Go to Source

Author: Brandy Betz

Go to Source

Author: Sage D. Young

Go to Source

Author: Nikhilesh De, Jesse Hamilton

Go to Source

Author: David Z. Morris

Go to Source

Author: Eliza Gkritsi

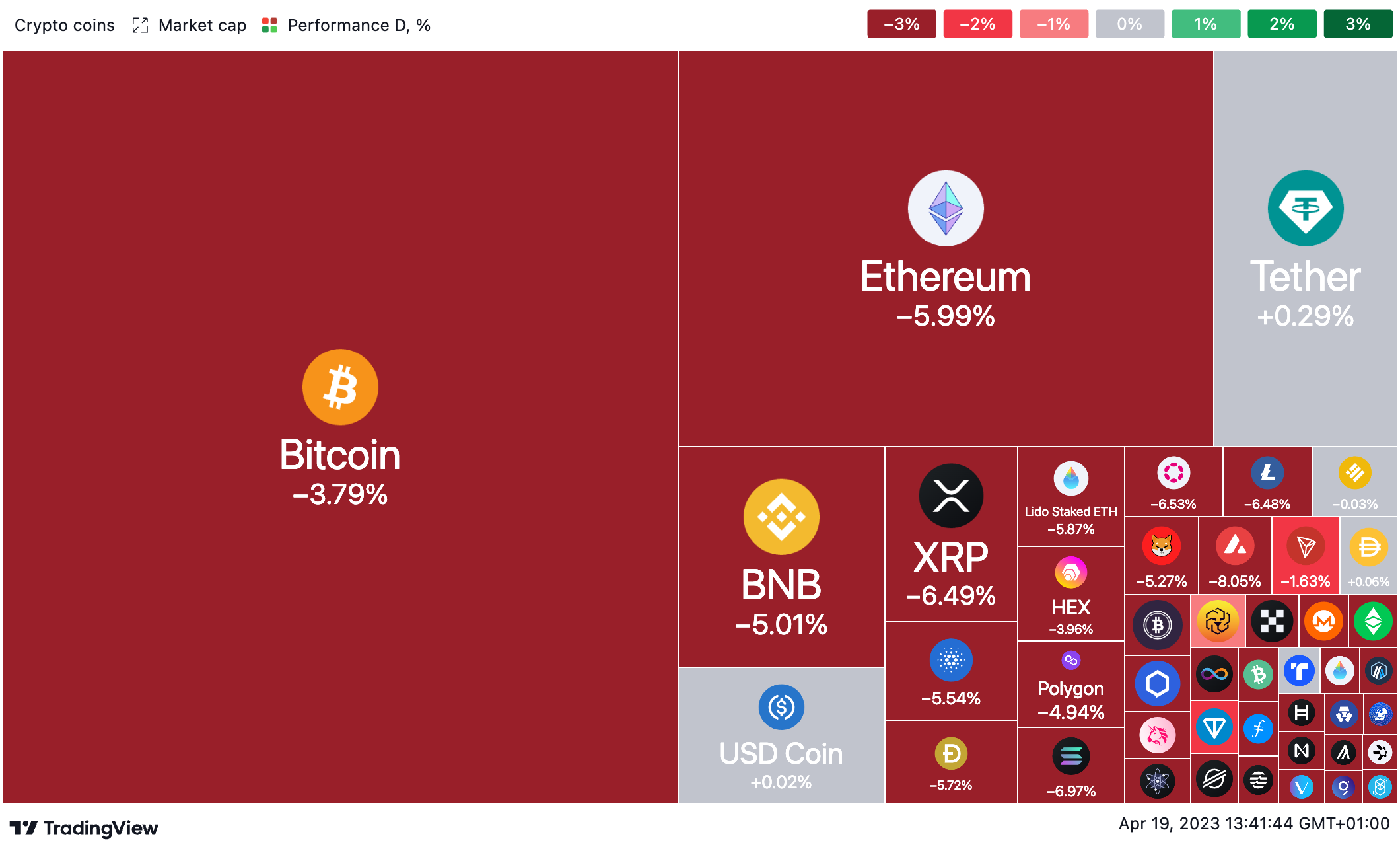

Bitcoin slipped below $30,000 as the broader crypto market declined in early U.S. trading alongside traditional markets. Equities linked to cryptocurrency and blockchain also fell.

The leading cryptocurrency by market cap fell 3.8% to trade at $29,282 at 9:45 a.m. EDT, according to Binance data via TradingView. Ether slipped below $2,000, bringing its losses over the past day to 6%.

Altcoins were similarly affected. Binance’s BNB dropped 5% over the past day, with Ripple’s XRP shedding 6.5% and Cardano’s ADA down a little under 6%.

Crypt market 24-hour heat map via TradingView

Bitcoin declines with equities

Crypto prices have become closely tied to equity markets again, which will be focused on the continuation of first-quarter earnings this week, according to market maker B2C2’s Adam Farthing.

Equities will be “paying particular attention to banking results and very much on the lookout for any signs of stress or fundamental changes to deposit bases and trading patterns,” Farthing said.

Equities linked to crypto and blockchain were down, with Coinbase and MicroStrategy leading declines.

Shares in the crypto exchange were down 4% to about $64.50 by 9:45 a.m. EDT, according to TradingView data. Coinbase shares have skyrocketed this year, up 82% since January and leading the way in large-cap stock gains.

MicroStrategy fell 3.2% to $318, while Jack Dorsey’s Block was down about 2.3% to trade around $62.30.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

Go to Source

Author: Sandali Handagama

Chainstack, a web3 infrastructure firm, has released Subgraphs, a blockchain data indexing tool intended to deliver real-time on-chain data access for applications such as crypto projects, exchanges, wallets, and NFT and gaming platforms.

An on-chain data indexer extracts and organizes data from a blockchain’s transaction history in a format that is easily searchable and accessible. This makes it easier for developers to access and analyze blockchain data and enables the creation of decentralized applications that interact with the blockchain in real-time.

According to a release, Chainstack Subgraphs supports 13 major blockchains at launch, including Ethereum, Polygon, BNB Chain, Avalanche, Optimism, Arbitrum, Near, Aurora, Fantom, Gnosis, Harmony and Cronos.

Chainstack’s solution aims to streamline the extraction and processing of data from archive nodes on Ethereum and other blockchains, enabling developers to query real-time on-chain data with fast syncs. It aims to compete with existing indexing solutions such as The Graph, Covalent and Dune Analytics.

It complements Chainstack’s existing multi-chain node and data APIs offering, as well as other tools for building applications across popular blockchains and web3 protocols.

Subgraphs aims to simplify on-chain data access

By providing a single access point for data across all supported protocols with Subgraphs, Chainstack aims to help teams begin using the indexer through a hosted service. By using a hosted service, developers can focus on building applications without worrying about the complexities of extracting, indexing and maintaining the data themselves.

“We are excited to launch the Chainstack Subgraphs and maximize the value of our platform, providing web3 developers and businesses with a simple and reliable way to access on-chain data,” said Eugene Aseev, founder and chief technology officer at Chainstack.

The team claimed that Chainstack Subgraphs aims to fill any potential gaps with the gradual sunsetting of a hosted on-chain indexing solution offered by The Graph, one of the most-widely used data indexers in the crypto space. In mid 2022, The Graph said it would discontinue support for its hosted service in favor of a more decentralized, open architecture.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Vishal Chawla

Go to Source

Author: Aoyon Ashraf

Go to Source

Author: Jack Schickler