From the dizzying highs of the bull run, when NFT Google searches were up what felt like thousands of percentage points, to the dark corners of the bear market, it’s been a tumultuous year for NFTs.

As “What is an NFT?” became one of the most searched terms, marketplaces squabbled over royalty payments, volume dwindled, and some surprising players entered the space. The pervading theme for 2022 seemed to be mainstream adoption.

The Block right-clicked and saved some of the year’s most dramatic data points. Here’s the year in NFTs:

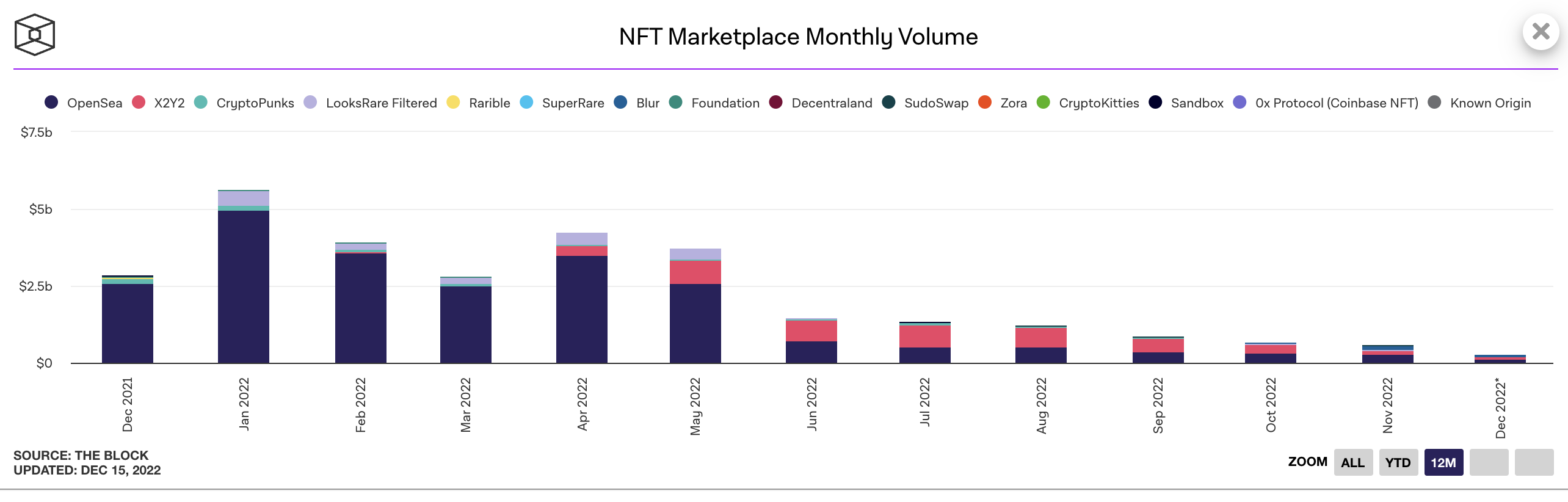

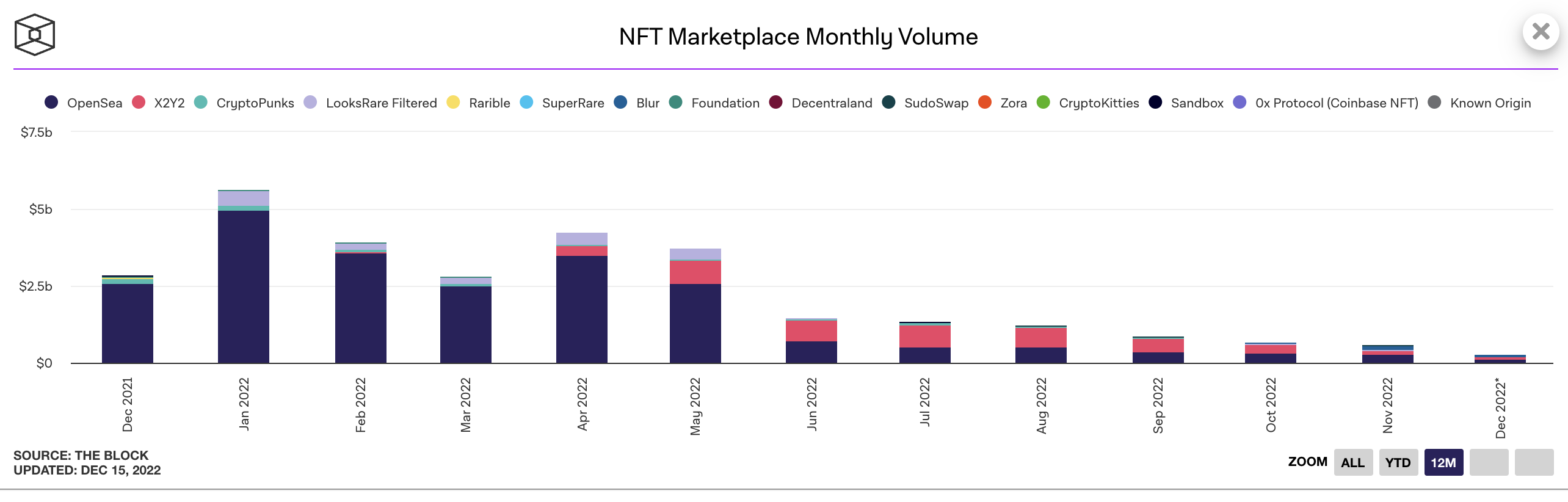

NFT marketplace wars and a drop in volume

Earlier this year, a wave of new, disruptive NFT marketplace entrants looked to shake up fee structures, including all-important artist royalty payments.

These levies, sometimes called creator fees, have been used to justify the existence of NFTs for artists — offering consistent income on future sales of work.

XY2Y was at the forefront of this, offering an optional payment model – which means that users themselves can choose to enforce (or not enforce) royalties. The marketplace launched in February, with a ‘vampire attack’ airdrop of millions of tokens to users of OpenSea. The fruits of this, however, didn’t come good until five months later.

This was around the time the team behind the decentralized NFT marketplace Sudoswap launched a new platform called SudoAMM on July 8, nixing all creator royalties to keep fees down to 0.5% per transaction. SudoAMM saw $50 million in total trading volume two months after the platform launched.

The surge in low-fee marketplaces sparked an ongoing, and sometimes labored, debate among people working in the sector, causing some artists to get creative about the terms of their smart contracts.

On Sept. 28 Fidenza artist Tyler Hobbs launched the QQL Mint Pass; a project which protests those dodging royalties through blocking X2Y2’s wallet in the smart contract coding, effectively blacklisting it.

Solana’s biggest NFT marketplace Magic Eden also subsequently switched to an optional royalty payment model in October, a move it later modified by issuing code allowing the enforcement of royalties and ‘gamification’ of collections.

Meanwhile, heavyweight OpenSea also rolled out tools to help artists enforce royalties on-chain; an action that was later criticized for having tenants of centralization.

As squabbles have died down somewhat, it’s unclear who will emerge as the moral winner in this debate. What’s clear, though, is that despite the erosion of OpenSea’s market share over the course of the year — competitors are still not close to touching it in terms of volume. It might take more than cut trading fees to lure customers away.

Read more: The TL;DR on NFT royalties

You’ve been CryptoPunk’d

Blue-chip project CryptoPunks saw more action in 2023 than most NFT collections will see in their entire lifecycle — with a buyout, a new manager and a play for exclusive utility.

Yuga Labs acquired the rights to the collection in March from Larva Labs for an undisclosed sum. In the same fell swoop, the NFT giant also bought out gaming collection Meebits. This meant a new set of terms and conditions, and question marks surrounding what the new heavyweight manager had in store.

By June, Christie’s NFT maven Noah Davis had been poached by Yuga to shepherd the collection’s future. At Christie’s, Davis was responsible for bringing Beeple’s piece ‘The First 5,000 Days’ to auction. The sale made headlines at the time in March 2021 for its $69 million price tag, a figure which put Beeple — the American graphic artist Mike Winkelmann — “among the top three most valuable living artists.”

CryptoPunks floor price in ETH up to Dec. 20. Chart: NFT Price Floor

August saw the Punks team up with luxury jewelry retailer Tiffany & Co. to create bespoke pendants and corresponding NFTs dubbed NFTiffs. The limited run sold out in about 20 minutes for around $50,000 each.

Total volume for the collection had surpassed $3.5 million by mid-December, according to data provider NFT Go, with an average price of about 29 ETH, or about $35,000.

Read more: Tiffany CryptoPunk NFTs are already being ‘flipped’

OtherSide’s gas wars

OtherSide not only sold out all available 55,000 Otherdeed metaverse land NFTs within three hours of its public sale in May; it also momentarily caused a gas war on the Ethereum network.

Ethereum users tried to buy NFTs at the same time and outbid each other by using the network’s transaction fees. Such bids can cause the fees on the blockchain to spike, as was the case during the mint.

On-chain data revealed the Otherdeed gas war led to the sale running up an additional $172 million in transaction fees that cost individual buyers between $4000 and $10,000. Such high mint fees caused many to complain they were unable to make purchases.

Read more: Yuga Labs champions openness, collaborative development in Otherside litepaper

‘More buyers than sellers’ — the ETH trading ratio

Quite simply put, the data shows that there were more buyers than sellers by the end of the year for Ethereum NFTs.

Despite the rise of other chains, Ethereum still remains the dominant blockchain in NFT land.

A Solana September

No blockchain had a hotter year than Solana in terms of piqued NFT interest.

The number of NFTs minted on Solana hit a high of 312,000 on Sept. 7, up from 39,000 just three days earlier. On Sept. 6, Solana-based NFT market volume his $11.5 million, the highest level since May.

The surge was likely influenced by the excitement surrounding the y00ts mint. The 15,000-strong NFT collection was a new release from Dust Labs, the team behind the DeGods NFT collection.

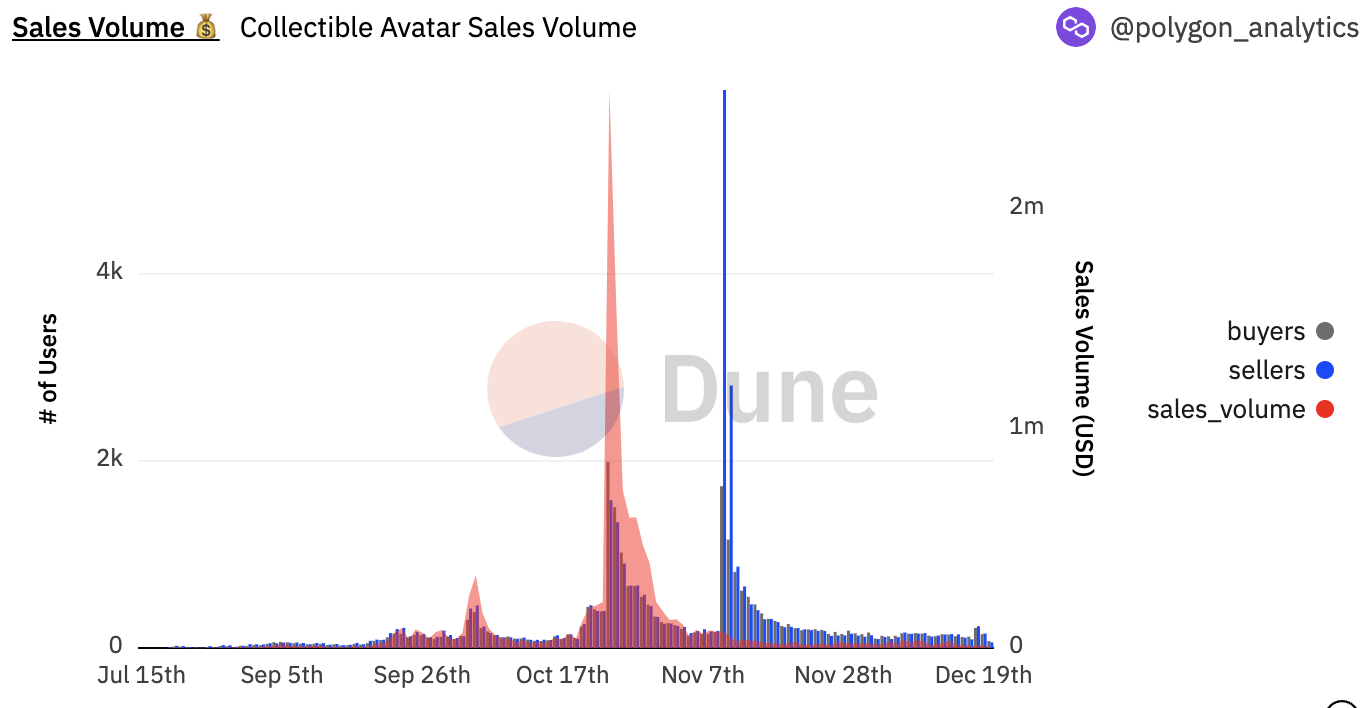

Reddit’s stealth recruitment drive

With an eye on distancing itself from perplexed users’ qualms about NFTs, Reddit launched a collection of cute ‘digital avatars,’ available to buy with regular fiat currency rather than cryptocurrency.

The net result was that since the inception of its NFT marketplace in July, users have created about 3 million crypto wallets, a company executive said in October. That’s several hundred thousand more than the 2.3 million active wallets held on OpenSea, the world’s largest NFT marketplace, which has been in operation for nearly five years.

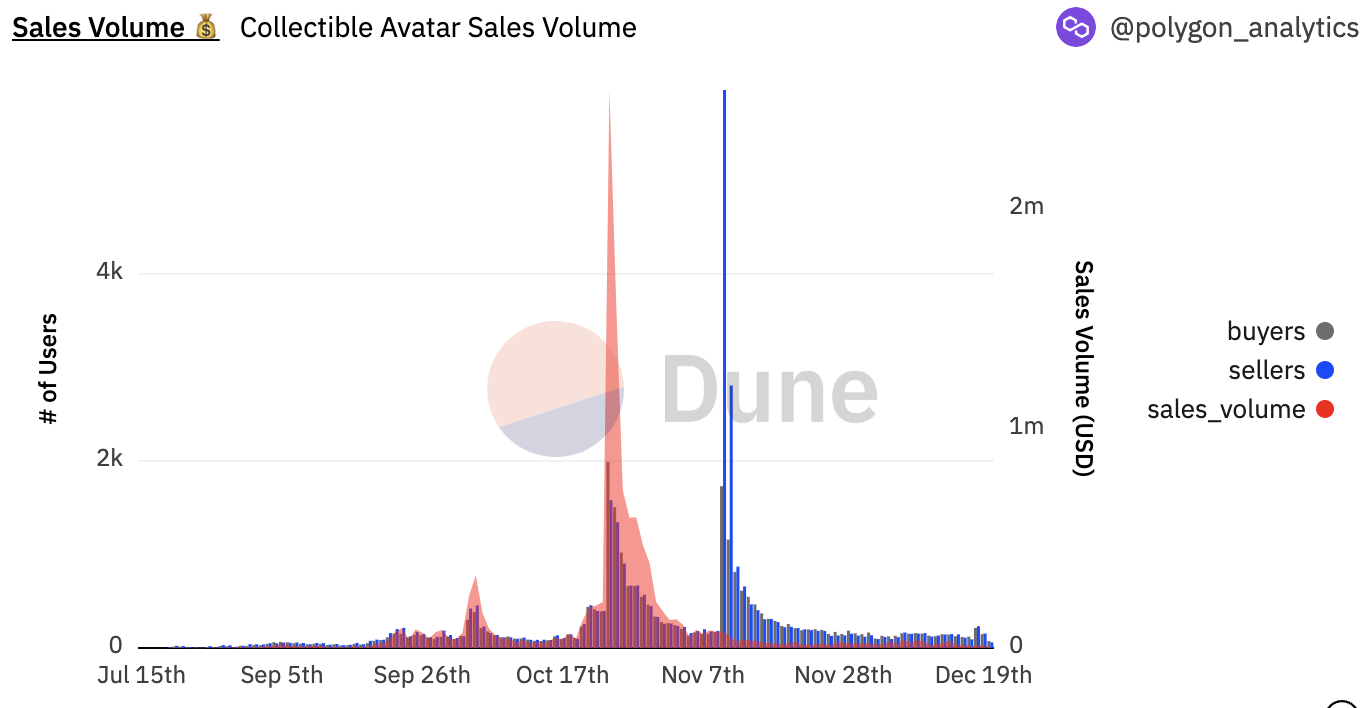

Reddit Avatar trading volume. Chart: Dune Analytics

Subtracting the number of active OpenSea wallets —again, the most popular NFT marketplace— by the number of Reddit wallets suggests that Reddit’s strategy may have helped encourage as many as half a million or more people to buy an NFT for the first time.

It was lauded across the ecosystem as an example of successful ‘onboarding’ of non-crypto normies.

Read more: Reddit avoids crypto lingo, shows how to take NFTs mainstream

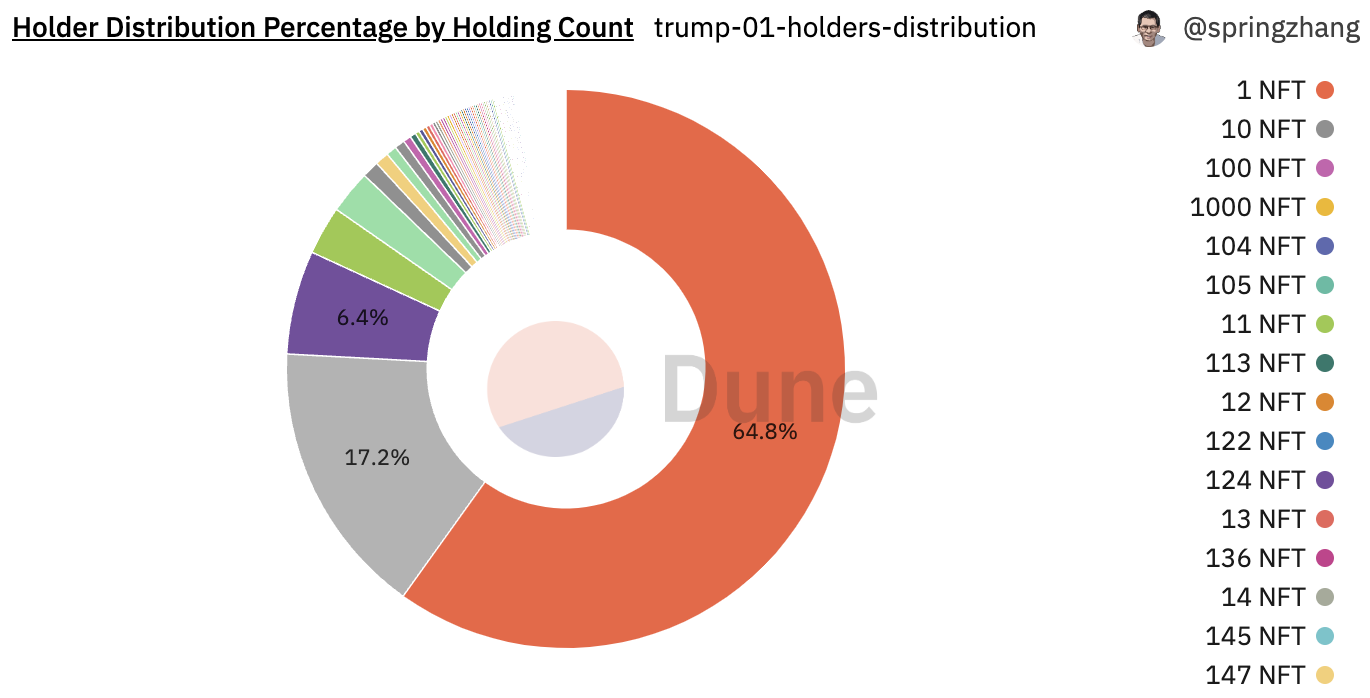

A last-minute Trump card

Former U.S. President Donald Trump swooped in at almost the last moment in 2022, conspiring to Make NFTS Great Again with a so-called trading card collection of 45,000 items.

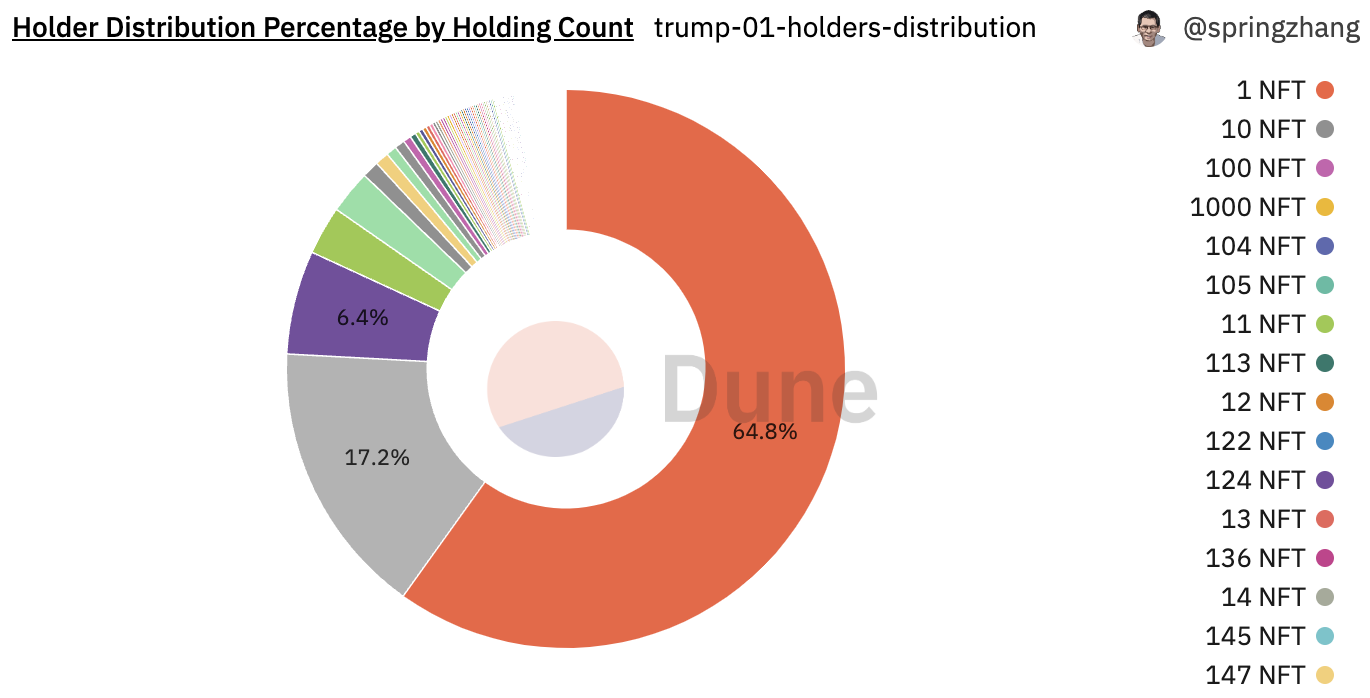

The collection sold out within hours, with the majority of holders hanging onto one NFT each from the collection, according to data from Dune Analytics.

Trump NFT holder distribution. Chart: Dune Analytics

Still, even hours after the sale there were already some Trump NFT whales among holders. 34 wallets held 100 or more items from the collection the day after launch. OpenSea figures also suggest that 1,000 of the NFTs were airdropped to one wallet hours before the public sale.

Read more: Donald Trump NFT collection sells out within hours

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.