Go to Source

Author: Bonnie Cheung

Episode 25 of Season 5 of The Scoop was recorded remotely with The Block’s Frank Chaparro and LMAX Group CEO David Mercer.

Listen below, and subscribe to The Scoop on Apple, Spotify, Google Podcasts, Stitcher, or wherever you listen to podcasts. Feedback and revision requests can be sent to podcast@theblockcrypto.com.

David Mercer is the CEO of LMAX Group — a leading operator of institutional execution venues for FX and crypto trading.

In this episode, Mercer makes the case that embracing regulation is the only way for the crypto industry to mature beyond its “tiny” role in global markets.

During this episode, Chaparro and Mercer also discuss:

- Why bitcoin dominance has been increasing

- Post-SEN/Signet opportunities

- Where markets go from here

This episode is brought to you by our sponsors Railgun, and Flare Network

About Railgun

Railgun is a private DeFi solution on Ethereum, BSC, Arbitrum and Polygon. Shield any ERC-20 token and any NFT into a Private Balance and let Railgun’s zero-knowledge cryptography encrypt your address, balance and transaction history. You can also bring privacy to your project with Railgun SDK, and be sure to check out Railgun with partner project Railway Wallet, also available on iOS and Android. Visit Railgun.org to find out more.

About Flare

Flare is an EVM-based Layer 1 blockchain designed to allow developers to build applications that can use data from other blockchains and the internet. By providing decentralized access to a wide variety of high-integrity data from other blockchains and the internet, Flare enables new use cases and monetization models. Build better and connect everything at Flare.Network.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Davis Quinton and Frank Chaparro

The exploiter of Euler Finance returned 3,000 ether (ETH) worth about $5.4 million to the DeFi lending protocol on Saturday, according to tweets from on-chain sleuth ZachXBT.

The return indicates the exploiter may have reached a deal with Euler Finance after stealing $197 million from the protocol on Monday.

Euler Finance offered a 10% bounty ($19.7 million) to the attacker on Tuesday to return the remaining 90% of the stolen funds. It warned the attacker that if the funds were not returned within 24 hours, it would launch a $1 million reward for information that would lead to their arrest and the return of all funds.

Euler lost the $197 million in a flash-loan attack. Flash loans allow DeFi users to borrow large amounts of funds against zero collateral, but the loans must be repaid before the transaction ends. The Euler attacker drained $136 million of staked ether (stETH), $34 million of USDC, $19 million of wrapped bitcoin (WBTC) and $8.7 million of DAI from the protocol.

Then they transferred 1,100 ETH ($1.8 million) to the cryptocurrency mixer Tornado Cash in an attempt to launder the stolen funds.

It remains to be seen whether the attacker returns the rest of the funds. “They stopped at 3k ETH so could be trolling again,” tweeted ZachXBT. “They were [previously] trolling with that transaction to Lazarus.”

On Friday, an address controlled by the Euler attacker sent 100 ETH (around $170,500) to a wallet associated with Lazarus Group’s Ronin network hack, according to Lookonchain. The U.S. Department of the Treasury added Lazarus Group, a North Korean hacking group, to its list of designated entities in April last year.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Elizabeth Napolitano

Go to Source

Author: Nelson Wang

Go to Source

Author: Jeff Wilser

Go to Source

Author: Azeem Khan

Go to Source

Author: J.D. Lasica

Bitcoin mining stocks tracked by The Block were higher on Friday, with 16 gaining and two declining.

Bitcoin rose 7% to $26,774 by market close.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Catarina Moura

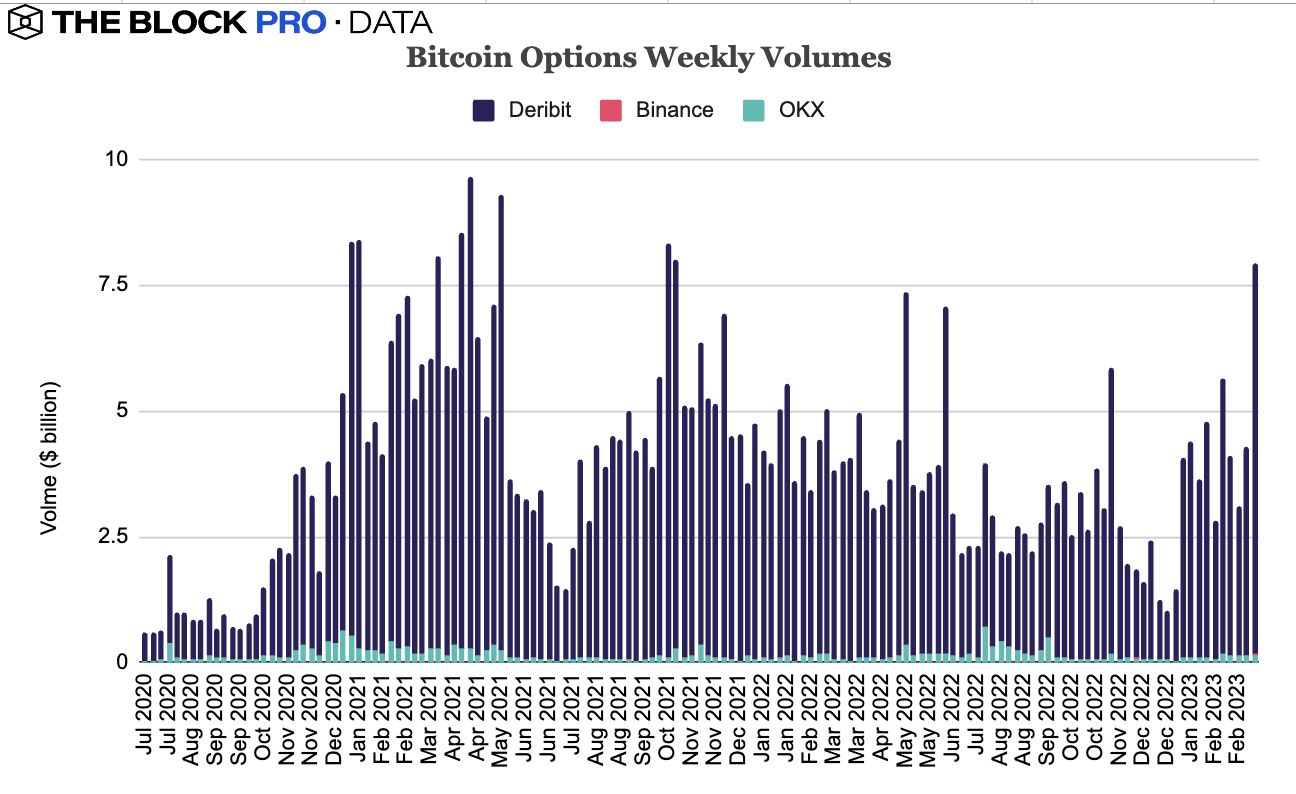

Bitcoin option volumes reached their highest point since October 2021 when the price of bitcoin reach a high of over $60,000 amid a crisis in banking.

The volume of bitcoin options trading was $7.94 billion this week, according to data from The Block, as traditional financial markets are seeing significant volatility.

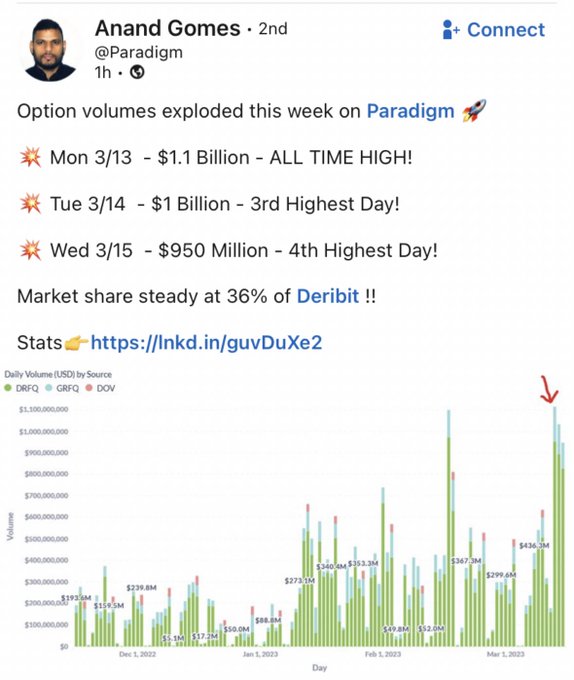

The market is “pricing in looser monetary conditions,” said Anand Gomes, co-founder at Paradigm, an institutional liquidity provider, because “the Fed can’t hike rates anymore.”

“[The Fed] raised rates and it broke the banking system,” Gomes said in an interview via Telegram, referring to the collapse of Silvergate, Silicon Valley Bank and troubles faced by Credit Suisse.

“[The Fed] raised rates and it broke the banking system,” Gomes said in an interview via Telegram, referring to the collapse of Silvergate, Silicon Valley Bank and troubles faced by Credit Suisse.

“Loose monetary policy means cheaper capital,” said Gomes, “and cheaper capital means we deploy it in higher yielding assets.” In response “macro sentiment has turned incredibly bullish.”

According to Laura Vidiella, vice president at LedgerPrime, the reason has more to do with volatility.

“High volatility and high trading volume are generally very correlated especially for liquid assets,” she said, which is why Paradigm had record volumes this week, doing over $1 billion in a single day.

Another reason for the rally, Vidiella said, is that investors are buying bitcoin as a way to get their funds out of banks with a high risk of failure. “This is a strong response to how people are hedging their exposure to fiat,” she said.

Vidiella thinks the reaction may spur some cooperation between crypto and regulators.

“Being stuck with financial regulation that doesn’t adjust or evolve with new advancements and innovation frightens me more than trying new developments and failing in the process,” she said.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Sam Venis