Go to Source

Author: Ian Allison

Go to Source

Author: Omkar Godbole

Arbitrum governance took center stage over the weekend before its self-titled foundation walked back the problematic proposal AIP-1 and its “ratification” vote for financial actions it had already taken.

Conceding that AIP-1 was unlikely to pass after votes flooded in against the proposal, the Arbitrum Foundation now plans to divide the dense AIP into smaller segments.

“AIP-1 is too large and covers too many topics,” it tweeted, adding: “We will follow the DAO’s advice and split the AIP into parts. This will allow the community to discuss and vote on the different subsections.”

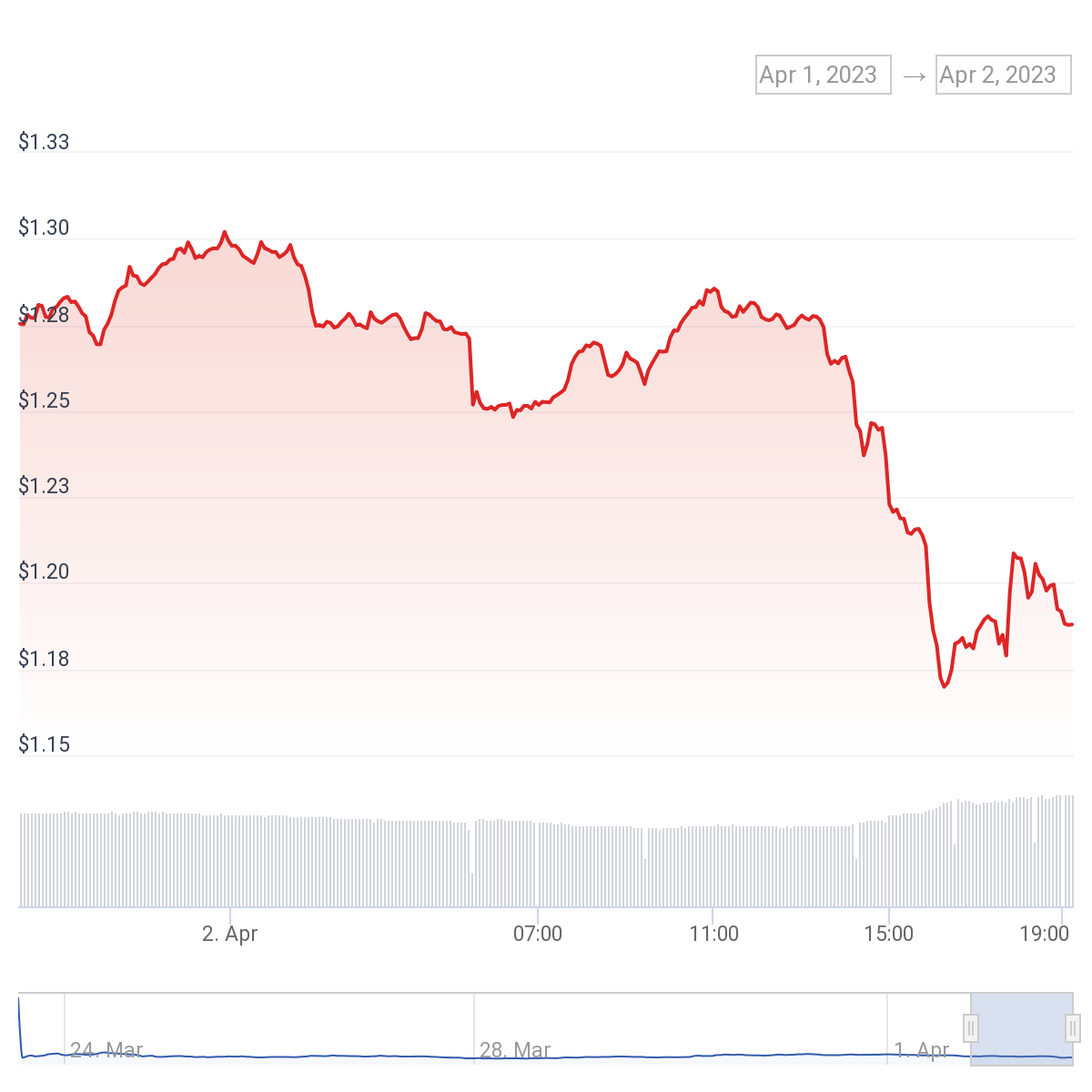

The drama caused a noteworthy decline in the price of Arbitrum’s governance token — which is down approximately 5% over the past 24 hours.

The price of ARB declined over the weekend amid drama surrounding AIP-1.

Arbitrum whales aren’t selling

Despite the Sunday price declines, on-chain analysis shows that many proverbial whales — large holders often exhibiting market-swaying influence — are reluctant to sell.

Arbitrum whale 0xe04d has yet to make any sales after purchasing ARB governance tokens on Binance three days ago. They currently hold 4,048,948 tokens.

Another Arbitrum whale, 0xadf5, also has yet to make any sales after purchasing ARB governance tokens on OKX three days ago. It currently holds 4,099,518 tokens worth $4,837,431.

Meanwhile, Arbitrum whale 0xa252 received approximately 676,000 tokens from Binance around noon EDT. Its ARB hoard currently totals 1,679,798 tokens, which on-chain analysis account Lookonchain notes were purchased at an average cost of $1.24 per token.

The largest Arbitrum buyer, 0xb154, still holds 9.94 million tokens at an average buying cost of $1.26, according to Lookonchain, after adding a somewhat-negligible 111 tokens late last night.

(But some are)

Not every Arbitrum whale is holding, however. 0x1dd9 realized a loss of approximately $141,000 after selling 2.03 million tokens for ether at an average price of $1.15 — though it still holds 500,102 ARB.

Most recently, just hours ago, whale 0x09d4 sent 700,000 Arbitrum governance tokens to Binance. Their average buying cost was $1.41, according to Lookonchain, and they still hold 1,215,453 tokens.

‘Decentralization theatre’

Though whales currently appear to be holding onto their governance tokens, generally speaking, The Arbitrum Foundation has gained its fair share of critics.

In response to what some view as “decentralization theatre,” The Arbitrum Foundation says it will propose transparency reports to illustrate better how funds will be spent. It will also rename its special grants program “Ecosystem Development Fund.”

“We believe that having a Foundation that is empowered to act in the service of the DAO is important for Arbitrum’s success,” it tweeted, adding: “We clearly could have communicated that better, and will take this opportunity to improve and continue to build Arbitrum as the most community-centric L2.”

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James

Go to Source

Author: Jamie Crawley

Go to Source

Author: Sam Reynolds, James Rubin

Go to Source

Author: Danny Nelson

Crypto prices shrugged off the Commodity Futures Trading Commission’s case against Binance early in the week as bitcoin clocked its best quarter since 2021.

Bitcoin was trading at $28,200, up about 2.6% over the past week, according to Coinbase data via TradingView. The first quarter of the year saw bitcoin jump more than 70% as risk assets rallied, leading to its best quarter since the first of 2021.

Binance and CEO Changpeng Zhao are being sued by the CFTC for allegedly violating federal laws and not registering the exchange in the U.S. The regulator’s move caused crypto prices to dip at the top of the week before shrugging off the news. The BNB coin fell about 3% to $314 over the past week.

Ether was up about 3.2% over the past seven days, trading around $1,800. Ripple’s XRP added around 18% following news from its case with the SEC, although a verdict is still some time off. Cardano’s ADA added over 8%, and dogecoin jumped 7.5% in the same period.

DAO-rama

The price of ARB fell to $1.18, down 7.2% over the past 24 hours, according to data via CoinGecko.

The drop followed the news that the Arbitrum Foundation had begun selling ARB tokens for stablecoins before the community had formally ratified its budget.

What’s coming up

With the first quarter of 2023 over and done with, several key economic indicators lie ahead in April for the U.S. Traders and the Fed will keenly watch next Friday’s U.S. jobs report. Any signs of a softening labor market could impact interest rate expectations.

Inflation data for March on April 12 will also prove pivotal to any potential Fed pivots or pauses. An advanced estimate of first-quarter GDP will be released on April 27.

There’s no Fed decision in April, with the next FOMC interest rate decision expected on May 3. The CME’s FedWatch tool shows markets are split on whether the Fed will pause or increase by 25 basis points again.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

Questions are being asked on a Sunday regarding Arbitrum’s governance after its centralized, self-titled foundation sold ARB tokens before the conclusion of a key governance vote, rendering the democratic process essentially moot.

The “special grants” program sees the Arbitrum Foundation receiving 750 million ARB governance tokens — worth nearly $1 billion — to spend without the expressed approval of token holders.

Rebranding the keystone Arbitrum Improvement Proposal’s vote as a “ratification,” the Arbitrum Foundation nonetheless claims “decentralized governance is working as intended” via both the official Arbitrum Twitter account and a lengthy governance forum post.

It also claimed it did not sell 50 million governance tokens but rather allocated 40 million “as a loan to a sophisticated actor in the financial markets space” and converted 10 million to fiat for “operational costs.” Prominent market maker Wintermute confirmed it is the former via retweet.

Free governance responsibilities (kind of)

The debacle follows the high-profile airdrop of Arbitrum governance tokens to users of the Ethereum Layer 2 scaling solution last week, which saw more than one billion ARB tokens allocated to nearly 300,000 wallets — creating a so-called decentralized autonomous organization, ArbitrumDAO.

Token holders and the wider crypto community have taken to Twitter to voice concerns (and jokes) over the apparent lack of decentralized autonomy. A wider theme is that some aren’t buying the Arbitrum Foundation’s lengthy argument, claiming it’s merely a lot of words to say, “we sold.”

The Arbitrum Foundation, however, claims this is merely a “chicken and egg problem,” as “certain parameters need to be decided” before truly decentralized governance may be reached. It also claims the massive “special grants” combats “voter fatigue” and are crucial to the project’s viability against the competition.

AIP-1 is currently slated to fail, with more than 77% of the total vote against its passing, as of 3:00 p.m. EDT.

The price of Arbitrum’s governance token declined by 8% over the past 24 hours.

Disclaimer: Evgeny Gaevoy, the founder and CEO of Wintermute, sits on The Block’s board of directors and holds an equity stake in the company.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James

Go to Source

Author: Cristiano Ventricelli

Go to Source

Author: Danny Nelson