Here are some of the most significant events of 2022 told through charts.

Bitcoin crashed around 65% year-to-date, dropping to $16,800 from $47,000 at the top of the year. As cryptocurrencies entered a bear market in line with traditional markets, several key events exacerbated the collapse.

Gone with the wind

The number of stolen funds in DeFi hacks increased sharply in 2022.

The biggest-ever exploit detected in crypto happened in March on the Ethereum sidechain Ronin, supporting the then mega-popular play-to-earn game Axie Infinity. A total of 173,600 ETH (at the time worth roughly $590 million) and 25.5 million of the stablecoin USDC were lost — all thanks to a fake job offer, as The Block reported. The U.S. government later tied the incident to the North Korean hacking group Lazarus.

Terra collapse

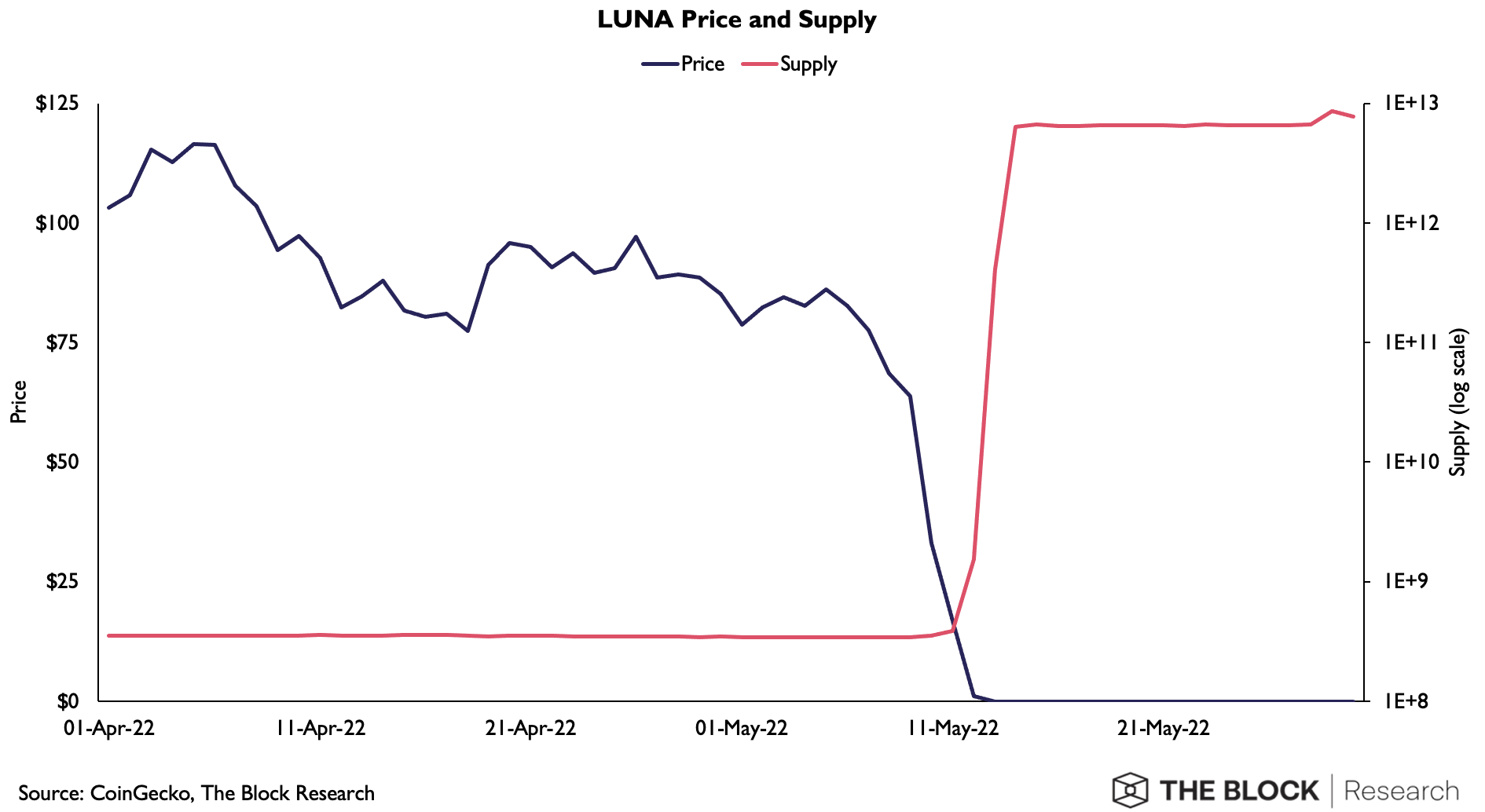

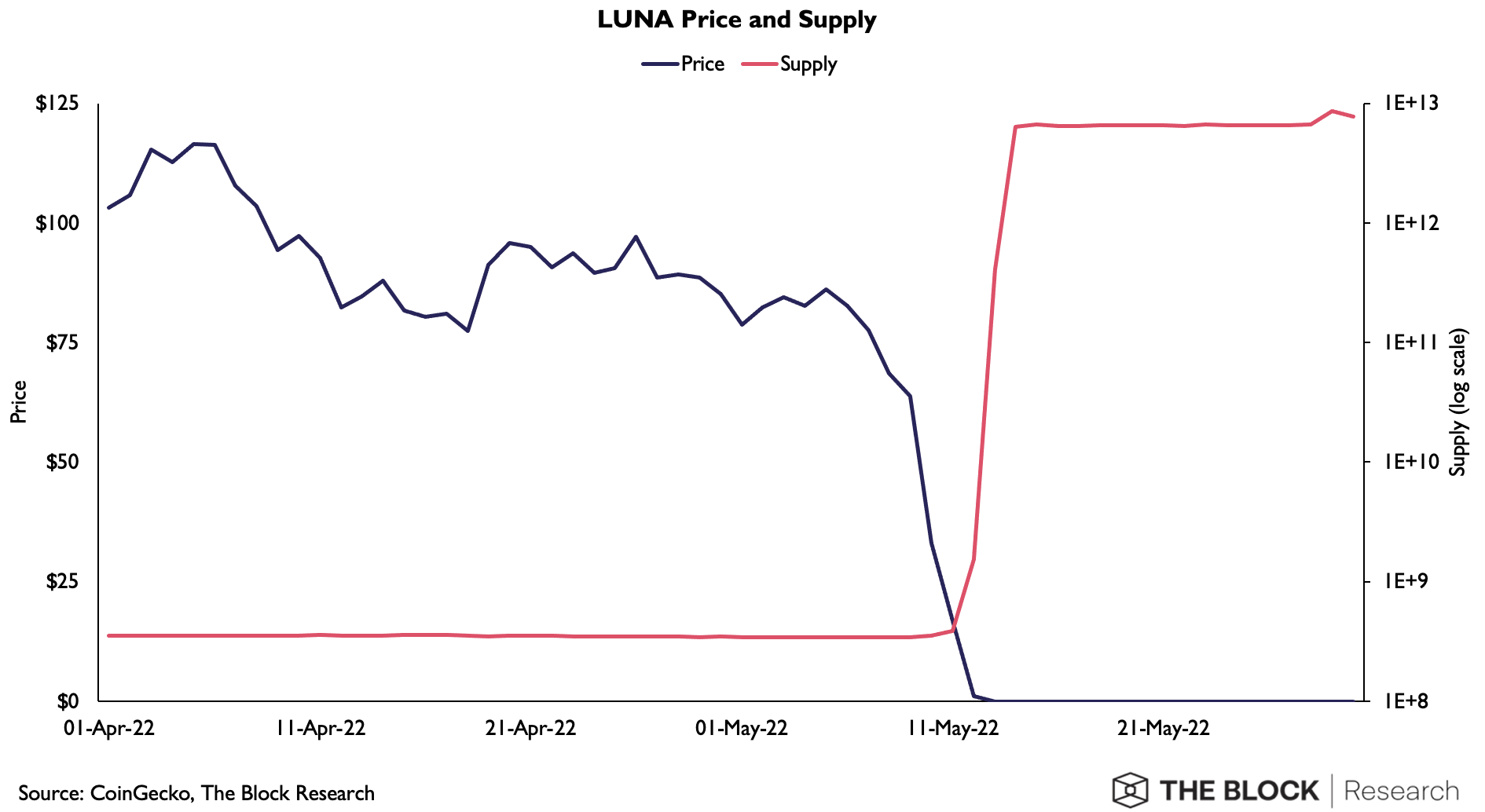

The circulating supply of Luna surged to more than 6.5 trillion in May before the Terra blockchain was halted for a second time in an attempt to salvage the collapsing ecosystem. The attempts were inevitability in vain.

TerraUSD — the algorithmic stablecoin of the Terra blockchain — lost its peg to the U.S. dollar in May, kickstarting a downward spiral for Luna, a related token that was supposed to prop up UST’s value. The design of terraUSD meant that sales of Luna were supposed to help the algorithmic stablecoin keep parity with the U.S. dollar. But once terraUSD lost its peg and investors tried cashing out en masse, the mechanism put much downward pressure on Luna.

Throughout the beginning of May, the supply of Luna was around 340,000, according to data from Terra Analytics. Between May 10 and 12, the network rose to 176 billion tokens, despite the chain being halted for a short time. It reached 6.5 trillion on May 13.

Tornado Cash

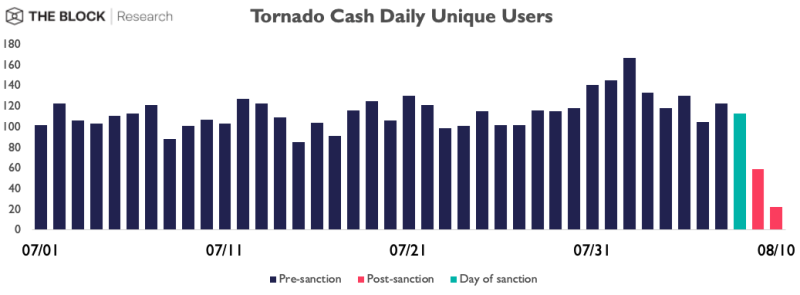

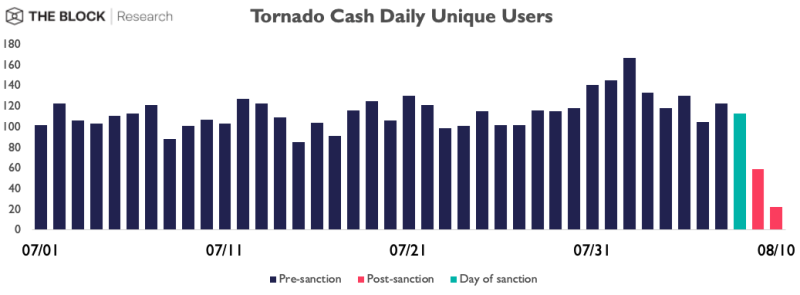

In August, the U.S. Treasury announced it was sanctioning Tornado Cash, a cryptocurrency mixing service that allows users to obscure the details of transactions. The regulator added Tornado Cash and 44 associated Ethereum and USDC wallets to its Specially Designated Nationals list. The wallets include the smart contract that runs Tornado Cash, its Gitcoin grants address and the Tornado Cash donation wallet.

The SDN list bars U.S. persons and firms looking to operate in the U.S. from financial interactions with designated entities. In May, OFAC added Blender.io, its first designation of a crypto mixer. However, Tornado Cash is distinct from Blender.io in being a decentralized protocol. It might well have been the first example of a U.S. sanction targeting a DeFi operator.

The day after the sanctions, just $6 million was deposited into the protocol, according to data from The Block Research. This represented a 78.5% decline compared to the same length of the previous week.

ASIC mining machine prices plunge (all years, later half more)

At the height of the bull market last year, bitcoin miners raced to grow hashrate and were happy to sign purchase deals with months-long delivery times. But as mining economics worsened over the past months, ASIC machine prices also slumped. The market was saturated with them and, per terahash generally, prices fell over 80%.

On top of that, companies used those same machines to secure loans, which might pose a challenge to financiers like BlockFi, as they deal with potential defaults.

The Merge

The highly anticipated move of the Ethereum blockchain from proof-of-work to proof-of-stake finally happened on Sept. 15. Instead of miners using GPU machines to approve transactions, the network now relies on validators that stake tokens to participate, with rewards sharply going down. The move addressed Ethereum’s high energy consumption.

Ether futures come in ahead of bitcoin

For the first time, the volume of ether futures was larger than bitcoin futures, during August.

The volume of ether futures exceeded that of bitcoin futures by 1.11 times in August, according to The Block Research. The Block’s Lars Hoffman attributed this to a carry play around the Ethereum Merge.

GBTC discount to net asset value (NAV)

GBTC’s discount to net asset value (NAV) reached fresh all-time lows throughout the year. The bitcoin fund dipped on June 17, when it reached -34%. The discount narrowed ahead of the SEC’s ruling on whether or not GBTC could be converted to a spot bitcoin ETF. The discount widened to a near 50% discount to NAV in December 2022.

Grayscale’s bid to convert its product into a spot ETF was rejected based on the regulator’s conclusion that the company hadn’t shown sufficient planning to prevent fraud and manipulation. Grayscale later filed a lawsuit against the SEC after the decision.

In the 73-page response brief, the SEC argued its rejection was “reasonable, reasonably explained, supported by substantial evidence,” with “no inconsistency in the Commission’s disapproval of Grayscale’s spot ETP despite having approved two CME bitcoin futures ETPs.” The SEC said futures and spot-based bitcoin funds are “fundamentally different products.”

FTX’s downfall

The quick unraveling of FTX caught many by surprise in early November. Pressure started mounting after a leaked balance sheet from Alameda Research showed that a large portion of its holdings was made up of FTT tokens. A “bank run” followed and by Nov. 8, the centralized exchange had halted most withdrawals. The aftermath of the collapse is still unfolding, with crypto lender BlockFi filing for chapter 11 bankruptcy last week.

Apes vs. Punks

The two top non-fungible token (NFT) collections, Bored Ape Yacht Club (BAYC) and CryptoPunks, have been trending closed together in recent months in terms of a floor price, meaning the lowest price available for sale. Apes fell below for a short period in late August and then again in November.

Bitcoin volatility reached a multi-year low

Annualized bitcoin volatility hit 27.06% on Oct. 25 — its lowest level since July 2020, when it fell as low as 23.37% — according to The Block’s data.

Volatility here was defined as the standard deviation of the previous 30 days’ daily percentage change in the price of bitcoin. The lack of volatility saw price movement stagnate, although it didn’t last long as the FTX collapse came just weeks later.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.