The crypto OTC market is sputtering, and that has otherwise high-spirited crypto enthusiasts bummed out.

Amid a dramatic backdrop of snow-capped mountains in the Swiss Alps, crypto investors lamented the recent pullback of key market infrastructure players and its impact on trading. Specifically, there is concern regarding over-the-counter trading, which has become muted with few places for large traders to trust to make big crypto trades after the collapse of FTX.

“Everyone is certainly weary of counter-party risk now,” Evgeny Gaeovy, who runs UK-based trading firm Wintermute, said at the CFC Conference in St. Moritz.

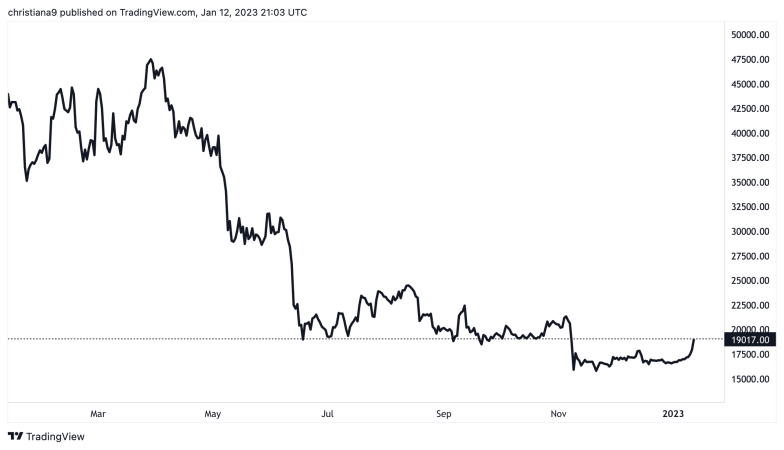

Spot volumes on exchanges reached $357 billion in December from a peak in May 2021 of $2.23 trillion, according to The Block Research. The muted volumes in OTC feel more pronounced, according to traders who spoke to The Block.

Wintermute which operates its own OTC desk, has seen volumes decline in the wake of the bankruptcy filing of Sam Bankman-Fried’s Alameda and FTX.

“Our volumes are down 30-50% across the board,” he said, referring to the OTC business. He added that the decline is much more pronounced in so-called alternative cryptocurrencies.

Still hopeful

To be sure, participants at the event were hopeful about the future impact of blockchain technology despite the chaos in the nascent space’s capital markets. Union Square Ventures’ Albert Wegner said in a panel at the conference that 2023 is the best time to make bets in the market in about a decade.

Still, it’s unclear to traders which players continue to be exposed to hidden risks.

Genesis — which was one of the largest players in the OTC market in 2022 — reportedly owes creditors more than $3 billion, which is a hole that is larger than previously thought.

Speaking to the need to rebuild trust in the industry, Messari CEO Ryan Selkis described the crypto landscape as a “football team running a play with six injured players.”

The muted volumes tied to a lack of trust could have financial implications on OTC desks, which printed money over the course of the 2021 bull run. One executive, who declined to be named, told The Block that the impact of lower volumes and tighter spreads could mean OTC desks would be “lucky” to print $20 million in revenue this year.

Bright spots

There continue to be bright spots in the industry, with several people pointing to Mike Novogratz’s Galaxy Digital and Chicago-based Cumberland as two firms filling the vacuum left by beleaguered market participants.

As for how OTC providers can regain trust in a post-FTX world, crypto hedge fund manager Jim Greco said in a message that the industry needs to be more highly regulated. Such firms could come under the jurisdiction of the New York Department of Financial Services, he said.

“To rebuild trust with OTC liquidity providers,” Greco said. “We need three things 1) US/EU broker dealer registration 2) audited financials 3) third party custody and settlement of coins.”

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.