Go to Source

Author: Helene Braun

Go to Source

Author: Marina Lammertyn

Agility, a decentralized finance platform, has seen a surge in interest and user deposits after introducing a token incentive program to coincide with Ethereum’s Shapella upgrade, more than quintupling the value locked in the protocol.

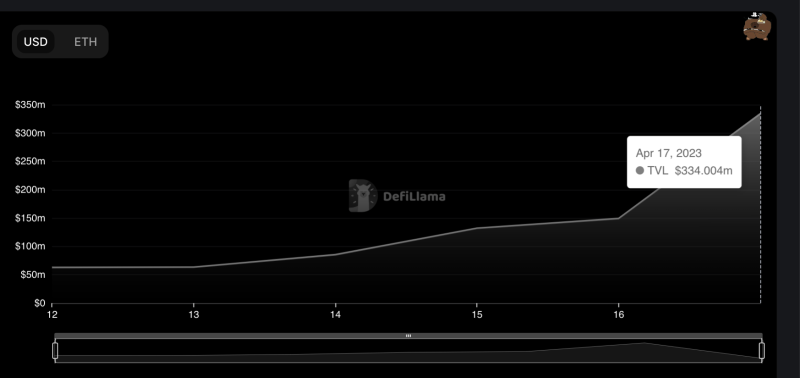

The platform drew more than $276 million in user deposits in the past week, on-chain data analytics provider Nansen noted in a tweet today. That brings the total value locked (TVL) to more than $337 million, up from about $60 million a week ago.

Agility specializes in streamline trading of various liquid staking derivative (LSD) tokens. It is a new entrant in building a DeFi protocol for LSDs, allowing users to swap one staking token for another and increasing liquidity for various LSD assets. For example, a user can swap one LSD, say staked ether (stETH) originating from Lido Finance, for another, such as Rocket Pools’ rocket ether (rETH).

Agility’s documents state it wants increasing liquidity for various LSD-related protocols. The platform’s approach to liquidity provision is comparable to Curve, a popular decentralized exchange for stablecoins.

The protocol’s staking pools experienced inflows of more than $110 million in the last 24 hours alone, according to data from Nansen. This included just over 125 addresses who deposited 68,100 staked ether, Nansen said.

Agility benefits from Shapella

Agility’s rise can be attributed to growing activity in decentralized staking protocols, such as Lido Finance and RocketPool, driven by last week’s Shapella upgrade of the Ethereum network. Liquid staking is a popular choice for users seeking decentralized alternatives that offer more flexibility and control over their assets.

Token incentives have also contributed to Agility’s success, as users are rewarded with another token called aLSD when they deposit an LSD token on the platform. At present, the protocol is offering a 60% annualized yield for staked ether (stETH) depositors, significantly higher than the 4.3% paid by Lido Finance. This incentive program has helped attract more users and increase overall user deposits. However, these token rewards are part of a temporary incentive program that will taper off in the coming weeks.

Agility protocol’s total value locked (source: DefiLlama)

Agility’s native token, AGI, has seen its price surge by 118% in the past week, going from $0.27 to $0.59, according to CoinGecko.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Vishal Chawla

Go to Source

Author: Markus Maier

Go to Source

Author: Riyad Carey

Go to Source

Author: Sandali Handagama

Go to Source

Author: Omkar Godbole

Go to Source

Author: Jeanhee Kim, CoinDesk Staff

Go to Source

Author: Oliver Knight