Ondo Finance, a crypto startup that provides structured products built on top of decentralized exchanges, has raised $20 million in Series A funding as it looks to build a decentralized investment bank.

Peter Thiel’s iconic VC firm Founders Fund and Pantera Capital co-led the round. This is the first time Founders Fund has led an investment in a token-based project, Ondo’s founder and CEO, Nathan Allman, told The Block. Founders Fund has previously participated in a token round for Parallel Finance.

An Ivy League endowment also joined Ondo’s Series A, said Allman, while declining to name it.

The fundraising was via an equity round but with token rights, according to Allman. Its native token ONDO and a decentralized autonomous organization (DAO) are expected to launch “in the next few weeks.”

Other investors in Ondo’s Series A funding included Coinbase Ventures, Tiger Global, GoldenTree Asset Management, Wintermute, Flow Traders and Steel Perlot, a deep tech management company led by former Google CEO Eric Schmidt.

How Ondo Finance works

Ondo provides investment products known as “vaults” built on top of decentralized exchanges. It offers two types of vaults: fixed yield and variable yield. Depositors in fixed yield vaults receive a fixed percentage of yield over their initial investment. Depositors in variable yield vaults receive all excess returns after the fixed yield vaults receive their payout, said Allman.

Ondo also provides liquidity-as-a-service to DAOs. It pairs DAOs with underwriters (for now, stablecoin issuers) to establish liquidity pools. DAOs provide their governance token and underwriters provide a base like stablecoins, which Ondo uses to establish liquidity providers, said Allman.

“The goal is to help DAOs establish their own liquidity without having to rely on liquidity mining or market making firms,” he said, adding that these can be “both expensive and unsustainable.”

Ondo has partnered with more than 10 DAOs — including NEAR, Synapse and UMA — and underwriters including Fei, Frax, Terra and Reflexer, according to Allman.

Ondo currently only supports Ethereum-based protocols on its platform, but that is about to change. The platform plans to integrate several Layer 2 networks and alternative Layer 1s in the near future, said Allman.

The current total value locked in Ondo Finance stands at $120 million, according to data from DeFi Llama.

Ondo plans to expand its team of around 20 people by hiring across various functions, including engineering, design, marketing and business development.

The Series A round brings Ondo’s total funding to date to $24 million. Last August, the project raised $4 million in seed funding led by Pantera Capital. Ondo is looking to raise more funds in the near future, said Allman, a Goldman Sachs alum.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

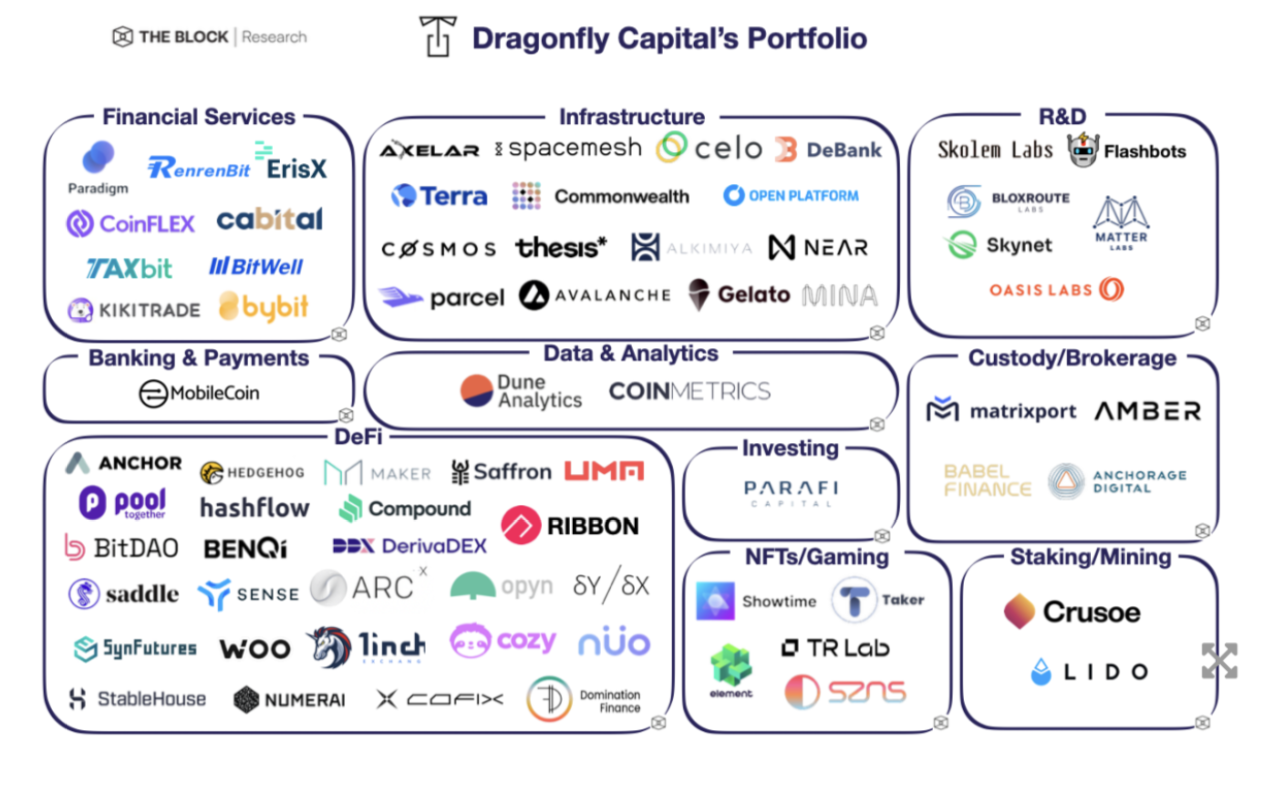

Dragonfly has invested in a wide range of companies, including blockchains like Terra and Near and financial services like Matrixport and Paradigm.

Dragonfly has invested in a wide range of companies, including blockchains like Terra and Near and financial services like Matrixport and Paradigm.