This research piece is available exclusively to

members of The Block Research.

You can continue reading

this Research content on The Block Research.

Go to Source

Author: The Block Research

This research piece is available exclusively to

members of The Block Research.

You can continue reading

this Research content on The Block Research.

Go to Source

Author: The Block Research

Indonesia-based cryptocurrency exchange Pintu has raised $113 million in a Series B funding round.

Investors in the round include Pantera Capital, Lightspeed India Partners, Intudo Ventures and Northstar Group. There was a lead investor in this round, Pintu’s founder and CEO Jeth Soetoyo told The Block in an interview, but he declined to name it because the investor prefers to remain undisclosed. But that investor is a global venture capital firm, he said.

Pintu’s raise comes at a time when crypto trading volumes are falling and exchanges are slashing jobs, given the current bearish market sentiment. When asked how Pintu could close the round successfully, Soetoyo said the firm started raising earlier this year and closed the round last month after Terra’s collapse because Pintu’s product “speaks for itself.”

Soetoyo went on to say that some of the investors already knew about Pintu’s position in the market and were comfortable backing it. Soetoyo, however, agreed that the fundraising environment has become more difficult now, especially for new ideas and startups.

Pintu was launched in April 2020 and is one of the top three Indonesian crypto exchanges, according to Soetoyo. The firm doesn’t publicly disclose its trading volumes. Its local rivals include Indodax and Tokocrypto.

With fresh capital in hand, Pintu plans to keep growing in Indonesia, the world’s fourth most populous nation, and offer access to new products and services such as DeFi and NFTs. “We need to cement our position in the market. I think pretty much that’s where our focus is going into,” said Soetoyo.

To that end, Pintu also plans to double its current headcount of around 200 people in the next two years across various functions, said Soetoyo. This is contrary to recent job slashes and hiring freezes in the market by exchanges such as Coinbase and Gemini. Pintu hasn’t laid off any staff and doesn’t have a plan to do so, said Soetoyo.

As one of the leading Indonesian exchanges, Pintu claims to have more than four million users. There are a total of more than 12 million crypto traders in Indonesia compared to 7 million equity traders, according to data from the Indonesian Commodity Futures Trading Regulatory Agency (Bappepti).

Soetoyo said Pintu, which is registered and licensed by Bappepti, plans to onboard more users to its platform. The current bearish market conditions wouldn’t impact the firm’s plans because long-term investors ignore short-term market movements, according to Soetoyo.

The Series B round brings Pintu’s total funding to date to over $150 million. Last August, the firm raised $35 million in an extended Series A funding round.

Soetoyo declined to comment on the firm’s valuation with the latest round, but according to Dealroom estimates, Pintu was valued at up to $210 million at the time of its extended Series A round.

Given its young age, Pintu currently doesn’t have an exit plan, said Soetoyo. The firm, in fact, may invest in some startups that would be a strategic fit.

“We are talking with different types of companies in Indonesia and globally, but not necessarily as an acquisition target,” said Soetoyo.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Crypto financial services firm BlockFi is in the process of closing a down-round — in which funds will be raised at a lower valuation compared to previous raises — according to three sources with knowledge of the process.

BlockFi, which was reportedly raising funds at a valuation above $5 billion last year, provides one signal that the compression of valuations that have hit public markets for tokens and stocks is making its way to private markets.

The firm, founded in 2017 by Zac Prince and Flori Marquez to offer uses a way to borrow funds against their crypto holdings, announced a $350 million raise at a $3 billion valuation in March 2021. At the time, the company touted breakneck growth metrics, such as a $10 billion loan book and 265,000 retail accounts.

Sources say the new round will be led by venture investment firm Bain Capital Ventures with participation from DST and Valar.

“BlockFi does not comment on market rumors,” a spokeswoman said, responding to a request for comment.

BlockFi’s down round represents a striking development in the industry for crypto services given the high degree of venture capital activity only months before.

Over the last year, the market saw a wide range of companies secure valuations above $1 billion, including exchanges like Gemini and data providers like Dune Analytics. VC firms deployed $28.94 billion in 2021, according to data compiled by The Block Research.

“Private valuations are being adjusted,” one market participant said of the current environment for private crypto companies.

The round also comes months after BlockFi settled with the Securities and Exchange Commission (SEC) as well as state regulators in the US over its crypto savings product. BlockFi previously told The Block that it plans to offer its more than 600,000 users a similar product after it secures the requisite regulatory approvals.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

In September 2020, hackers from the North Korean Lazarus Group broke into Slovakian crypto exchange Eterbase and stole currency worth roughly $5.4 million. Using only encrypted email addresses, the hackers opened at least two dozen anonymous accounts on Binance and used them to “convert the stolen funds and obscure the money trail,” according to a new Reuters investigation.

According to the report, the interactions between the exchange and the well-known state-sponsored hacking group are part of a much larger picture of illicit activity. From 2017 to 2021, Binance was used to process transactions totaling at least $2.35 billion associated with hacks, investment frauds and illegal drug sales, Reuters said.

Lazarus group, which was sanctioned by the US Government in 2019 over cyberattacks designed to support North Korea’s weapons program, made headlines again in April when the US government drew a connection between its actions and nearly $600 million stolen from Axie Infinity’s Ronin sidechain network. Blockchain analytics firm Chainalysis estimates that by 2020 Lazarus had stolen crypto worth $1.75 billion.

In response to Reuters’ investigation, Binance spokesperson Patrick Hillman claimed that accounts holding nearly $5.8 million used during the Ronin attack have been identified and frozen by Binance’s security team.

“Many Binance team members were involved in the initial investigation,” a statement released by the company claimed. “We proactively share intelligence with law enforcement to map out North Korea’s modus operandi globally.”

Referring to the Eterbase attack, Binance stated that “we fully cooperated with requests received from Slovak authorities.”

Binance strengthened its know-your-customer requirements in August 2021, and data from analytics firm Crystal Blockchain shows that flows of illicit funds have dropped significantly since then. However, with millions already stolen or used for illicit activity on Binance, it’s unclear what is being done to support victims of theft or fraud.

While consumers in many countries can call on banks to freeze or reimburse stolen funds, Binance explains on its website that law enforcement must be directly involved and victims must sign non-disclosure agreements as a condition for freezing assets.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Sam Venis

The Securities and Exchange Commission (SEC) is reportedly investigating whether Binance’s BNB token was a security at the time of its sale in 2017.

Bloomberg reported Monday that the SEC has launched a probe into the BNB token. The US securities regulator is taking a look at the early days of the exchange, examining whether the sale of its BNB token during a 2017 initial coin offering amounted to an unregistered sale of securities.

SEC chair Gary Gensler has been vocal in his concern that platforms may be hosting tokens that could be classified as securities, but his comments have focused more on taking exchanges to task for hosting unregistered securities than going after projects themselves, as previous SEC regimes did during the ICO boom.

Binance has faced scrutiny from a variety of US regulators in recent months.

The SEC is also reportedly investigating the exchange’s US arm, Binance.US, to ensure it’s appropriately differentiated from its global counterpart. The Internal Revenue Service and Department of Justice are also taking a closer look at Binance to gain insight into its business, and the Commodity Futures Trading Commission (CFTC) has also reportedly launched an inquiry into whether Binance allowed US residents to trade on its platform.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

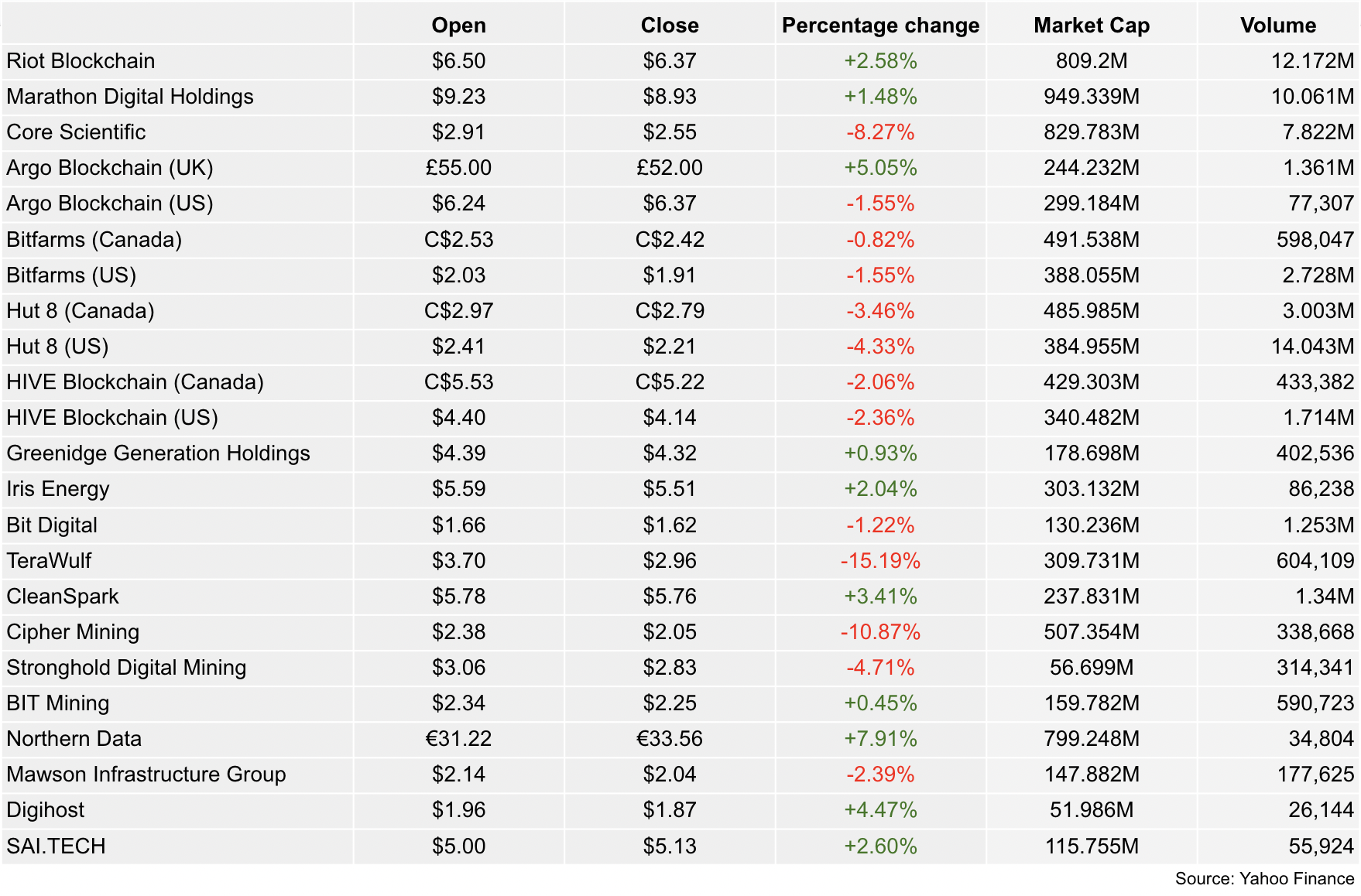

The trading week started off with a mix of Bitcoin companies posting recoveries and others seeing their stocks continue to drop.

Notably, TeraWulf’s stock went down by -15.19% and, on the opposite end, Northern Data’s rose by +7.91%.

Hut 8 announced with its May operations update that it had mined 309 BTC and decided to hold on to all self-mined bitcoin, keeping with its long-term HODL strategy.

Hive also released a statement about last month’s operations stating that it had grown its hash rate capacity by 8%. In May, Hive mined 273.4 BTC and 2,694 ETH.

On Monday Hut 8’s stock was down by -3.46% on the Toronto Stock exchange and -4.33% on Nasdaq. Hive’s stock was also down by -2.06% and -2.36% on each, respectively.

Here’s how crypto mining companies performed on Monday, June 6:

Data compiled by The Block

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Catarina Moura

Crypto investment firm Paradigm has hired crypto and fintech legal veteran Katie Biber as its chief legal officer.

Biber, who was tapped by Paradigm from credit card startup Brex, previously served as general counsel to the 2012 presidential campaign of Mitt Romney, who now serves as the junior US senator of Utah.

Biber wrote in a blog post:

“Over the next few years, I look forward to working with the exciting, cacophonous web3 community to tell our story and definitively flatten the meme that our technology is just a solution in search of a problem (a criticism leveled against the internet in the early days, too).”

“The future is obvious, and it’s our job to make it happen in partnership with regulators,” Biber, who previously held top legal roles at Anchorage and Protocol Labs, added. As Brex’s chief legal officer, Biber played a role in doubling the legal department of the company, as per reporting from Law.com. Biber first joined Brex in 2020.

Paradigm, similarly to rivals like a16z, has been staffing up its legal and policy teams with a number of hires, including Rodrigo Seira Silva-Herzog and Josh Ephraim who both joined as general counsel associates last fall. The firm also hired Justin Slaughter — who previously served as the chief policy advisor and special counsel to former CFTC commissioner Sharon Bowen — as its chief policy officer in December 2021.

Led by Fred Erhsam and Matt Huang, Paradigm raised a $2.5 billion fund last fall.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Tech giant Apple is jumping into the buy now, pay later (BNPL) fray via a new Apple Pay feature.

The feature, dubbed Apple Pay Later, will mirror similar services, with zero interest or fees, with payments being made in four equal increments. Such payments can be issued to merchants that accept Apple Pay.

The announcement was made during the first day of Apple’s developer-focused event on Monday.

As The Block previously reported, a growing number of financial technology firms have carved out market share in BNPL services, buoyed by interest from venture capitalists. Some of these companies are also exploring crypto offers as part of a bid to cater to younger customers.

Recent reports indicate, however, that some consumers have struggled to meet payments after opting for BNPL.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Michael McSweeney

Bitcoin miner Hive grew its hash rate by 8% in May, according to the company’s most recent operational update.

“We are pleased to report in May HIVE continued its strong momentum in expanding our hash rate, notably our Bitcoin mining hash rate grew by 8% this month, through installations and electrical upgrades,” said CEO Frank Holmes.

In May, Hive mined 273.4 BTC and 2,694 ETH. By the end of the month, the company had 2.18 exahash per second (EH/s) of Bitcoin mining capacity and 6.26 terahash per second (TH/s) of Ethereum mining capacity.

“In May we produced an average of 8.8 BTC per day, and we are pleased to note that as of today, we are producing approximately 9.2 BTC a day even after the recent difficulty increase of 5.5%,” Holmes also said.

The company said that it plans to reach 6.2 EH/s in BTC equivalent (a number that combines Bitcoin and Ethereum) in one year — up from 3.4 EH/s now.

The company also addressed its stock value, which, in line with other bitcoin miners, has been on the decline:

“The stock price is not a fair and reasonable price relative to our track record, growth plans and negative sentiment towards Tech stocks, especially bitcoin miners. We are frustrated like most loyal long-term shareholders that we are not enjoying a premium as measured in revenue, cash flow multiples for superior execution, green energy focus and ESG strategy. Important for our shareholders as we weather the Bitcoin winter together, is that management remains focused on basic business fundamentals.”

Hive recently consolidated its stock in a 5-t0-1 ratio, in an effort to reduce the number of outstanding shares and increase their price, ultimately making its stock more attractive for investors.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Catarina Moura

The blockchain-based game Axie Infinity brought in only $988,400 in revenue last week — the first week the play-to-earn (P2E) game has clocked less than $1 million since February of 2021.

Axie, the darling of the P2E world, experienced a meteoric rise in popularity in the summer and early fall of 2021. At its peak, the game accrued over $215 million during the week of August 8, 2021. In October of that year, Axie’s creator Sky Mavis had even reached a $3 billion valuation after a $152 million funding round led by a16z.

But as The Block’s data dashboard shows, Axie Infinity has experienced a steady decline since November of 2021. Sky Mavis couldn’t continue its rapid growth due to an imbalance issuance and burn mechanism for Axie’s in-game tokens, The Block previously reported.

Too much of the Axie’s in-game token, Smooth Love Potion (SLP) was issued without ample ways to destroy, or burn, the token. This lead to inflation that caused the token to lose value, disincentivizing players to continue using the game. Sky Mavis attempted to instill more burn mechanisms into the game, but it does not appear to have had the desired affects.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov