Rising regulatory scrutiny isn’t coming between Coinbase and one of its banking partners, JPMorgan Chase.

The cryptocurrency exchange and the Wall Street stalwart are sticking together amid increasing scrutiny from Washington and elsewhere, two people familiar with the matter told The Block.

Coinbase pointed to its website listing its banking partners when asked to comment, while JP Morgan declined to comment.

The industry is on high alert as the Securities and Exchange Commission cracks down on a range of crypto companies, including a recent settlement with Kraken over allegations surrounding its staking program. Paxos yesterday was ordered by the New York Department of Financial Services to stop issuing BUSD.

Bloomberg earlier reported the regulatory actions could push banks to stop working with crypto firms, pushing them to the fringes of finance.

SEC Chair Gary Gensler didn’t mince words after the Kraken enforcement.

“This really should put everyone on notice in this marketplace whether you call it lend, whether you call it earn, whether you call it yield, whether you offer what’s called an annual percentage yield, APY,” Gensler said on CNBC Friday.

In early January, the Federal Reserve, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. put out a joint statement that reminded banks of their safety and soundness obligations and outlined risks they see in the cryptocurrency sector. Though the statement noted that banks aren’t prohibited from doing business with companies that operate within the law, the regulators raised several red flags for those hoping to dive deeper into crypto-related activities.

On Jan. 12, the agency charged both Gemini and Genesis with the unregistered offering and sale of securities through the Gemini Earn lending program.

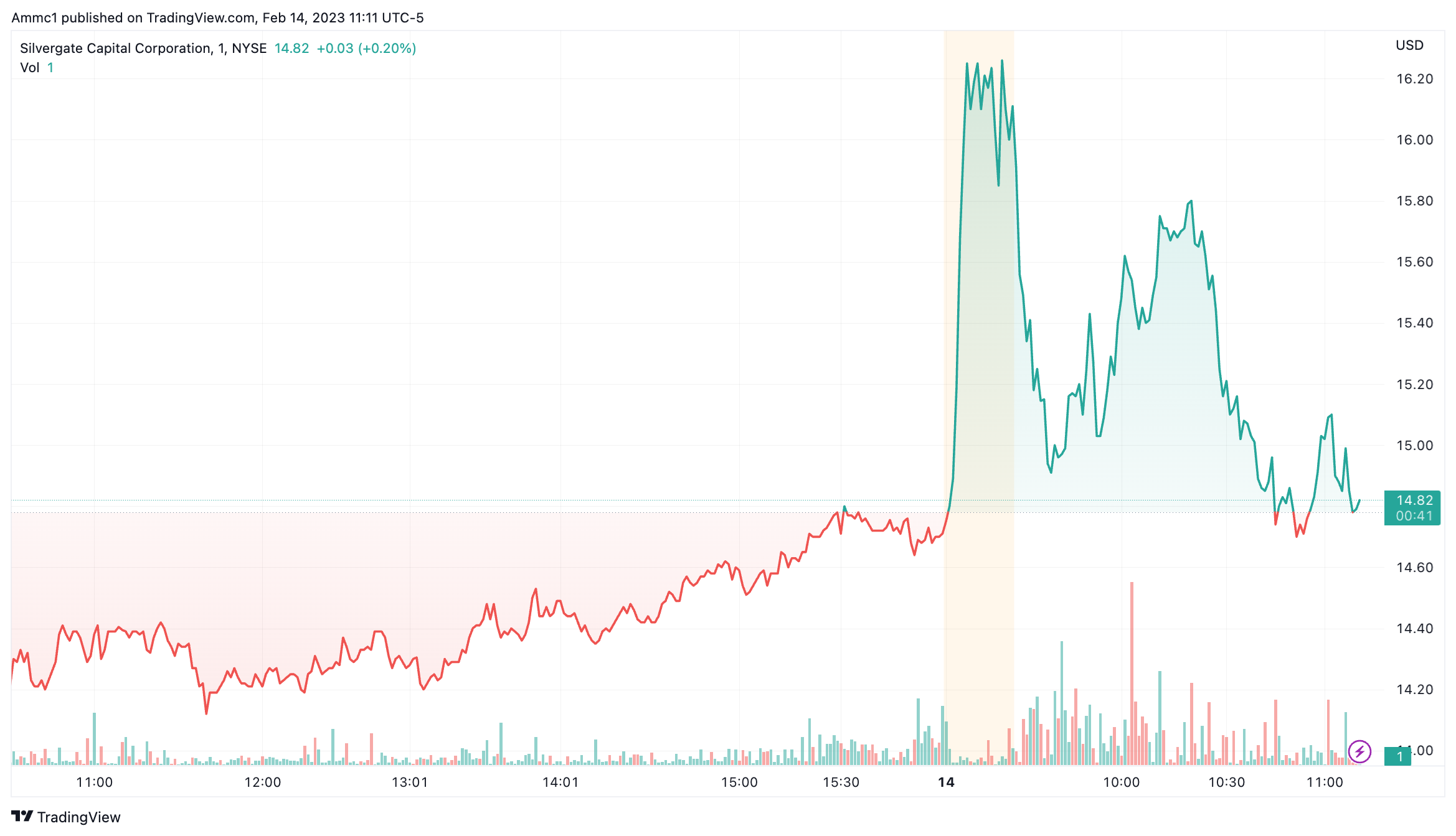

JPMorgan is listed along with Signature Bank, Cross River Bank, Silvergate Bank and Pathward as depository institutions at which Coinbase may deposit customer funds.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Christiana Loureiro and Frank Chaparro