June was a torrid month for crypto in general; a fact that meant it was almost unavoidable for the non-fungible token (NFT) space to feel a knock-on effect.

In this inaugural edition of The Block’s monthly gaming, NFT and metaverse data roundup, we look at the numbers behind the news, and bring you some of the latest data on trends in the space.

The bear market hits NFTs

NFT marketplace trading volume fell from $16.6 billion at the start of this year to just over $1 billion last month, a 94% decline. The start of this year was a boom period for NFTs in terms of trading activity.

In January NFT trading on Ethereum hit an all time high of $16.6 billion. But there is a caveat. It’s thought NFT trading was particularly high in January due to users trading tokens among themselves to drive up prices – known as wash trading – on LooksRare.

Alongside this, despite a rocky patch, OpenSea clawed back some of its market dominance.

Meanwhile, NFT prices were generally in decline. The floor prices of so-called blue chip projects such as Bored Ape Yacht Club (BAYC), Doodles and Cool Cats have fallen around 30% since the start of the year.

BAYC’s creators Yuga Labs, however, has increased its market share so far this year as it rolls out new products such as Otherdeed, the land NFTs for the company’s upcoming Otherside metaverse. It will hold its first demo on July 16.

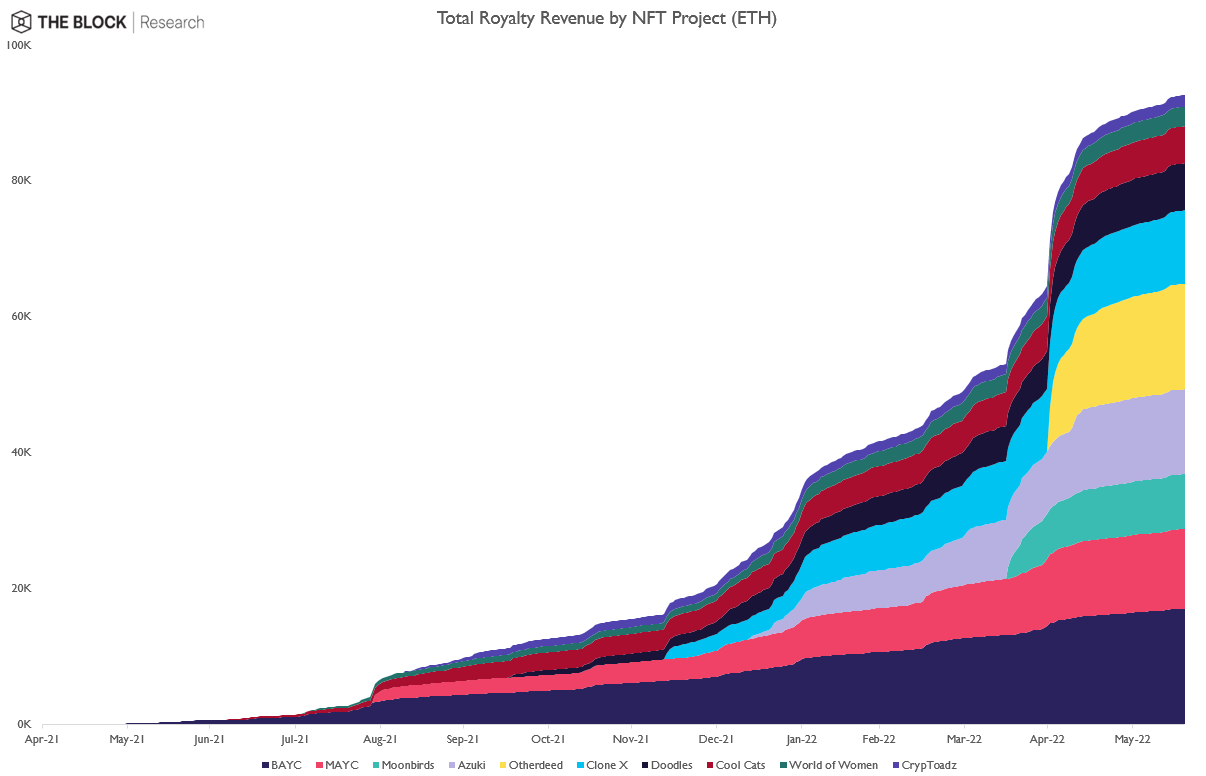

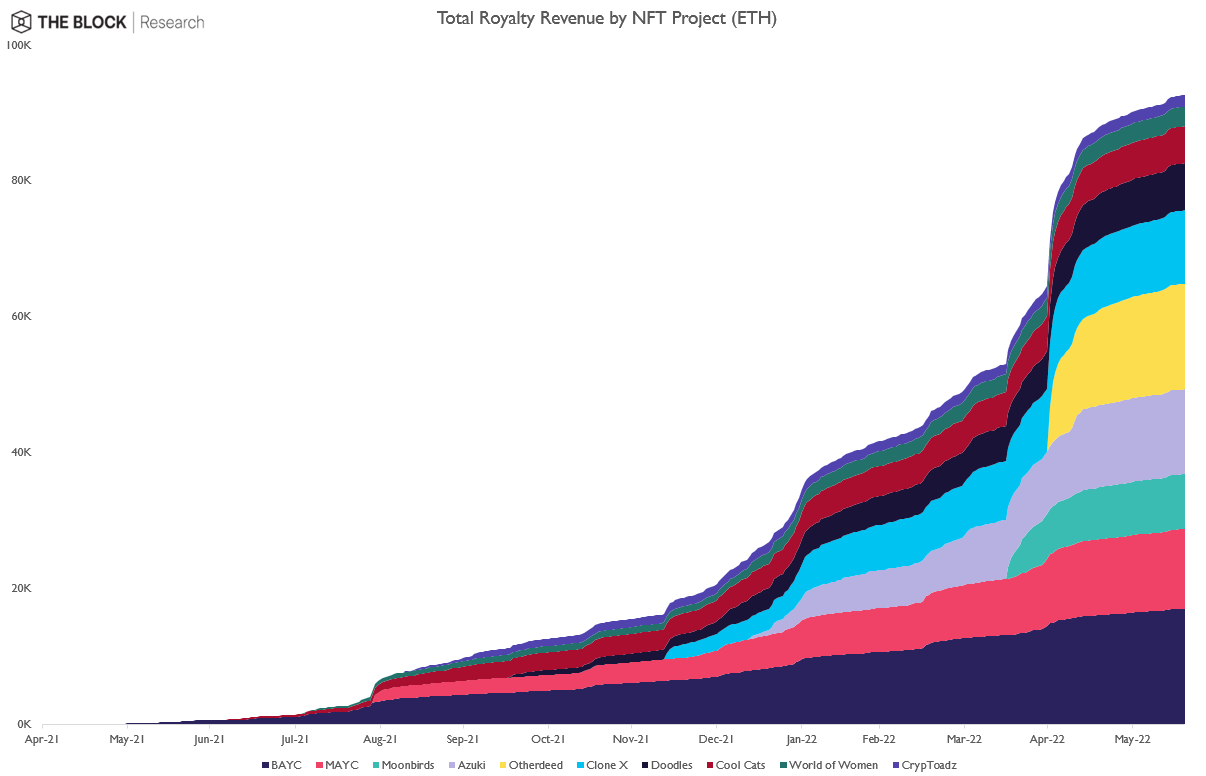

NFT Royalties

Research from The Block shows that the top ten NFT projects have amassed 92,600 ETH in cumulative royalty revenue. The steep ascent in sector-wide royalties in April and May this year has been driven mainly by just two collections: Otherdeeds and Moonbirds.

Source: The Block Research, Dune Analytics (@cryptuschrist)

But don’t be fooled into thinking this graph paints a rosy picture of the fortunes of these top collections. Converted into USD, the picture becomes somewhat bleaker.

Source: The Block Research, Dune Analytics (@cryptuschrist)

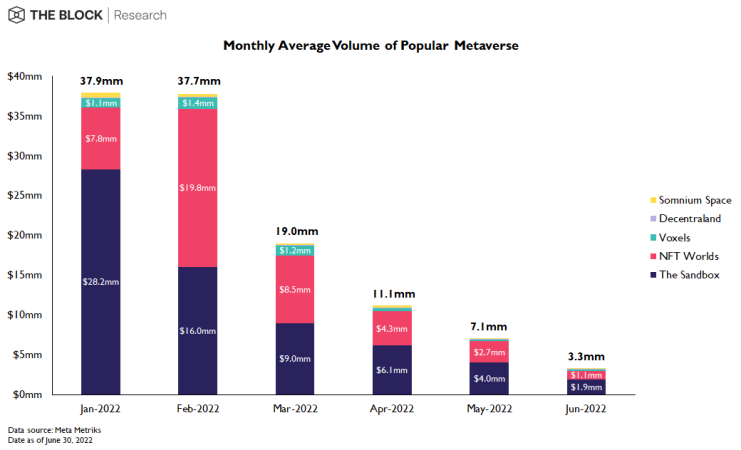

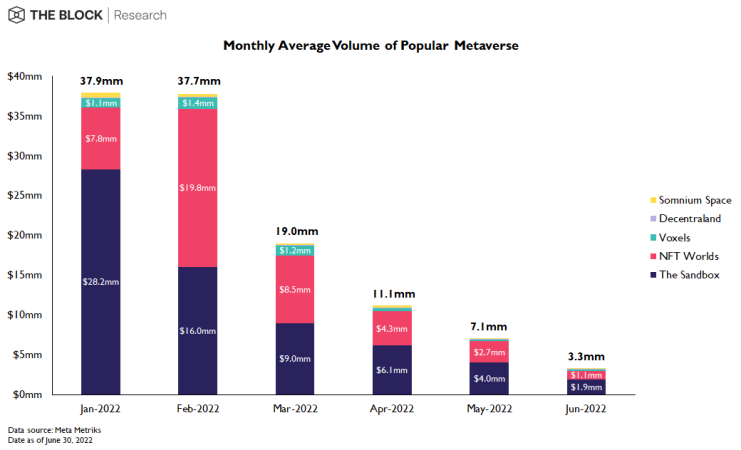

Metaverse land prices, volume down

Decentraland land prices decreased from an average of $6,000 in January to $3,500 last month. The Sandbox is down from $4,700 to $2,100. NFT World, which saw its $4,400 January price rise to a peak of $11,600 in March, is back down to $4,300. However, much of the price decline was seen earlier on in the year as opposed to last month.

The outlier was Otherdeed. The price of these land parcels soared to almost $22,000 in May following the Otherdeed mint at the end of April but have since slumped to an average of around $5,700 a piece.

Sales volume continues to fall from highs edging towards $40m at the start of the year to more than ten times less than that in June. The Sandbox and NFT Worlds continue to take in the lion’s share of sales volume but have also seen huge decreases.

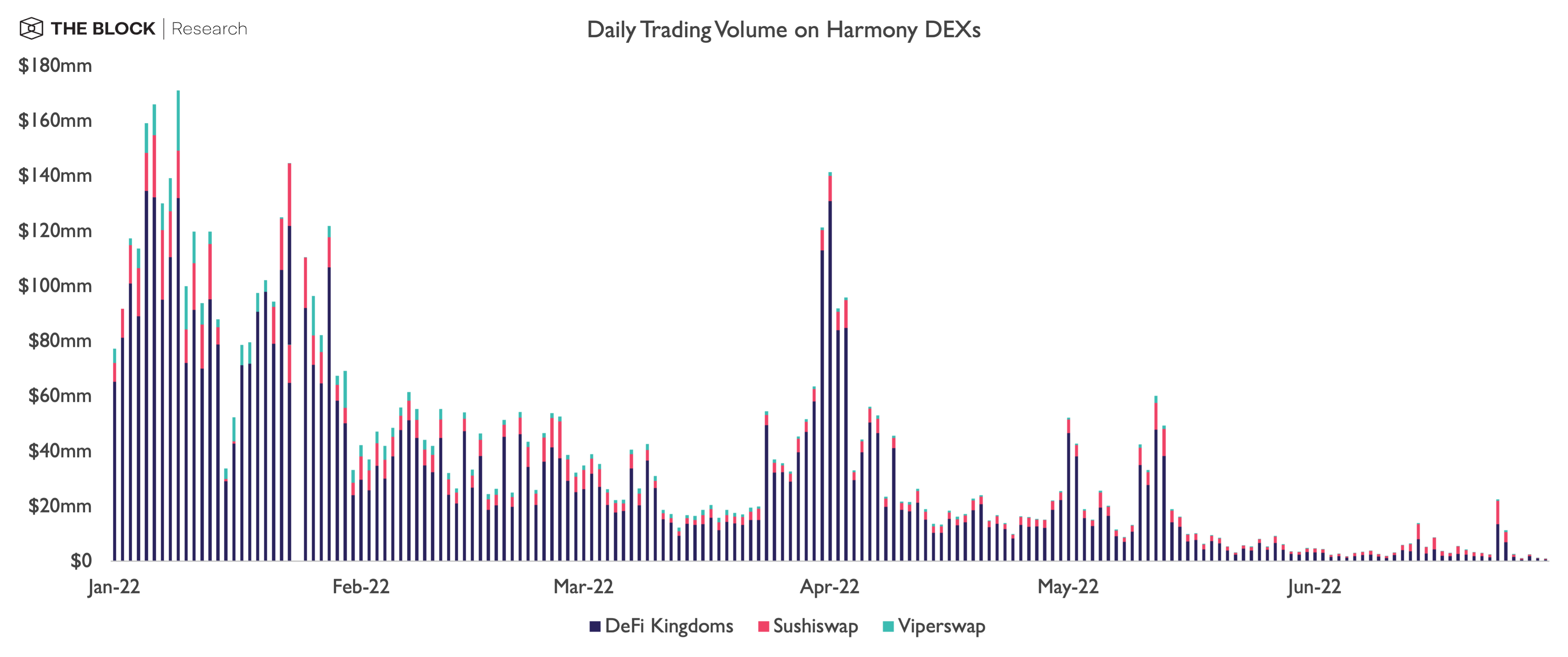

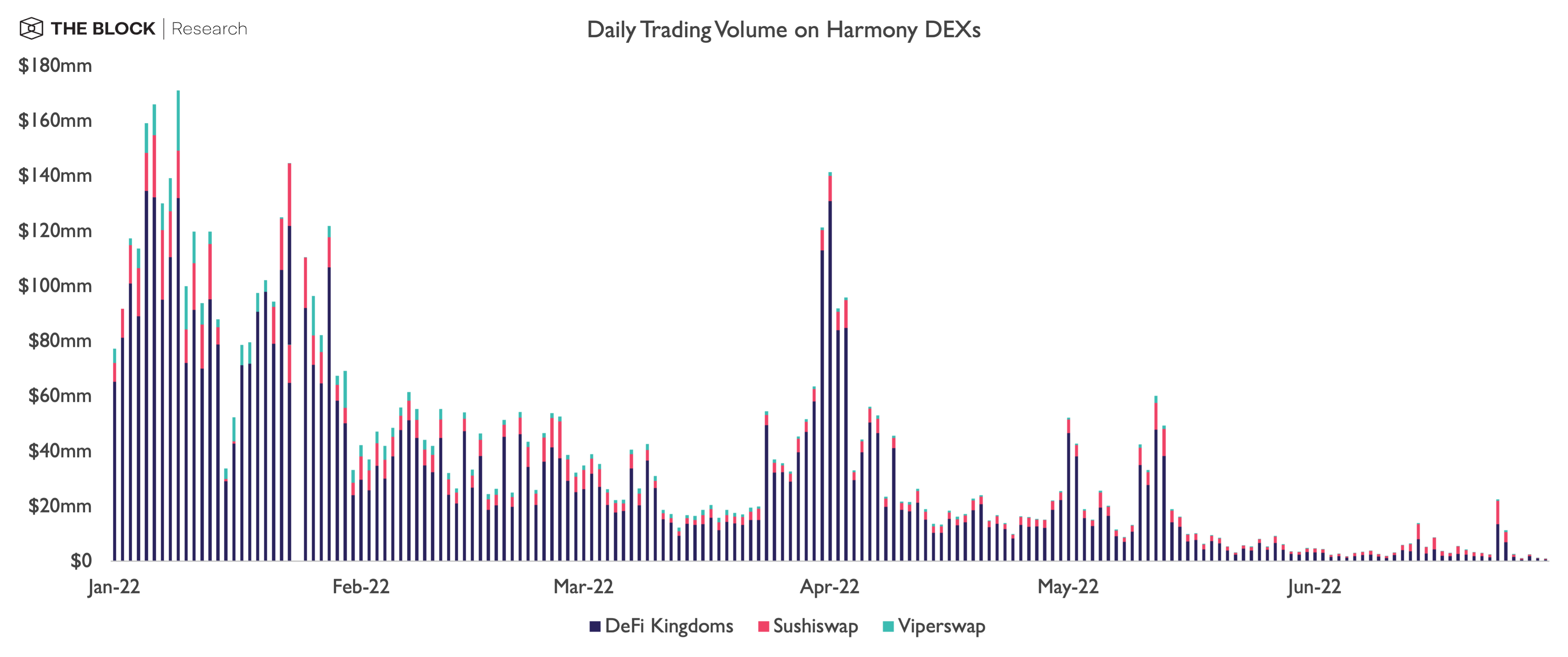

Harmony Hack hits DeFi Kingdoms trading volume

Volume on Harmony DEXs have dropped significantly since the start of this year. The popular DeFi Kingdoms game represented the chain’s largest DEX, although its launch of its own Avalanche subnet in late March marked a significant loss for the ecosystem.

But this has now come to a head with the Harmony bridge hack. The hack brought a spike in volume to the DEXs on June 23, including a 434% spike on DeFi Kingdoms compared to the June average as user scrambled to unload their assets.

Source: CoinGecko

Following the hack, the number of ONE tokens on DeFi Kingdoms dropped. The Block published this research on June 30, showing that 50% of the tokens live on the protocol two days before the hack had been removed.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.