Go to Source

Author: Sebastian Sinclair

Go to Source

Author: Christine Kim

Go to Source

Author: Sebastian Sinclair

Privacy-oriented Brave browser’s Swag Store now sells non-fungible tokens (NFTs), or digital collectibles that are tokenized on blockchain.

Brave has partnered with Origin Protocol for the initiative, which powers its store via decentralized e-commerce marketplace Dshop since April last year. The extended partnership now allows Brave to sell NFTs in return for crypto payments.

Swag Store accepts ether (ETH) and Brave’s native basic attention token (BAT) for payments, in addition to credit cards.

Brave’s first NFT sale features a total of 30 collectible tokens and physical stickers based on the three winning submissions in its recent Brave and BAT Community Meme Competition. In the coming weeks, Brave is also expected to release “a very limited set” of NFTs, created by designers at Brave and Origin.

NFTs have soared in popularity in recent weeks as artists and brands are venturing into the space. Over the past 30 days, NFT sales have topped a record $100 million, according to tracker Cryptoslam. Dapper Labs’ NBA Top Shot holds the lion’s share, followed by CryptoPunks.

“NFTs are more than digital art,” said Matthew Liu, cofounder of Origin Protocol. “They can serve not only as collectible, transferable assets but as digital representations of real-world goods and services. For example, NFTs representing limited edition premium goods can be bought, traded, and then redeemed.”

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

The canton of Zug, one of the Swiss Confederation member states, has begun accepting bitcoin (BTC) and ether (ETH) for tax payment after initially announcing support last September.

Kanton Zug has partnered with Bitcoin Suisse for the initiative, meaning the Swiss crypto firm will convert residents’ BTC and ETH tax payments into Swiss Francs for the authority.

The process of paying taxes with crypto appears to be simple. Residents have to scan a QR code and pay from a crypto wallet of choice. The cap for such payments is up to CHF 100,000 (about $110,000).

Swiss city Zug also accepts bitcoin for tax payments via Bitcoin Suisse since 2016. The Swiss municipalities of Zermatt and Chiasso also support the cryptocurrency for smaller tax payments.

It is unclear how many people prefer to pay taxes with cryptocurrencies, especially given their prices are skyrocketing. Bitcoin is currently trading at around $52,000 and ether at about $1,900.

The Block has reached out to Bitcoin Suisse for details and will update this story should we hear back.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: David Pan

The Sand Dollar, a digital currency issued by The Bahamas’ central bank, is at the center of a new prepaid card arrangement involving Mastercard.

Mastercard published details of the set-up on Wednesday, which involves mobile payments service provider Island Pay in addition to the central bank. Mastercard will issue a prepaid card that allows users to instantly convert the Sand Dollar, The Bahamas’ central bank digital currency (CBDC), to cash during purchases.

The Bahamas piloted its Sand Dollar in 2019 before fully deploying the CBDC in October of last year. Initially, it was only accepted by select merchants through a digital app that required user registration. The new prepaid card can be used with any merchant that accepts Mastercard.

Mastercard’s executive vice president of Digital Asset and Blockchain Products and Partnerships, Raj Dhamodharan, said Mastercard is focused on creating possibilities for governments related to new forms of payment.

“This partnership is an example of how the private and public sector can rethink what’s possible, while delivering the strongest levels of consumer protection and regulatory compliance,” he said in a statement.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Michael McSweeney

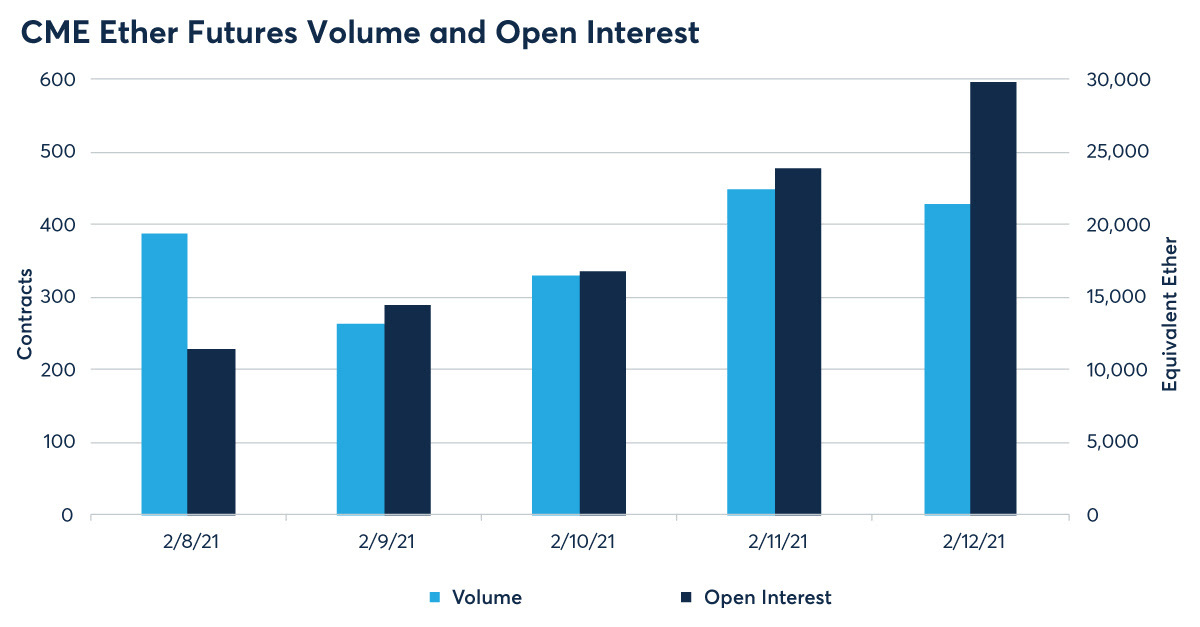

CME completed its first full week of ether futures trading last Friday, and it nearly sustained the volume of its opening day.

Over the course of the week, an average of 371 contracts was traded each day at 50 ETH per contract. That’s about 18,600 ETH or $34 million. Monday’s volume was 19,400 ETH or $33 million at the time.

Source: The CME Group

The derivatives exchange announced it would launch cash-settled ether futures in mid-December. They began trading on Sunday evening, with the first contracts purchased at 6:00 PM ET on Feb. 7. Since then, CME has seen 121 unique, active accounts trading the offering.

In total, 1,856 contracts were traded last week, which comes out to about 92,800 ETH, roughly $160 million. A third of the week’s volume came during non-U.S. trading hours, and 27% of volume came from outside the U.S.

The ether futures product joins CME’s popular bitcoin futures product. Bitcoin futures saw nearly 1,000 contracts, approximately $100 million worth of bitcoin, traded on opening day.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

Go to Source

Author: Brady Dale

Go to Source

Author: Emily Parker