Bitcoin miners are clinging to life. It’s a far cry from a year ago, when they were racing to keep up with incessant demand. So what’s in store for miners in 2023?

Bankruptcies have already been filed and there may be more to come with many miners continuing to face severe liquidity crunches. Companies have been operating for months at depressed margins and dealing with high energy costs. That could also mean mergers and acquisitions, a movement that has already started to gain traction.

“There’s a lot of moving pieces out here and the industry is going to look a lot different 12, 18, 24 months from now,” said Riot CEO Jason Les in an interview with The Block.

Mining executives agree that those without a fixed low-cost power or too much debt will have a hard time hanging on, while the network hashrate will likely continue to go up. They shared their thoughts with The Block.

The sword of Damocles

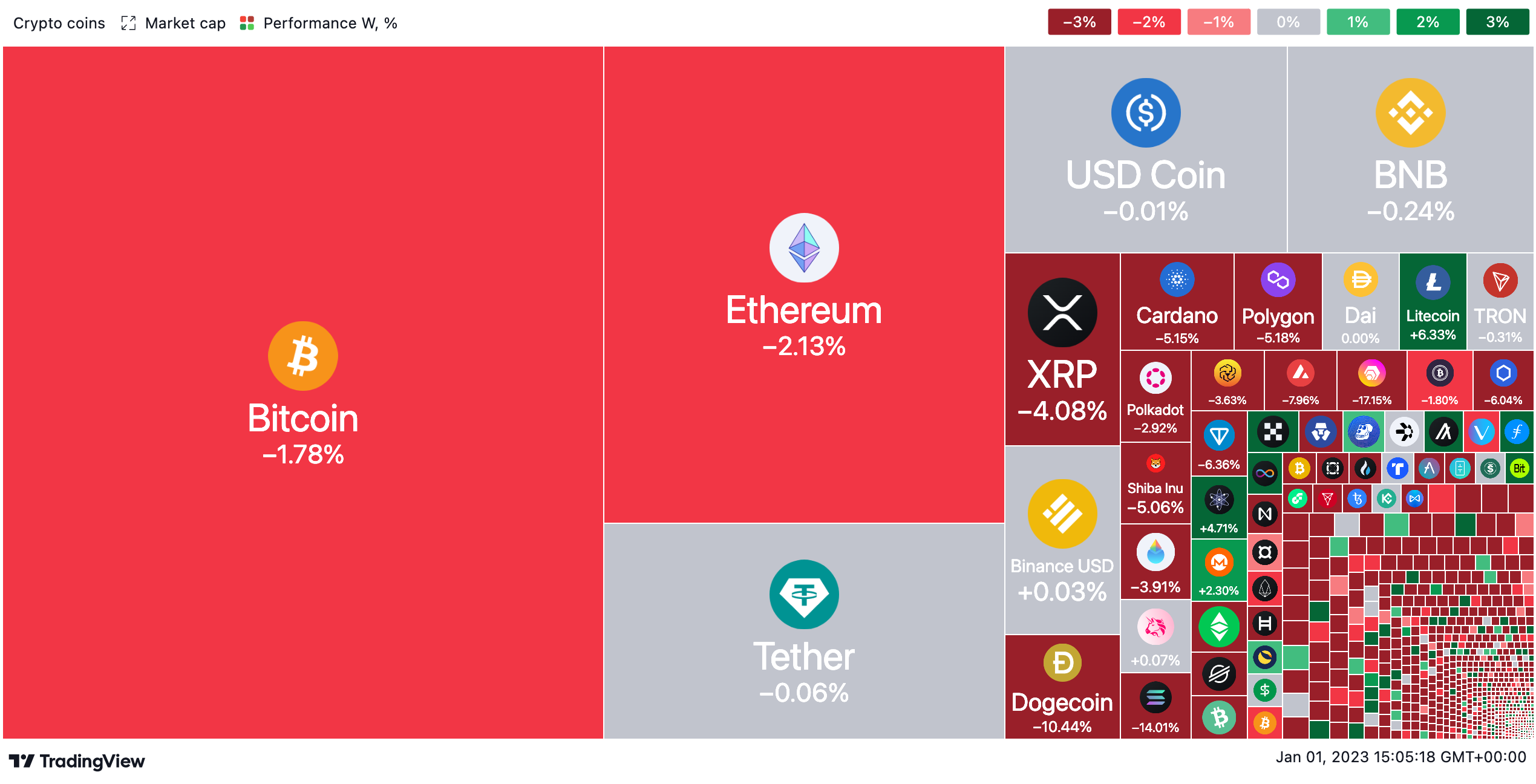

The price of bitcoin drives everything in mining, from hashrate to ASIC machine prices. Bitcoin’s price is currently hovering around $16,545, down about 65% in 2022.

Marathon’s CEO Fred Thiel believes that the price will remain in the $15,000 to $21,000 range until “there’s some broader good news on the macro front.”

“The Fed has to ease interest rate increases or some major institution has to take a position. Somebody has to start transacting,” Thiel said.

While the Fed has indicated that it would slow down interest rates, “we need to get all the way to stop the hikes,” Cipher Mining CEO Tyler Page said.

The next bitcoin halving — which happens after a certain number of blocks are mined and cuts mining rewards in half — should happen around March 2024.

“Bitcoin needs to double in price between now and the halving for this industry to continue to operate,” Thiel said.

On the other hand, the halvings have historically been followed by price appreciation because the supply of bitcoin drops while demand stays the same, Cipher’s Page said.

“You need to plan to sort of survive the halving,” he said. “That halving an event is like the sword of Damocles hanging over the industry.”

Consolidation

Machines have been trading hands this year, and that’s likely to continue, Les said. After all, there is no shortage of ASICs at depressed prices and more distressed assets will probably flood the market.

Buying them, however, requires cash, and many miners are far from flush. But not all are in dire straights. Most notably, CleanSpark has scooped up over 15,000 ASICs and two mining sites since mid-year.

“There’s more consolidation to come, some of that [is] going to come from pain of other players,” said CleanSpark CEO Zach Bradford earlier this month during an earnings call.

Marathon recently considered bidding on part of a facility but decided against it. That’s not to say it’s out of the game.

“If the right opportunities arise we’re obviously going to look at things,” Thiel said.

Riot’s CEO said it’s in a position to acquire assets, but it has its “own pipeline of expansion.” The CEO had expected to see more consolidation taking place this year.

“The problem with that, though, is you can’t take two underperformers and put them together. Two problems don’t come together and form a solution,” he said.

In recent weeks, NYDIG and Galaxy Digital cut deals with miners. The former agreed to buy most of Greenidge’s machines, and the latter inked a deal to purchase Argo’s flagship facility for $65 million, on top of a $35 million loan. In both cases, the parties will enter into a hosting agreement.

Galaxy is looking to sign a fixed-price power purchase agreement — something Argo had been seeking for months. Analysis firm D.A. Davidson downgraded Argo in October to neutral precisely over a lack of fixed power purchase agreements.

The biggest player in the industry, Core Scientific, last week filed for Chapter 11 bankruptcy protection with a prearranged deal and plans to turn most of its debt into equity. It might consider selling facilities under development but not any that are already operating.

Looking at the 20 or so public miners out there, “I don’t know if that’s going to like just shrink to five because they all get gobbled up by the bigger ones,” Cipher’s Page said. “Not very many people want to take on an overleveraged miner that doesn’t have good unit economics.”

Hashrate and difficulty

Network hashrate will continue to grow in 2023, executives said.

“There’s a lot of short-term variability in hashrate that’s driven by spot energy prices. But over the next six months, I think you’re going to continue to see hashrate grow because there are people like us who are continuing to deploy miners,” Thiel said. “We’re not stopping.”

The company is projecting to grow from around 7 EH/s now to around 23 EH/s mid-year 2023. CleanSpark, however, recently slashed its 2023 hashrate guidance from 22.4 EH/s to 16 EH/s because of build-out delays coming from its infrastructure partner, Lancium.

“Is that much going to come off of miners closing down? I don’t know,” Thiel said. “If the price of coin moves up, then I think the likelihood is hashrate will grow faster too. If Bitcoin stays here then, you know, it’ll only grow modestly.”

Looking to spring

Companies that took a more prudent approach to growth are generally in a better position. CleanSpark and Cipher, for instance, didn’t overleverage to buy machines at top prices only to see them lose 80% of their value.

“What’s important to us and our success is to really always kind of assume the worst,” said Riot’s Led. “We’re not betting on a future price. We’re not betting things are gonna turn around. Even in this depressed market, we’re focused on how can we be the most efficient producer.”

Marathon will keep operating assuming the price of bitcoin will come back.

“It’s all a question of making sure we get through this winter period in as good shape as possible so that when spring comes, we’re able to grow again,” Thiel said.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.