Go to Source

Author: Eliza Gkritsi

Go to Source

Author: Sandali Handagama

The Ethereum Shapella upgrade is right around the corner, promising to enable withdrawals of staked ether on the network for the first time.

The upgrade comes seven months after Ethereum’s core developers activated The Merge and kicked off the network’s transition away from proof of work, with a main goal of reducing the network’s energy consumption and a side effect of switching up its tokenomics. Since The Merge took place, Ethereum’s environmental impact has been massively reduced. At the same time, it has seen a significantly lower emissions rate — resulting in a net decrease in circulating supply due to a transaction-fee burning mechanism.

Both goals have gone to plan, with withdrawals the only remaining issue at hand. If successful, direct ether withdrawals will be available immediately and all major platforms — from decentralized protocols like Lido Finance to exchanges like Coinbase — will have added support for withdrawals within a few weeks. Once this has been done, the network will have finally completed its transition to proof of stake.

What is Shapella?

Shapella is a portmanteau of Shanghai and Capella, referring to two network upgrades that will happen simultaneously. These will upgrade the code on Ethereum’s two mainnet layers: the consensus layer (the beacon chain) and the execution layer.

Since The Merge, ether staking has been a one-way system. You can stake ether, but you can’t withdraw it. Shapella’s goal is to fix this and enable validators and users to unstake their ether on the network.

This crucial upgrade will enable users to access and potentially unstake over 18 million ETH staked on the beacon chain, Ethereum’s consensus layer network.

The main feature of the upgrade is called Ethereum Improvement Proposal (EIP) 4895, which enables validator staking withdrawals on the network. Developers have also planned additional specifications within Shapella to optimize transaction fees for certain activities on the network.

Ethereum developers have successfully tested the Shapella upgrade on public test networks for many months. It is set to occur on mainnet epoch 620,9536, expected at 10:30 a.m. UTC on April 12.

How will withdrawals work?

Shapella will activate two types of withdrawals: partial and full withdrawals. Partial withdrawals will allow validators to access their balance over the 32 ETH needed to establish a validator node. In every Ethereum block, 16 validators can make partial withdrawals, and users collect their rewards at the end of each week.

Full withdrawals will be a more significant event to track, as they enable validators to completely exit their stake on the beacon chain, taking their entire ETH balance, including their original 32 ETH and any accrued rewards or penalties each epoch.

Once withdrawals go live, users will not be able to unstake or exit all at once, as there will be a limit on the number of validators that can withdraw each day in a queue.

“In a period where liquidity is at the forefront of our minds, it is important to note that users can withdraw their rewards without removing their stake. Ethereum’s stability is further insulated by the fact that removals are processed in a queue, only happening gradually if there is large withdrawal demand,” said Ken Timsit, head of blockchain developer Cronos Labs.

How much ether will get unstaked?

A maximum of 1,800 validators per day will be allowed to fully unstake, which equates to 57,600 ETH ($109 million) per day that can be withdrawn, in addition to partial withdrawals, according to estimates by Pooja Ranjan, founder of EtherWorld.co and project manager at Ethereum Cat Herders.

“Ethereum imposes a churn limit on how many validators can withdraw each epoch. This limit increases with more validators on the beacon chain. Currently, the churn limit is between 7-8 validators per epoch by the time of the upgrade. So when the upgrade occurs, 1,800 validators can fully exit every day, which is over 57,600 ETH per day,” said Ranjan.

Validators don’t need to wait for Shapella to get into the unstaking queue; they can already tell the network they intend to unstake their ether. But it seems that not many have chosen to do so. Aave Chan initiative founder Marc Zeller noted that 1,622 validators had exited the network as of April 9, meaning that when Shanghai is implemented, they will be the first to withdraw their cumulative 51,000 ether. That said, some validators may be waiting for Shapella to take place before getting in the queue to withdraw.

Why open up withdrawals months after the Merge?

There were several reasons why ether unstaking wasn’t enabled when The Merge took place. The initial upgrade was a complex process that required careful planning and execution. It combined the Ethereum mainnet with the Beacon Chain, which was running in parallel.

If it had allowed users to unstake their ether during the transition, this could have introduced additional complications and risks to an already challenging endeavor. By splitting the changes into two, this allowed for more time to be spent testing each upgrade and checking it will work properly.

Moreover, the Ethereum network depends on a sufficient amount of staked ether to ensure its security and maintain the proof-of-stake consensus mechanism. By delaying withdrawals, developers created a more controlled environment, enabling a smoother transition.

What’s next?

The Ethereum ecosystem may be impacted by the Shapella upgrade in several ways. The ability to withdraw staked ether will allow users to access previously locked funds, giving them more flexibility to allocate their assets.

In the short term, the ability to access these previously locked funds could lead to price fluctuations. Yet with ether at a lower price now than when many users staked their funds, it’s possible that these holders wouldn’t want to sell at a loss.

“ETH stakers will likely monitor withdrawals and may overreact in the short term if there is significant demand or signals pointing to large ETH liquidations,” stated Ken Timsit of Cronos Labs. “Once short-term volatility has been smoothed out, however, the outcome is likely to be neutral, as this upgrade has been priced into ETH value for some time now.”

Beyond this, it’s possible that the gap between the price of staked ether derivatives, like stETH, and their notional value (the value of ether each derivative represents) could close as arbitrage opportunities open up.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Vishal Chawla

Go to Source

Author: Jamie Crawley

Go to Source

Author: Lyllah Ledesma, Omkar Godbole

Going into Ethereum’s high-profile “Shapella” upgrade, the leading smart-contract protocol is burning ether at a rate of $5.5 billion per year.

Ethereum began burning ether 613 days ago when it implemented Ethereum Improvement Proposal 1559 — which burns a portion of fees generated through transactions — but EIP-1559 itself hasn’t decreased the blockchain’s total supply. Since EIP-1559 went live, the total supply of ether has increased by 3.23 million coins ($6.2 billion).

It wasn’t until Ethereum implemented its high-profile switch from the energy-intensive proof-of-work to the more environmentally friendly proof-of-stake consensus mechanism — commonly known as “The Merge” — that the ether supply began to shrink in earnest.

When The Merge occurred, it reduced the number of rewards given to those running the network. In combination with EIP-1559’s burning mechanism, this has had the effect of reducing the supply of ether.

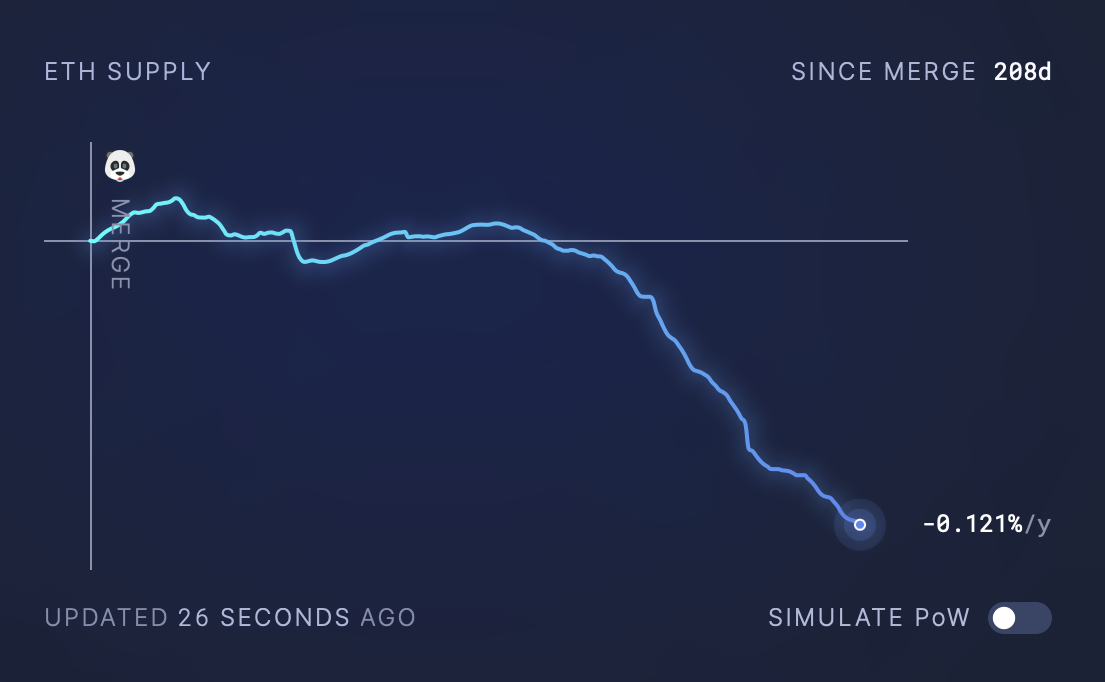

Since The Merge took place 208 days ago, the total supply of ether has dropped by 82,924 coins (more than $159 million). Had The Merge never occurred, the ether supply would have increased by 2.33 million ($4.5 billion) coins over the last 208 days, or 5.66 million ETH ($10.9 billion) since EIP-1559.

The Merge reduced the supply of ether by 0.121% per year. Source: ultrasound.money

Ethereum rewards are locked (but not for much longer)

Alongside The Merge came the temporary suspension of unstaking ether, which will be resolved soon by implementing Ethereum’s Shanghai and Capella upgrades — known together as “Shapella” — on April 12.

The upgrades will enable the withdrawal of staked ether in a phased manner, allowing staking pools to control the release of rewards.

For instance, Coinbase announced that it would start processing unstaking requests 24 hours after the completion of the upgrade. However, the exchange also mentioned that, due to high demand, the protocol might take weeks (or even months) to process all unstaking requests.

Lido Finance, a major player in ether staking, anticipates that stETH withdrawals won’t be initiated on the mainnet until around mid-May, following the completion of code audits and a two-week safety buffer.

The potential delays in withdrawal processing are mainly attributed to technical on-chain constraints. Only 16 partial withdrawal requests, consisting solely of staking rewards, can be processed approximately every 12 seconds. As a result, the queue for withdrawals could become quite long once Shapella is live.

Additionally, full withdrawals, wherein a validator entirely exits the Ethereum blockchain, might also take considerable time.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James

Go to Source

Author: Omkar Godbole

Go to Source

Author: Jack Schickler

Go to Source

Author: Shaurya Malwa

Go to Source

Author: Jamie Crawley