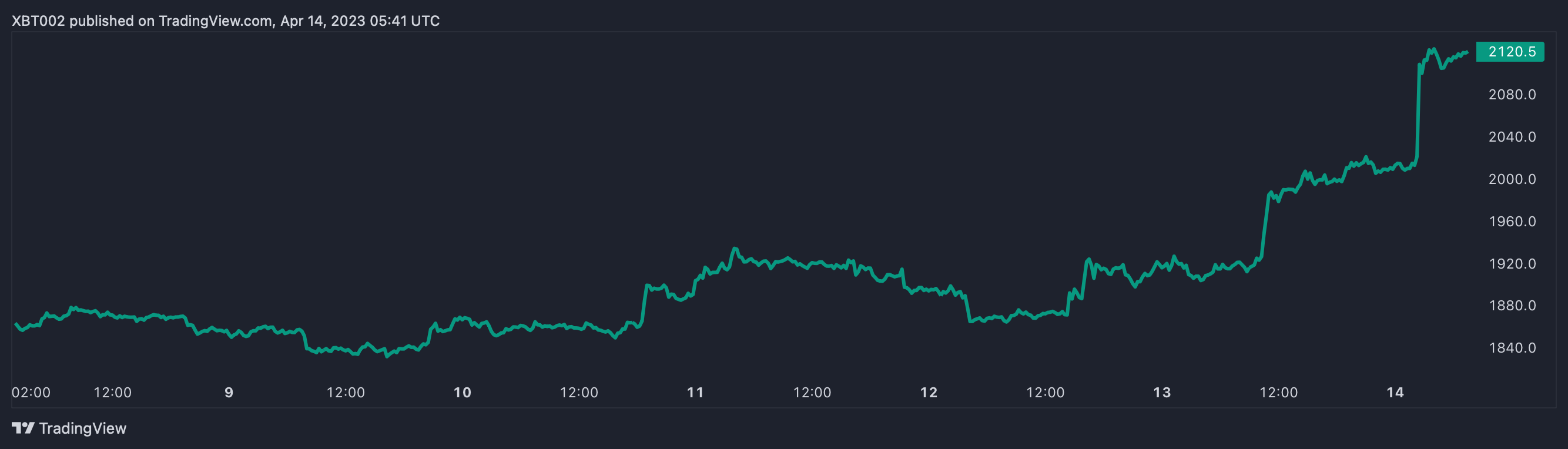

The price of Ethereum’s native coin, ether, is up roughly 10% over the past 24 hours and is trading above $2100 on various crypto exchanges.

At the same time, the total amount of ether (including rewards) that has been confirmed to withdraw — meaning its status changed to 0x01 — has surpassed $2 billion. As of 1 a.m. EDT, 1.07 million ETH, worth $2.27 billion, is pending withdrawal, per data tracking application tokens.unlock.

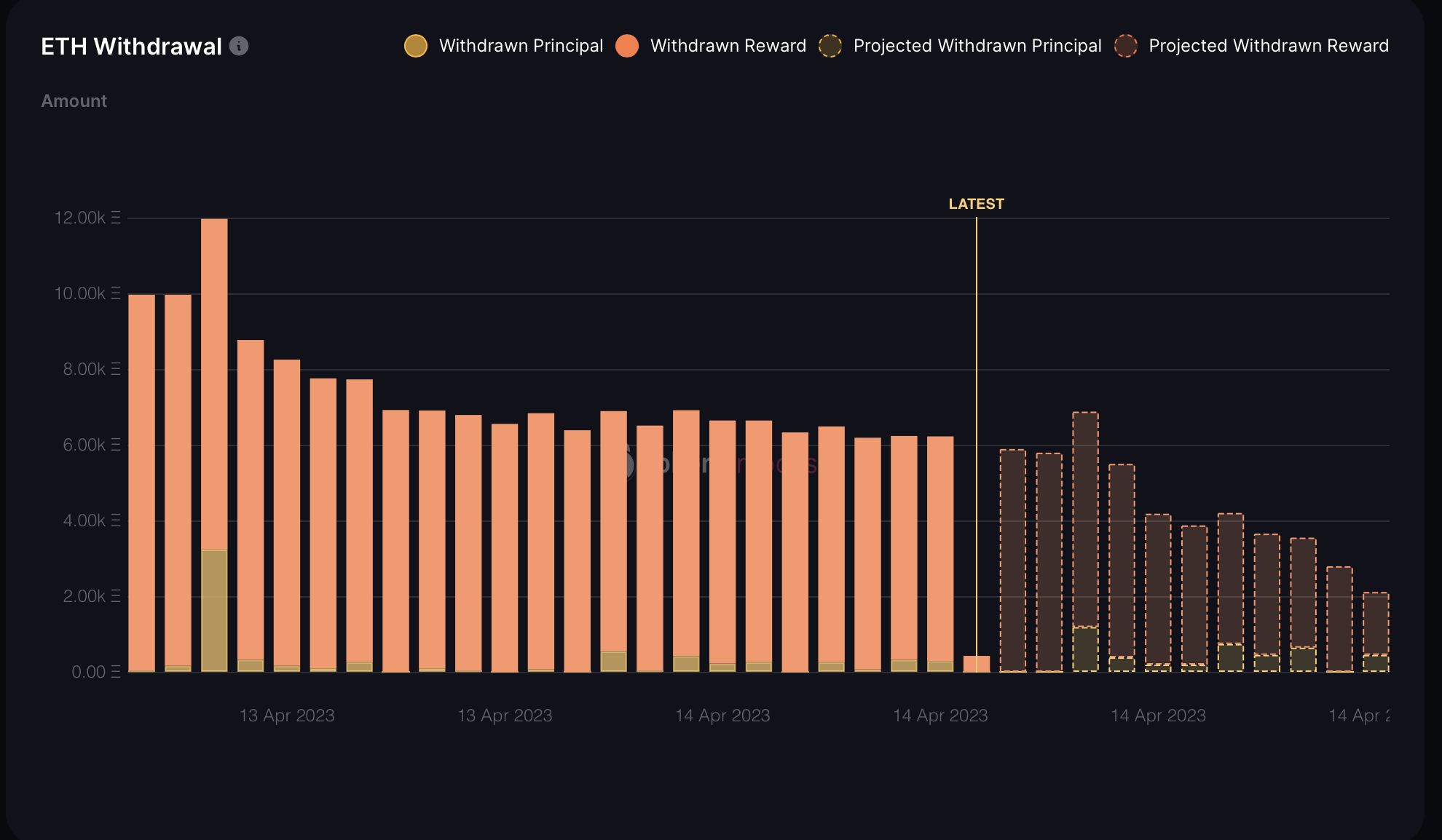

Over the next 11 hours, an estimated 53,050 ether, totalling $111.81 million, is slated to be withdrawn — creating an average of $223.54 million ETH withdrawn daily.

The price of ether has increased to over $2100. Source: TradingView

Ethereum staking withdrawals vs. deposits

17.39 million ether (excluding earned rewards) remains deposited — worth $36.54 billion. This deposited ETH accounts for 15.42% of the total supply.

The net staking balance yesterday — calculated by subtracting the total amount of ether withdrawn from the total amount of Ether deposited — is actually positive. Partial withdrawals amount to 14,300 and deposits amount to 18,370. This means that some 4,070 more ETH was deposited than withdrawn.

The net staking balance since the Shapella hard fork went live is nearly -140,000. Withdrawn ether amounts to 247,820, while deposited ETH is less than half of the withdrawn amount at 107,790 coins.

The amount of ether withdrawn hourly has slightly decreased at a steady rate. Source: token.unlocks.app

What is Shapella?

Ethereum’s Shapella upgrade — the first major change since last year’s Merge transitioned the protocol to a proof-of-stake consensus mechanism — went live just before 6:30 p.m. EDT on April 12 at block height 6209536.

The Shapella hard fork implemented Ethereum Improvement Proposal 4895 — effectively allowing users and validators to withdraw their staked ether.

Secondarily, the Shapella upgrade also optimizes Ethereum gas fees on certain transactions.

Updated with an additional price chart.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James