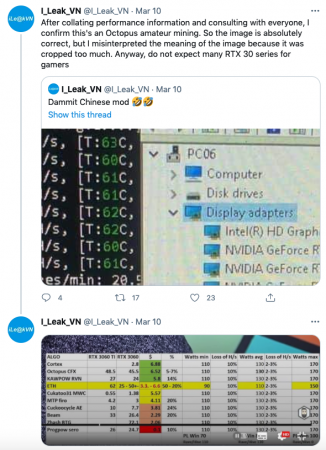

On March 10, an anonymous tech Twitter account posted a dashboard screenshot with the caption “Dammit Chinese mod.”

The tweet suggested that Chinese Ethereum miners successfully bypassed the restriction that Nvidia integrated into its RTX 3060 GPUs used to mine ETH. The screenshot showed that the RTX 3060 GPUs were delivering a usual hashing power of 45 MH/s, well above the supposed 50% hash rash limiter announced by Nvidia last month.

The information quickly spread across both gaming and crypto publications which ran headlines citing the Twitter account as the source that said Chinese miners have “allegedly” bypassed Nvidia’s hash rate limiter on Ethereum. The problem: it’s not true.

None of the Chinese Ethereum miners or pool operators that The Block spoke with said they had seen a real solution that could bypass the RTX 3060 GPU limiter to deliver a hash rate performance of more than 40MH/s.

It would have been a notable development, though, because when Nvidia introduced its latest RTX 3060 GPUs last month, the company said it was enforcing a secure way to reduce 50% of the GPU’s computing power if used to mine ETH. Meanwhile, Nvidia is launching a new processor chip specifically dedicated to cryptocurrency mining.

The curb and the launch plan are part of the chipmaker’s efforts to provide a balanced supply to satisfy the demands of both gamers and crypto miners.

But the fact that the misinformation swiftly raised eyebrows and drove headlines within hours offers a glimpse into the seemingly irreconcilable tension – at least for now – between gamers and miner operators.

That’s because surging mining revenues have resulted in operators buying up as much inventory as they can, driving up market prices. Some are even turning to gaming laptops to squeeze out some extra hash rate.

In fact, according to industry experts, it’s almost impossible to crack Nvidia’s GPU hash rate limiter. Bryan Del Rizzo, Nvidia’s RTX product PR executive, said in a tweet last month that the restriction isn’t limited to a software update.

“It’s not just a driver thing. There is a secure handshake between the driver, the RTX 3060 silicon, and the BIOS (firmware) that prevents removal of the hash rate limiter,” Del Rizzo tweeted. He has not responded to The Block’s request for comment on this article.

Kristy-Leigh Minehan, a crypto mining expert previously with Core Scientific and Genesis Mining, suggested that it would take an insider job to do the trick.

“To bypass it, you’d need a NVIDIA private key to be able to sign a custom driver and VBIOS implementation [and] the tool used to do VBIOS modifications ‘phones home’ to Nvidia, same with drivers (on their build servers), so they would have record of all of this,” she said in a direct message to The Block.

Put simply: “[The] only way to get around it is be a NV [Nvidia] employee with both a signed VBIOS and a new driver version,” she added with a laugh-out-loud emoji.

So what caused all the fuss?

It turns out the Twitter account that leaked the original dashboard image didn’t confirm until hours later that the screenshot was misinterpreted.

The same account posted a follow-up tweet to clarify that the screenshot wasn’t related to the Ethereum hashing power performance. Rather, it was related to Conflux, another proof-of-work blockchain network that’s not subject to Nvidia’s hash rate limiter.

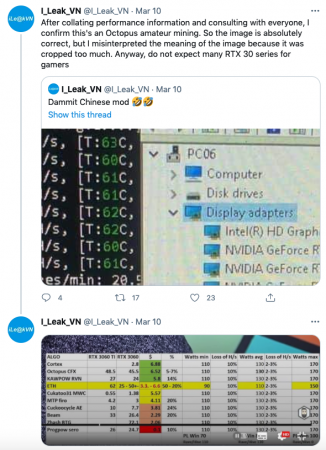

The account tweeted another chart screenshot showing how the RTX 3060 GPUs were, in fact, delivering a reduced hash rate of 25MH/s.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.