Go to Source

Author: Prachi Vashisht

Go to Source

Author: Will Canny

Bitcoin miners notched another month of growing revenue, according to The Block Research.

Miners brought in a collective $755.4 million, most of which came as block rewards. Each bitcoin transaction block rewards miners 6.25 BTC plus transaction fees. Transaction fee revenue was $23.47 million for March.

The March figures were roughly 20% higher than February’s $613.15 million revenues.

Revenues have trended upward in recent months after dropping to around $470 million in November and December amid weakness in crypto markets.

Bitcoin is trading at about $28,000 as of press time, according to TradingView data.

Image via The Block Research

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Michael McSweeney

Go to Source

Author: William Mougayar

Go to Source

Author: Jamie Crawley

Go to Source

Author: Shaurya Malwa

Go to Source

Author: Jamie Crawley

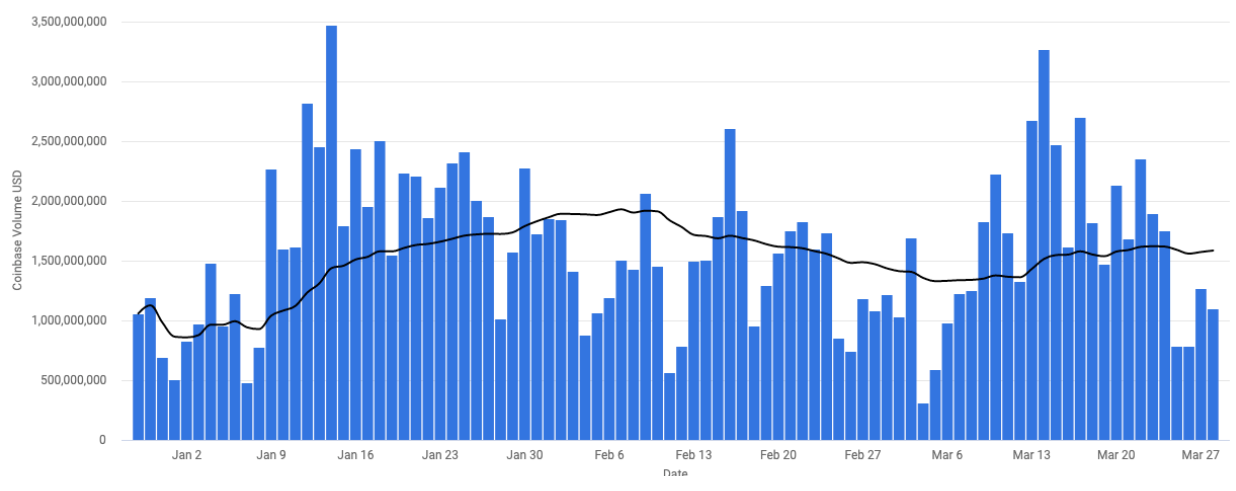

Trading volume on Coinbase came in below that of decentralized exchange Uniswap for the second month in a row.

Spot market volume on Uniswap hit $71.6 billion in March — 45% higher than Coinbase’s, according to data from The Block Research. March was the decentralized exchange’s best month, in terms of volume, since January 2022. Uniswap beat Coinbase despite a month-on-month improvement in Coinbase’s volume. (Coinbase stock has held steady at around $67.57 for the last few days.)

Coinbase noted in its weekly market commentary that the exchange’s volume fell in the last week of March. Spot market volume on Coinbase was $49.4 billion last month — up 23% from about $40 billion in February.

Coinbase noted that trends on the exchange mirror the broader market, with investors focused more on tokens with large market caps and stablecoins. “Bitcoin dominance rose even further this week as the recent regulatory headlines with the SEC and CFTC highlighted the uncertainty that still surrounds ether and other altcoins,” the exchange explained. The SEC has strongly suggested in recent weeks that many crypto tokens might be illegally trading as unregistered securities.

Coinbase added that its trading desk continued to see crypto-native hedge funds as net bitcoin and ether buyers. “High net worth individuals and family offices took profit in the large caps,” it added.

Crypto threatened by potential SEC regulation

The increased volume on Uniswap comes amid threats from the government of regulatory actions against centralized crypto businesses in the U.S. — particularly in February and March.

In February, the centralized exchange Kraken agreed to pay $30 million to settle charges with the Securities and Exchange Commission. The charges related to the exchange’s failure to register the offer and sale of its crypto asset staking-as-a-service program.

The SEC showed no signs of slowing down when it hit Coinbase with a Wells notice last month. A Wells notice informs a company that it is under investigation by the SEC, usually for the potential sale of unregistered securities. The SEC’s notice related to the firm’s staking service, Coinbase Earn, and Coinbase Wallet.

And last week, the CFTC brought a case against Binance and its CEO, Changpeng Zhao. The regulator alleges the exchange violated federal laws and failed to register the exchange in the U.S.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

The BNB Chain team announced on Twitter that it identified the individual behind the recent exploit on Allbridge — which caused an estimated loss of $570,000.

“BNB Chain has pinpointed the Allbridge attacker through on-chain analysis,” the BNB Chain team stated, adding: “We are actively assisting the Allbridge project in recovering the stolen funds.” The team declined to comment on further details of the attacker.

As a cross-chain bridge, Allbridge enables the transfer of digital assets from one blockchain network to another via liquidity pools. On Sunday, an attacker drained funds after manipulating the prices in Allbridge’s liquidity pools on BNB Chain using a flash loan, security firm PeckShield first noted.

Allbridge quickly suspended its bridge protocol and offered an undisclosed bounty to the attacker — giving them a chance to avoid legal repercussions if the assets were returned. The attacker’s response to this proposition is currently unknown.

At the same time, the project is also focusing on tracking down the culprit — working with teams from BNB Chain and others. “With the help of our partners and community, we are tracking the hacker through social networks like Twitter,” Allbridge stated.

The project also plans to compensate affected users by establishing a “recovery fund.” Allbridge said it intends to resume operations once the issue is resolved. In the meantime, a separate web interface was created for liquidity providers to withdraw their assets from its liquidity pools.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Vishal Chawla

Go to Source

Author: Lyllah Ledesma, Omkar Godbole