We’re two weeks into 2023, and the crypto news cycle shows no signs of slowing down. Heading into the new week, some of the month’s major headlines continue to develop.

There’s the drama around crypto financial services firm Genesis, which last week drew the ire of the Securities and Exchange Commission. Elsewhere, digital asset prices continued to post significant gains over the weekend.

Let’s take a look at some of the biggest stories in crypto right now.

What’s next for Genesis?

Genesis, a subsidiary of Digital Currency Group, is waging a war on several fronts: with creditors, including crypto exchange Gemini, and U.S. regulators.

The firm halted withdrawals and new loan redemptions in its lending unit in November amid significant financial headwinds. Since then, it has sought new funding in a bid to fill what’s been reported to be a multi-billion-dollar hole.

Recent days have also seen an escalating war of words between Digital Currency Group and Gemini over funds locked up in Genesis. Gemini and Genesis partnered on the exchange’s Earn program, which offered interest to users who loaned their funds.

The situation was further inflamed last week when the SEC accused Gemini and Genesis of conducting an unregistered sale of securities via Earn.

What’s next for bitcoin?

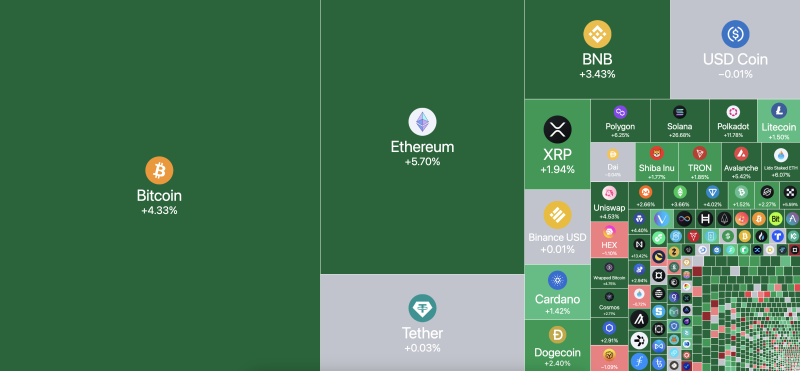

Bitcoin’s price is on a bit of a tear, in case you haven’t noticed.

The cryptocurrency — largest by market capitalization — is trending near $21,000 across major exchanges. Bitcoin began 2023 at around $16,600, according to data from TradingView.

Reporting from The Block’s market-focused journalists suggests that activity in the futures market could be responsible for some of the momentum. The market might also benefit from a slightly less chaotic period compared to November during the peak throes of FTX’s collapse.

As The Block noted this weekend, crypto-related stocks have also benefited from the environment. Coinbase, for example, gained more than 41% last week.

Still, the famously fickle market for digital assets means that no future is assured, meaning that you’ll have to watch in the days ahead to see where bitcoin will fly — or fall — next.

What’s next for Nexo?

Last week, the story broke that crypto lender Nexo is the subject of an investigation in Bulgaria.

Nexo’s offices in the country were raided by local police in what is said to be an investigation into alleged money laundering and tax crimes.

Nexo has denied any wrongdoing. “The allegations are absurd — we are one of the most stringent entities with regards to KYC/AML,” Nexo co-founder and managing partner Antoni Trenchev said last week.

Fears over Nexo’s long-term viability led to an upswing in withdrawals from its platform.

The situation represents the latest development in a wide arc of scrutiny around crypto lenders. Other lenders in the crypto space, including Celsius and BlockFi, previously drew the ire of regulators.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.