Go to Source

Author: Brandy Betz

Go to Source

Author: Krisztian Sandor

Go to Source

Author: George Kaloudis

Ether is rising ahead of the upcoming Shanghai-cappella (dubbed Shapella) upgrade on Ethereum set to occur on April 12.

Ether was trading at $1,897 by 1:30 p.m. EDT, up 1.5% over the past few hours, according to Binance data via TradingView. The volume of ETH/USDT, the most popular trading pair with 9.1% of market volume, has increased to $1.04 billion. Bernstein analysts said it is breaking out into the “Shanghai catalyst” in a note on Wednesday.

The Shanghai upgrade will enable withdrawals of staked ether that was deposited onto the chain ahead of The Merge in September.

While ether has underperformed bitcoin this year by about 14%, the second largest cryptocurrency by market cap is in a “break-out pattern,” according to Bernstein analysts led by Gautam Chhugani. The investment bank compared the move to the price increases seen ahead of The Merge — when ether last traded above $1,900.

There had been a long-held narrative that this upgrade would be a bearish event for ether, Matt Kunke, research analyst at GSR, told The Block, saying some thought Shapella would “introduce material sell pressure as staked ether becomes withdrawable for the first time.” That pessimism has begun to dissipate, replaced with a “more nuanced understand of the ether staking backdrop,” Kunke said.

The largest segment of ether stakers without any liquidity are solo stakers, he added, and this cohort is “most ether-aligned” of any and, as such, “least likely to exit in full, having already jumped through the non-trivial hurdles to help secure Ethereum directly.”

Liquidity cliff

Ethereum also has a queue mechanism to spread validator exits over weeks to months, preventing a liquidity cliff, Kunke said, adding that Shapella is a “material derisking event” for ether stakers. GSR expects the total stake securing the Ethereum network to grow meaningfully this year, regardless of a temporary blip downward as some validators exit.

Noelle Acheson, writer of Crypto is Macro Now newsletter, echoed this sentiment, pointing to a report by research firm K33 which notes that most staked ether belongs to “long-term network participants who are unlikely to exit at this stage.”

“On the other hand, the upgrade could make staking more attractive through its additional flexibility, and the offered yield of almost 5% could start to look even more attractive should treasury yields continue to drop,” Acheson added.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

Go to Source

Author: Lyllah Ledesma

Funding has dried up as the crypto industry undergoes bumpy times, and investors taking a more cautious approach in what companies they’re willing to pony up for. So what does it take to get money from a venture capital firm these days?

Saison Capital’s Qin En Looi sat down with The Block this week to share some insights about the firm’s approach to venture investing.

The firm invests up to $30 million annually and has maxed this out over the past two years, primarily focusing on early-stage companies at the pre-seed level. Saison Capital looks at these firms in two categories: applications and enablers, according to Looi, a principal at the firm. Crucial to both categories are founders with proven experience and “operational discipline.”

Saison Capital is backed by Credit Saison, a Japanese financial services firm affiliated with Mizuho Financial Group, which has $30 billion in assets under management. Since 2020, Saison Capital has been investing in crypto and blockchain startups when the firm “recognized the broader opportunity of Web3,” Looi said.

The competition for dollars is increasing as fewer and fewer deals are being made.

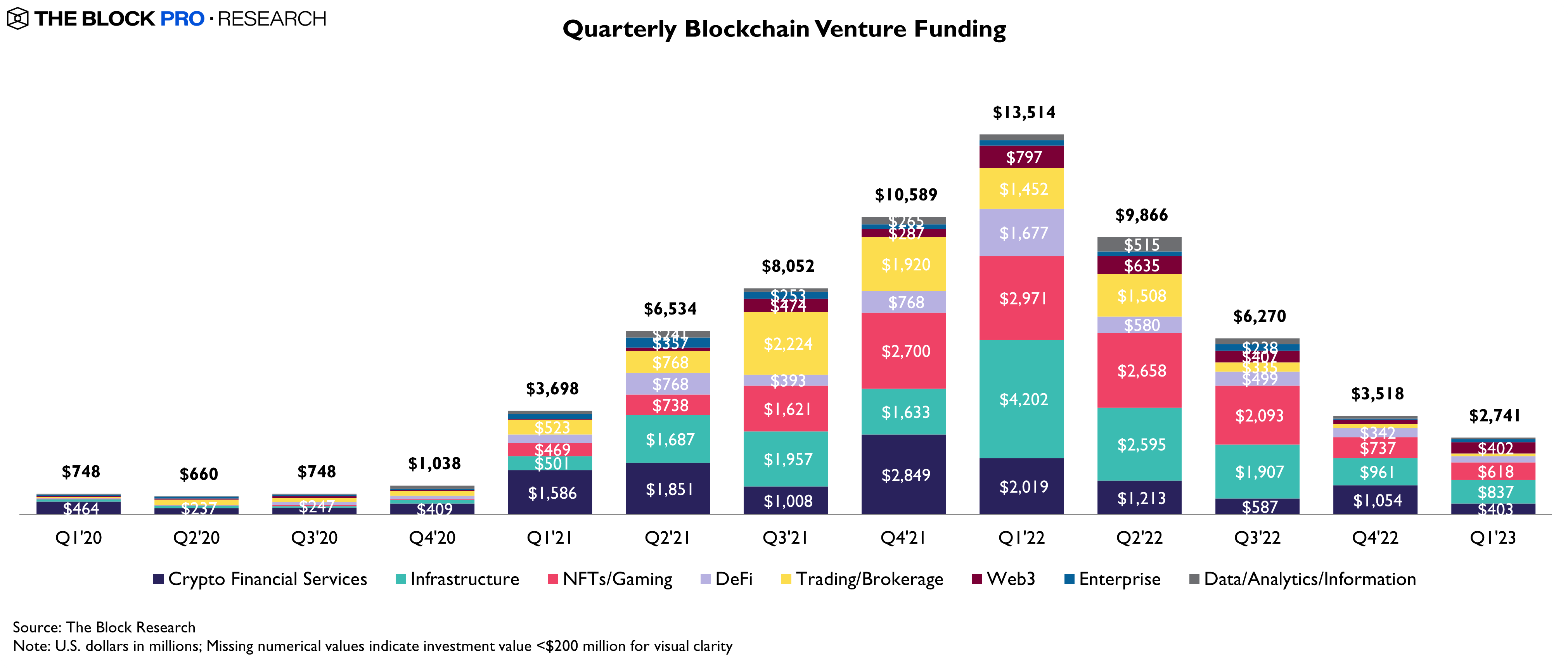

“In the first quarter of 2023, slightly more than $2.7 billion in venture capital was allocated across 402 blockchain-related funding deals,” according to The Block Research. “Funding in dollar terms was down roughly 22% Q/Q, from approximately $3.5 billion in Q4’22 to $2.7 billion. Q1 is the lowest quarter in funding since Q4’20 and it has now fallen for four consecutive quarters.”

Applications

Typically, Saison Capital focuses on firms that have strong intellectual property in media or entertainment, as well as founders in Asia with a proven track record in web2. One such firm Looi noted was Avium, which Saison Capital led a $2 million oversubscribed round last August.

Avium is a web3-based decentralized esports company founded last year by the founders of Southeast Asia’s largest esports company, EVOS. The platform brings creators and artists together to create and produce animated content with studios that have worked with Marvel Comics, Tencent, Netflix and Amazon’s Prime Video. Looi noted the founders’ proven experience in web2 gaming was a factor in the fund’s decision to invest in Avium.

Mythic Protocol is another portfolio company displaying the application base that appeals to Saison Capital, Looi said. The firm was founded by Indonesia’s largest games development studio, which had been working on gaming for 12 years, with over 400 staff. The founders decided to pivot into web3 and brought 100 of their “best folks” with them.

The strong track record of working with intellectual property and media appealed to the fund. “We see that as an exciting journey that we can embark on together,” Looi said.

Infrastructure

The second layer the fund looks at is “enablers,” which provide infrastructure in web3. These include startups working on marketing solutions, payments, finance and insurance.

An example is web3 back-office platform Headquarters, HQ.xyz, which closed a $5 million pre-seed round in September. It was co-led by Crypto.com Capital, ForgeCapital and MassMutual ventures.

HQ solves “one of the biggest struggles for crypto firms,” Looi said. “How do you account for transactions?” The firm provides balance management tools to track funds across wallets and enable the labeling and filtering of transactions to ensure wallets are accounting-ready.

Evertas, a crypto insurance carrier authorized by Lloyds of London, is another firm Looi earmarked. The fund invested in its $14 million Series A in December and $5.8 million in seed financing before that. The firm provides the “initial layer of protection” to firms investing in crypto, which is currently lacking in the space, according to Looi.

The final firm Looi noted was Jia.xyz, which is working to provide loans to small to medium enterprises in emerging markets. The founders previously worked in emerging market lending, which is what appealed to Saison Capital.

Jia’s thesis is “very simple,” Looi said. Customer acquisition is one of the biggest challenges for smaller companies in emerging markets. It gets costly, and it’s hard to reward loyalty. Businesses will shop around and compare rates each time they need a loan. “There’s no loyalty to where you get your loan,” according to Looi.

To solve this, the firm is creating a token layer to “reward and incentivize loyalty.” Businesses can take a loan from Jia and earn a formal token reward, which can be used to offset the next loan with the firm — building a credit history.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

Go to Source

Author: Daniel Kuhn

Go to Source

Author: JP Koning

Dogecoin’s price continues to defy gravity, having risen 24% since Twitter owner Elon Musk changed the famous blue bird logo to the meme of a Shiba Inu dog.

The memecoin currently trades at $0.09564 on Binance, where the DOGE/USDT pair accounts for roughly 18% of total dogecoin trading volume in the past 24 hours.

The price initially peaked on Monday, following Musk’s move to add the logo to Twitter’s website. Volumes have been in decline since Tuesday, according to Binance data via TradingView.

Analysts say that choppy waters are likely to come.

“Dogecoin liquidity is down roughly 10% in the last two weeks and plummeted -60% briefly as its price rallied on Monday,” Conor Ryder, research analyst at Kaiko, told The Block. “With a meme token like DOGE, the majority of its big moves come from narratives, and illiquidity acts as a leveraging force on the size of those moves,” he added.

Market depth in crypto is at 10-month lows, Ryder noted, meaning it’s getting easier and easier to move prices with a smaller-sized order.

The moves in dogecoin are no different, he said, adding that “it benefited from its illiquidity, but there is equally little support to the downside – investors can expect more volatility in the “short term.”

Matt Kunke, a research analyst at MGSR’s market-maker GSR, shared a similar sentiment, saying dynamics driven by “Musk’s sporadic behavior” have been “short-lived historically.”

Dogecoin has a history of moving based on what Musk says or is expected to do.

In October, the coin rallied following his acquisition of Twitter. It crashed a few days after reports circulated that Musk wouldn’t integrate crypto payments — and dogecoin specifically — into the platform.

Musk is now the target of a proposed class-action lawsuit over alleged market manipulation.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

Go to Source

Author: Margaux Nijkerk