Go to Source

Author: Sebastian Sinclair

Go to Source

Author: Benjamin Powers

Go to Source

Author: Noelle Acheson

Go to Source

Author: Muyao Shen

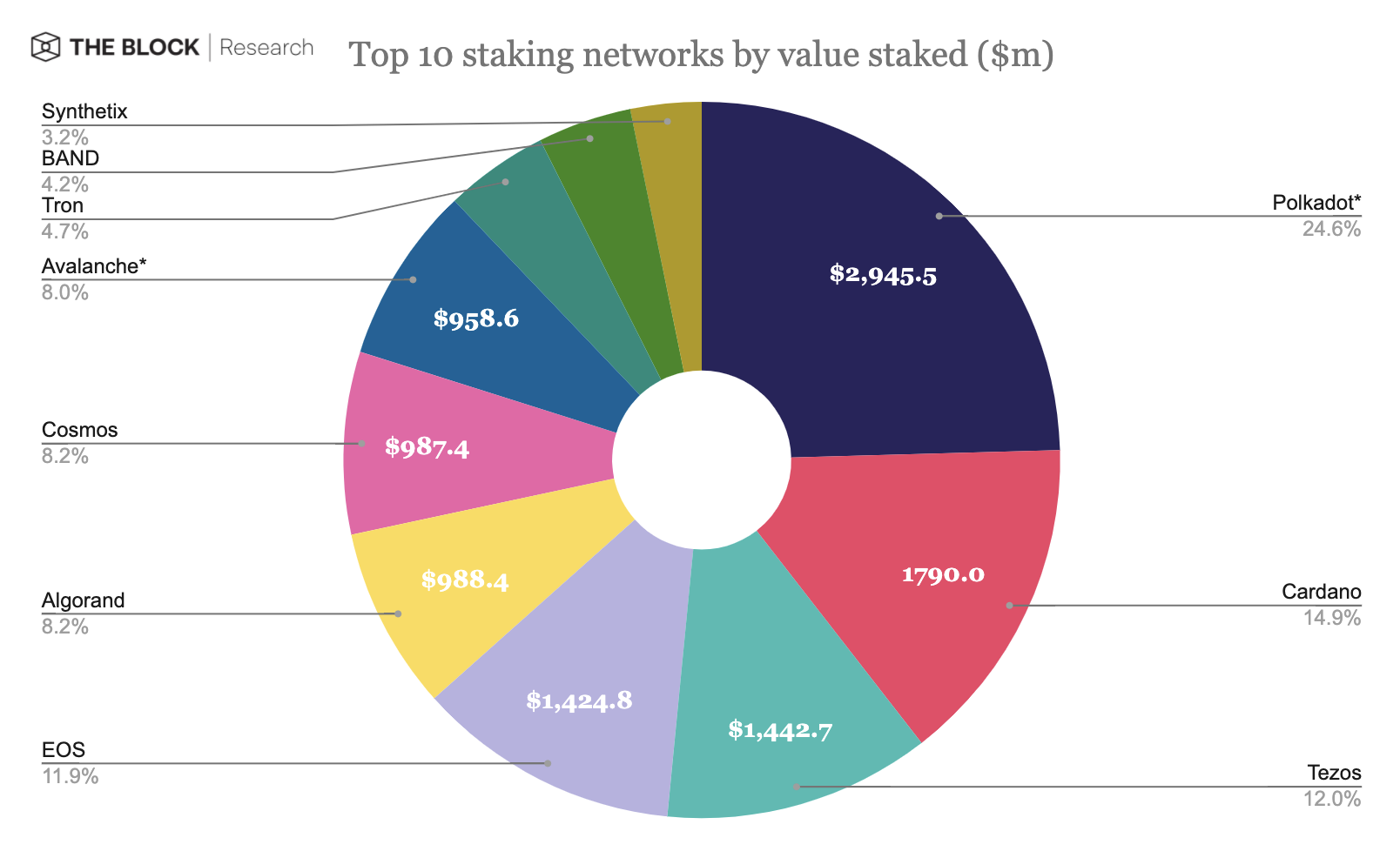

Polkadot is the most popular network for staking, nearly $3 billion worth of DOT tokens are at stake

Layer-1 blockchain Polkadot is the most popular network when it comes to staking. According to The Block Research, nearly $3 billion worth of DOT, Polkadot’s native token, are at stake.

The figure means DOT token holders have deposited $3 billion worth of funds with Polkadot validators for earning passive income. Cardano follows Polkadot as the second most popular network, with $1.79 billion worth of ADA staked.

Tezos (XTZ) and EOS are ranked third and fourth by staking value, each having roughly $1.4 billion within their networks. Overall, around $12 billion in total is staked across the top ten networks — eight of which are Layer-1 blockchain networks — except Band Protocol and Synthetix.

Source: Staking Rewards, The Block Research

Besides being the largest network by staking value, Polkadot’s DOT is the only token to have a positive return in the U.S. dollar, bitcoin, and ether over the past 90 days since the network launched trading of the token.

To read the full staking report and more such data-driven stories, subscribe to The Block Research.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Nathaniel Whittemore

Go to Source

Author: James Felton Keith

Go to Source

Author: Muyao Shen

The amount of available DAI — the stablecoin tied to the Ethereum-based lending protocol Maker — has surpassed $1 billion, according to available data.

DaiStats reports that a total of 1,001,031,052.54 DAI has now been issued. DAI is created when collateral, such as ETH, is locked into a smart contract called a Vault. That DAI may later be redeemed and the collateral removed from the smart contract.

The milestone was first noted by Maker founder Rune Christensen in a tweet on November 13.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Michael McSweeney

Value DeFi, a decentralized finance yield aggregating protocol, was exploited early Saturday morning for $7.4 million in DAI.

The attacker executed a flash loan attack, borrowing 80,000 ETH from the Aave protocol. Flash loans allow users to borrow funds instantly, so long as they are returned within one transaction block, meaning users can take advantage of uncollateralized loans. As part of the exploit, the attacker returned $2 million to Value DeFi and kept $5.4 million for themselves, according to available network data.

Additionally, the attacker left a cheeky message for the Value DeFi team, stating: “do you really know flashloan?” — a reference to Value DeFi’s Friday tweet claiming it has flash loan attack prevention.

The Value DeFi team later confirmed in a tweet that it had encountered “a complex attack that resulted in a net loss of $6M.”

“We are currently working on a postmortem and are exploring ways to mitigate the impact on our users,” the tweet continued.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: The Block