Go to Source

Author: Michael J. Casey

Go to Source

Author: Stephen Alpher

Go to Source

Author: Sandali Handagama

Go to Source

Author: Sam Reynolds

Episode 33 of Season 5 of The Scoop was recorded with The Block’s Frank Chaparro and Unstoppable Domains Chief Operating Officer Sandy Carter.

Listen below, and subscribe to The Scoop on Apple, Spotify, Google Podcasts, Stitcher, or wherever you listen to podcasts. Feedback and revision requests can be sent to podcast@theblockcrypto.com.

Sandy Carter is the Chief Operating Officer at Unstoppable Domains — a platform that allows users to create and manage digital identities that live on public blockchains.

In this episode, Carter explores why more brands are turning to web3 digital profiles for authenticity and how user-owned digital identities are poised to disrupt existing industries.

During this episode Carter and Chaparro also discuss:

- How AI refines the ‘Metaverse’

- Experimenting with loyalty and rewards

- The empowering nature of web3

This episode is brought to you by our sponsors Circle and CleanSpark.

About Circle

Circle is a global financial technology company helping money move at internet speed. Our mission is to raise global economic prosperity through the frictionless exchange of value. Visit circle.com/Scoop to learn more.

About CleanSpark

CleanSpark (NASDAQ: CLSK) is America’s Bitcoin Miner™. Visit cleanspark.com/theblock to learn more about the CleanSpark way.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Davis Quinton and Frank Chaparro

Go to Source

Author: Sandali Handagama

ZkSync said it had devised a solution to unlock the 921 ETH ($1.7 million) stuck in a smart contract used by a team called Gemholic on its Era network. zkSync is a ZK-Rollup Layer 2 scaling solution developed by Matter Labs that can support Ethereum smart contracts.

In a statement, zkSync confirmed “funds are safe” and that it has “discovered an elegant method to unlock the frozen contract.”

On Thursday, Eden Au, director of research at The Block, was the first to note that the project raised 921 ETH ($1.7 million) through a token sale on zkSync’s Era mainnet, but the funds had become trapped in the smart contract. The funds in the contract got locked due to an issue with using the .transfer() function, which resulted in a hard dependency on gas costs.

When the .transfer() function is used to send Ether to a smart contract, the fallback() function is triggered. If the fallback() function requires more than the allocated 2300 gas, the transaction may fail, and the funds get stuck.

To mitigate these gas issues, zkSync gives a warning about the .transfer() function directly into the compiler, which was likely ignored by the Gemholic team. The zkSync team further stated that Gemholic deployed contracts on the Era mainnet without testing on the testnet or a local node.

zkSync has been working to resolve the issue with a minor protocol-level change to recover the funds fully, and it plans to provide details shortly.

“We identified an elegant solution which can solve a broader class of gas-related problems. It will require minimal changes in the gas metering of the protocol, but will allow for full recovery of the funds,” the zkSync team said.

In response to zkSync’s efforts, Gemholic publicly thanked the project, adding they “sincerely apologize” for their actions.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Vishal Chawla

The deadline for Mt Gox creditors to provide their repayment information has now passed, opening the window for repayments to be made.

The base, intermediate and early lump sum repayments can now be paid out up until the Oct. 31 deadline, according to an April 7 letter from the Mt Gox Trustee.

The Trustee noted that he would carry out the preparations to make the repayments, coordinating with the list of financial institutions — including crypto exchanges — that will receive the payments and distribute them to creditors. “In light of this, it is expected to take some time before the repayment is commenced,” the Trustee said.

The Trustee noted that the deadline for making the repayments could be extended with the permission of the Tokyo District Court.

Mt Gox is set to distribute an unknown portion of the 142,000 BTC ($3.9 billion), 143,000 BCH ($17.9 million) and 69 billion Japanese yen ($523 million) that it holds.

Payments will be made in a mix of crypto — bitcoin and bitcoin cash — and fiat money. The first 200,000 yen worth of each creditor’s claim will be paid in yen. If their claim is greater than this amount and they choose crypto and cash, they will receive a mix of around 71% crypto and 29% cash after the initial payment.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Tim Copeland

Bitcoin’s mining difficulty — how hard and time-consuming it is to find a suitable hash for each block on the blockchain — increased by 2.23% at block height 784,224 yesterday.

The mining difficulty changes roughly every two weeks as the network automatically adjusts to changes in its hash rate. The difficulty changes to ensure that the network keeps processing blocks roughly every 10 minutes, rather than slowing down or increasing over time.

The increase in Bitcoin mining difficulty is the fourth in a row. March 23 saw a more-substantial increase of 7.56%, while the prior two increases went up by 1.16% and 9.95%. This shows that the network has been reacting to gradual increases in hash rate.

The latest block difficulty adjustment pushes the difficulty metric to 47.89 trillion — another record high. As a result, it’s harder than ever to mine a Bitcoin block.

The next difficulty adjustment will likely occur in 13 days.

Bitcoin’s hash rate is ‘up only’

The average hash rate — or computation power — of the entire Bitcoin network is also at a record high of 342.16 EH/s, while average block times — how long it takes miners to verify transactions and produce a block in the blockchain — remain under ten minutes.

According to The Block’s Data Dashboard, Bitcoin’s daily real-time hash rate — divided by mining pool — is dominated by Foundry USA and Antpool, with Binance Pool coming in third.

Miners see increased revenue from subsidies

While Bitcoin’s network difficulty and hash rate increased — making the network more expensive to mine — so has miner revenue.

Miners are rewarded in the blockchain’s native currency, bitcoins, for producing valid blocks and processing transactions. Miner revenue considers inflation rewards (block subsidies) and transaction fees.

Bitcoin miners made just under $732 million in March from block subsidies, the primary source of revenue. When combined with transaction fees, they made $755 million. While this has risen, profitability remains well below all-time highs.

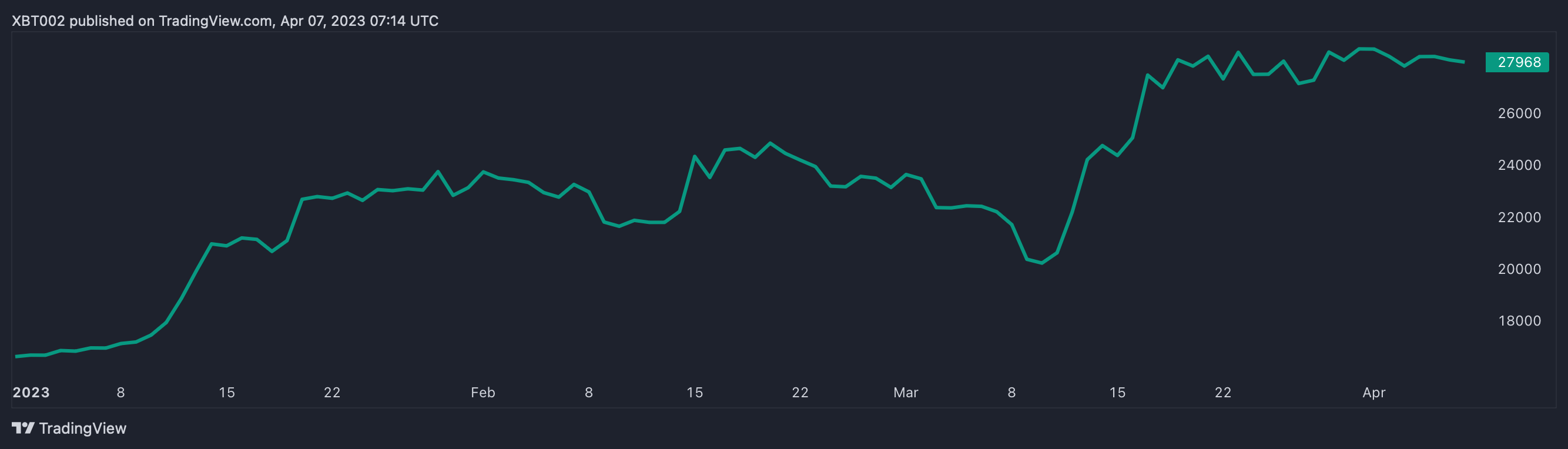

The increased revenue for miners correlates to the price of what they are mining: bitcoins. The cryptocurrency’s price has increased by 69% since Jan. 1, and nearly 26% over the past month, more than enough to counteract the increased mining costs.

The price of Bitcoin has increased substantially in 2023. Source: TradingView

“Most revenue comes from the block subsidy — 6.25 BTC per block right now — which is a constant in BTC terms, but goes up in USD terms as the price of Bitcoin increases,” The Block’s Director of Research Simon Cousaert explains, adding: “Increased network activity might also account for this (more transaction fees) — but that’s pretty much negligible compared to the price increase effect.”

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James

Go to Source

Author: Sam Reynolds