Crypto asset funds clocked the worst year since 2018, with inflows plummeting 95%.

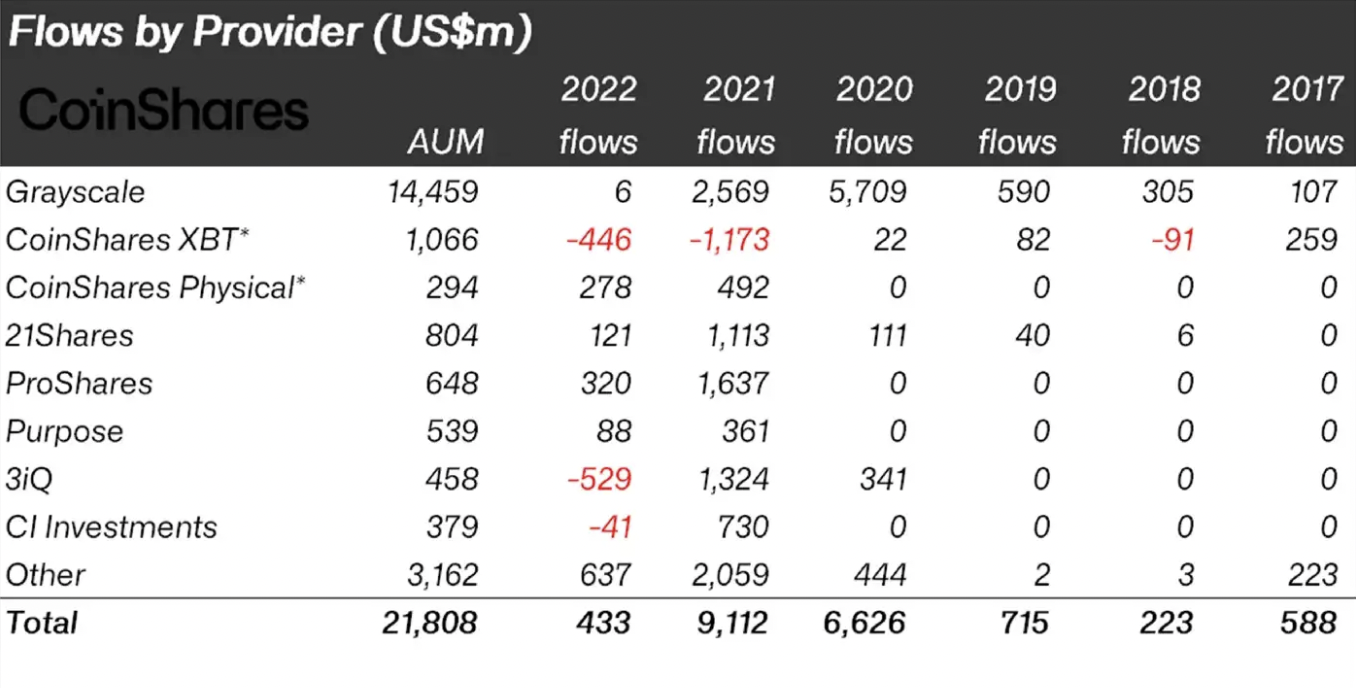

Funds tracked by CoinShares netted a total of just $433 million in 2022 compared to a massive $9.1 billion in the previous year, a decline of 95%. The price of bitcoin fell about 60% over the same period, as a crypto winter engulfed the market amid U.S. Federal Reserve interest rates hikes to combat red-hot inflation.

3iQ experienced the most significant net outflows, which totaled $529 million during the year. CoinShares’ XBT product saw outflows of $446 million, while ProShares crypto funds experienced the most inflows, reaching $320 million.

CoinShares Head of Research James Butterfill said it was difficult to predict what the new year would look like. The collapse of crypto exchange FTX kicked off a crisis of confidence in crypto, and questions remain over the liquidity of some key crypto platforms and lenders, he added.

“Sadly, we expect it will take many years for investor confidence to improve to match the levels seen in 2021 and early 2022,” Butterfill said in a report from the asset manager. “We believe a continued weaker U.S. dollar and a pivot from the Fed in the second half of 2023 are likely to be very supportive for bitcoin due to it being an interest rate-sensitive asset, but until this happens, the market is unlikely to see significant investor inflows.”

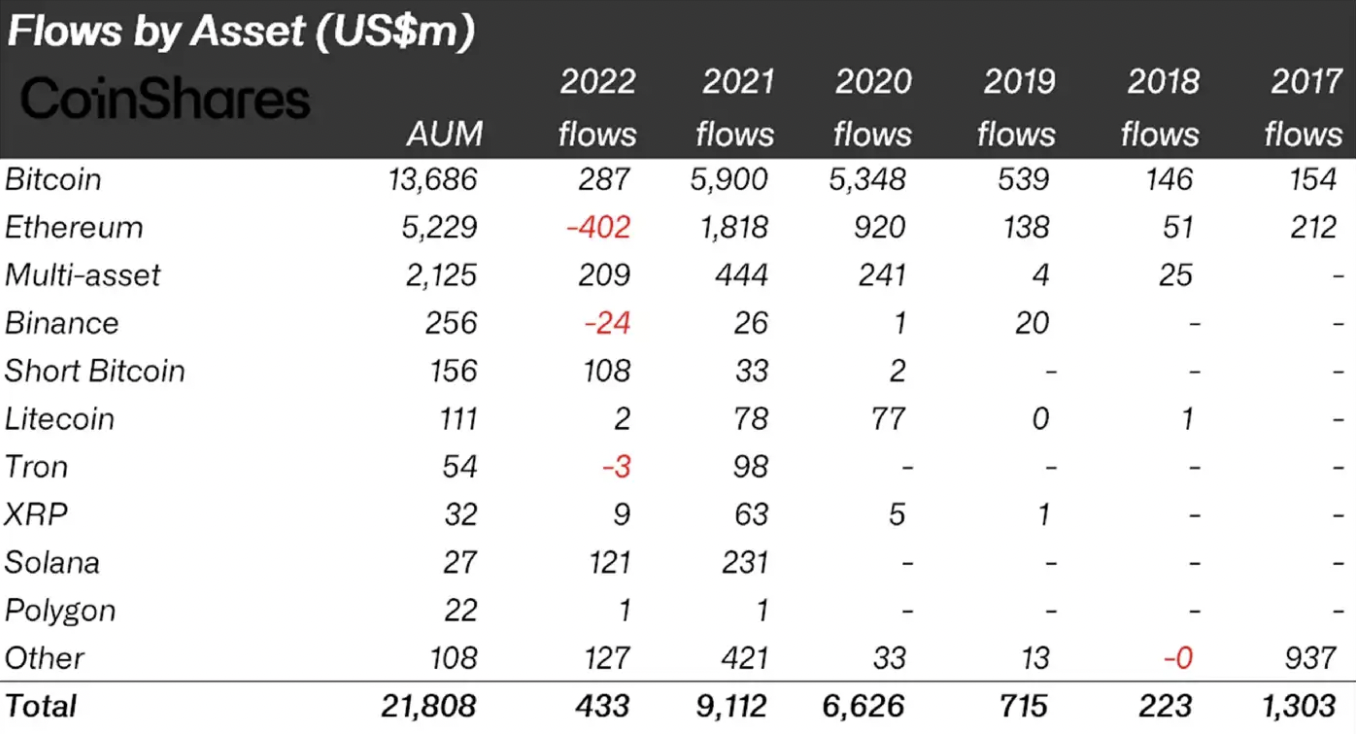

Bitcoin was the best-performing cryptocurrency of the year, with inflows of $287 million. That’s still its worst year since 2018, when inflows totaled $146 million, and a decline of 95% from the previous year.

Ether saw its worst year ever with outflows of $402 million, with CoinShares attributing the tumultuous year to “investor concerns over a successful transition to proof of stake and continued issues over the timing of un-staking” that could occur in the second quarter of this year.

© 2022 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy