mining results on chain [compared to traditional cloud mining].”

As of press time, over 8,500 pBTC35A tokens have been sold. Users either buy the hash rate token directly from Poolin at a price of 100 USDT per a unit or via the trading pair of pBTC35A against USDT on Uniswap, which is priced at $101 as of the time of writing.

Perpetual mining

Notably, such an offering carries a price premium compared to the cost of each TH/s of spot orders for the newest bitcoin ASIC miners.

For instance, Chinese wholesalers are now asking more than 40,000 yuan ($6,200) for a spot stock of Bitmain’s AntMiner S19, which has a computing power of 95 TH/s. That means 1 TH/s of spot S19 inventory is worth nearly $70.

According to Pan, what buyers get in return for paying such a premium are the perpetual bitcoin mining rewards without the issues that physical miner operators or cloud miners may encounter, including unexpected power shutdowns or power drops due to depreciation.

The wBTC mining rewards will be paid out perpetually if users stake pBTC35A in the Mars liquidity pools until bitcoin’s price drops significantly to a level that would make it no longer profitable to mine with a power efficiency of 35 J/TH at an electricity cost of $0.058 per kWh.

Bitmain’s S19, for example, has a standard power efficiency ratio of 34 J/TH. At bitcoin’s current mining difficulty and an electricity cost of $0.058 per kWh, the S19 becomes unprofitable if bitcoin’s price drops below $6,551, according to miner profitability data tracked by Poolin and F2Pool.

Poolin said that similar hash rate tokens for ETH and other PoW coins are in the pipeline but there’s no firm release schedule yet in place. The hash rate token comes at a time when bitcoin mining is becoming highly competitive due to bitcoin’s rising price, which caused a significant shortage in the market for new hardware.

Last week, a project called 1-b.tc rolled out similar products in an attempt to standardize bitcoin’s mining hash rate. The project, backed by the hash power provided by mining farms 360power and Ke Wo Ying Mining, launched the so-called BTC Standard Hashrate Token (BTCST) via Binance’s Launchpool.

Users staking BNB, BTC or BUSD in liquidity pools can receive rewards from an initial supply of 40,000 BTCST, each of which represents 0.1 TH/s of computing power. By staking BTSCT via the project’s dApp, users can receive wBTC based on the amount of bitcoin the underlying hash rate is able to generate.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Wolfie Zhao

Go to Source

Author: Daniel Kuhn

Go to Source

Author: Zack Voell

Go to Source

Author: Lyllah Ledesma

Go to Source

Author: Danny Nelson

German authorities have taken the alleged operator of underground internet marketplace DarkMarket into custody.

The investigators also deactivated the servers of the marketplace, which claimed to have over 500,000 users and 2,400 vendors among its user base.

DarkMarket processed at least 320,000 transactions, moving around 4,650 BTC and 12,800 XMR, according to a statement published today from Germany’s General Public Prosecutor Office in Koblenz. Total transaction worth is estimated to be around 140 million Euros ($170 million USD).

The suspected operator is a 34-year-old Australian citizen who was arrested near the Germany-Danish border. Authorities seized more than 20 servers from Moldova and Ukraine at the time of arrest, and they plan to use the stored data to investigate DarkMarket buyers, sellers, and moderators.

DarkMarket was primarily used as a market for narcotics, though other illegal commodities like counterfeit money, stolen credit cards, anonymous SIM cards, and malware were sold by vendors.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov