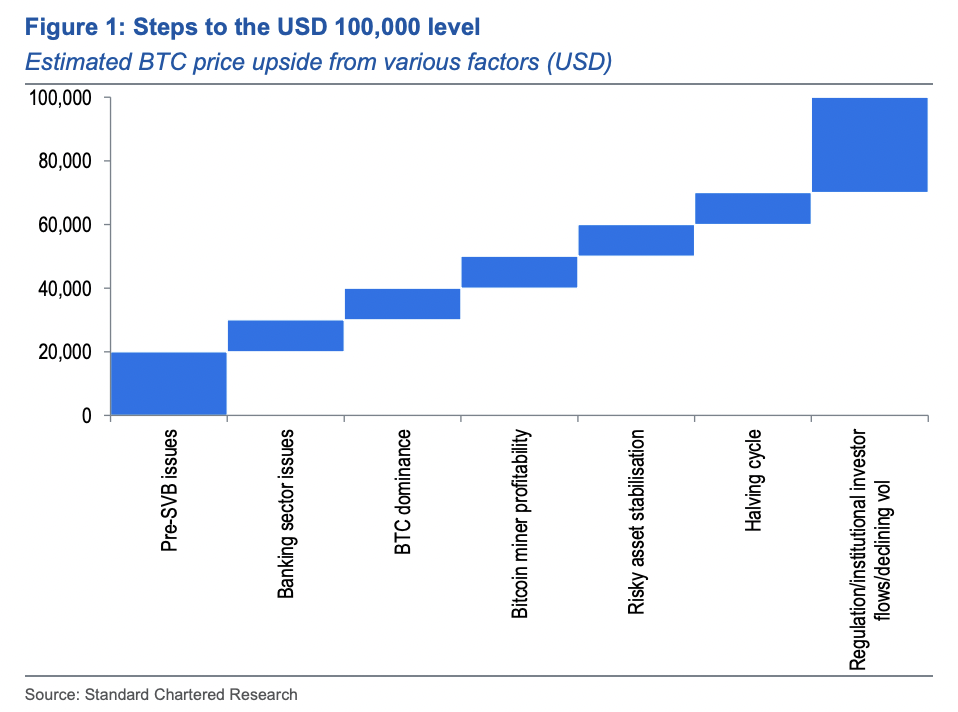

The crypto winter is over and Bitcoin could hit $100,000 in 2024, according to Standard Chartered.

“We see potential for Bitcoin (BTC) to reach the $100,000 level by end-2024, as we believe the much-touted ‘crypto winter’ is finally over,” Geoff Kendrick, head of crypto and FX research at the bank, said in a note Monday.

The recent U.S. banking crisis spurned a price rally in bitcoin and re-established its core use case “as a decentralized, trustless and scarce digital asset,” the bank said. It also pointed to the end of the Fed’s interest rate hikes, the next halving of bitcoin, and regulatory benefits.

The price of bitcoin, while down from recent highs last week, is still hovering around $27,000. That’s up from under $17,000 at the start of the year.

“Troubles faced by stablecoins (competing digital assets) have also helped bitcoin to regain its reputation as ‘digital gold’,” analysts wrote, noting that Circle’s USDC depegged following the revelation it had $3.3 billion held at Silicon Vally Bank.

A colleague of Kendrick’s at Standard Chartered predicted the price of bitcoin could fall to $5,000 in December. Eric Robertsen, global head of research and strategy, said at the time that gold would return to being the number-one safe haven it once was.

Bitcoin’s journey to $100,000

Bitcoin benefits from its status as a “safe haven,” and it has a perceived relative store of value and a means of remittance, all of which means the bank expects bitcoin’s dominance to continue to rise. Its dominance is its market cap relative to the market cap of the rest of the crypto market.

Risk assets in general should see improved fortunes with the U.S. Federal Reserve nearing the end of its interest rate hike cycle, according to Standard Chartered. Bitcoin can trade higher during difficult periods for risk assets, however, its increasing correlation to the Nasdaq at present means it should be better if risk assets improve more broadly.

Bitcoin halving’s impact on price

The next bitcoin halving — where the reward for mining a new block of bitcoin is halved — should also improve price outcomes, as evidenced by increases following the previous halvings. The next halving is estimated to happen around the end of March 2024, according to 21Shares’ Dune dashboard.

“This should add a cyclical tailwind to the structural positives at play,” Kendrick wrote, adding that “even further out, regulatory developments should provide a tailwind for bitcoin.”

The European Union’s Markets in Crypto Assets (MiCA) regulation, which passed last week through European Parliament last week, “could have constructive implications for investor interest and volatility,” he argues. The U.S. and Britain should follow suit, at least according to Kendrick.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy