Go to Source

Author: Shaurya Malwa

Go to Source

Author: Jack Schickler

Ark Invest, an American investment management firm run by CEO Cathie Wood, purchased more shares in Coinbase Global Inc. yesterday — the same day the United States-based crypto exchange announced that it was suing the Securities and Exchange Commission.

The ARK Innovation ETF purchased 122,083 shares in Coinbase, while the ARK Next Generation Internet ETF added 20,327 shares, according to a trade notification shared via email. The ARK Fintech Innovation ETF, meanwhile, bought 14,633 shares.

The total value of the share purchased amounts to nearly $8.6 million at current prices.

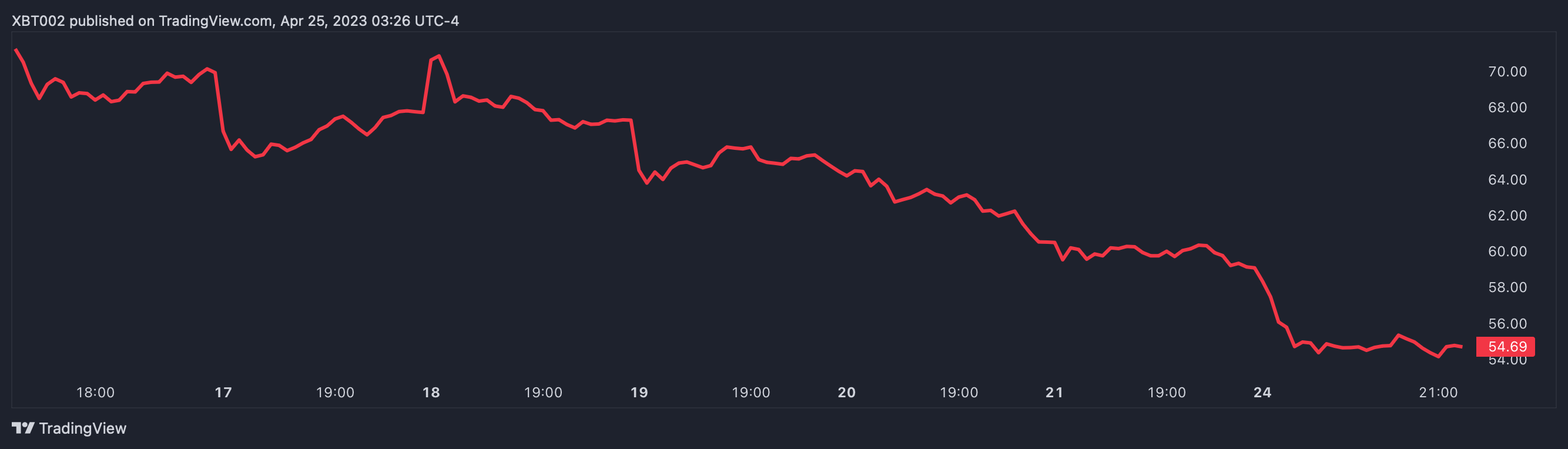

Coinbase’s share price is down more than 18% over the past week. Source: TradingView

Coinbase sues the SEC

Coinbase’s lawsuit against the SEC follows a petition for a rulemaking that the company filed with the U.S. securities regulator last summer. It looks to force the agency to provide a yes or no to Coinbase’s request for the commission to draft and approve a digital asset-specific rule.

“From the SEC’s public statements and enforcement activity in the crypto industry, it seems like the SEC has already made up its mind to deny our petition,” the company’s chief legal officer Paul Grewal wrote in a blog post about the filing. “But they haven’t told the public yet. So the action Coinbase filed today simply asks the court to ask the SEC to share its decision.”

Coinbase can file another lawsuit to try to make a federal court force the SEC to make a new rule — if the regulator declines.

As The Block reported earlier today, Coinbase CEO Brian Armstrong backed an NFT project to signal “unity for the crypto community seeking sensible crypto policy” almost immediately after the exchange sued the SEC.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James

Go to Source

Author: Omkar Godbole

Coinbase CEO Brian Armstrong backed an NFT project aiming to signal “unity for the crypto community seeking sensible crypto policy” hours after the crypto exchange giant sued the Securities and Exchange Commission for clarity on digital asset regulation.

“I just minted Stand with Crypto,” Armstrong tweeted, with a link to a free NFT image of a shield, hosted on the Zora marketplace. After minting the NFT, the executive hasn’t as yet taken the second step recommended to show support for the project: adding a shield emoji next to his Twitter name.

Coinbase didn’t immediately respond to a query seeking clarity on whether the Stand with Crypto campaign had been created by the exchange or was independent of the company.

Armstrong’s tweet came shortly after Coinbase announced it was suing the SEC, seeking to force a response to its July request for the U.S. regulator to draft a specific rule covering digital assets. Since that request, the agency has declined to create a separate crypto regulation, while reopening custody and exchange rules to explicitly say that they apply to digital assets. The SEC has also engaged in several enforcement actions against crypto firms, including an investigation into Coinbase.

“The Stand with Crypto commemorative NFT is a symbol of unity for the crypto community seeking sensible crypto policy,” the project’s page on Zora states. “The NFT features a blue shield, representing a collective stand to protect and promote the potential of crypto. The blue shield not only shows your support for the cause but also that you’re part of a growing community who believes in the future of crypto.

Coinbase’s lobbying efforts

Coinbase has a history of attempting to influence U.S. policy with grassroots lobbying campaigns. In February, it announced Crypto435, an effort “to grow the crypto advocacy community and share tools and resources to make your voice heard.” The movement aims to promote pro-crypto policy in America’s 435 congressional districts.

The Stand With Crypto page on Zora also encourages people to become a Crypto435 advocate.

The blue shield NFT created for the Stand with Crypto campaign is “purely commemorative,” with no limits on the number that can be minted. It doesn’t intend to have any utility or value. As of the time of publication, more than 11,000 NFTs had been minted.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Andrew Rummer

Go to Source

Author: Sam Reynolds

Go to Source

Author: Nikhilesh De

Coinbase is suing the Securities and Exchange Commission.

The lawsuit follows on a petition for a rulemaking that the company filed with the SEC last summer, requesting the commission draft and approve a rule specific to digital assets. The lawsuit aims to force the agency to provide a yes or no to Coinbase’s ask.

Since that request by Coinbase, the SEC has reopened custody and exchange rules to explicitly say that they apply to digital assets, but has not engaged in drafting a rule specific to digital assets. The agency has also engaged in several enforcement actions against crypto companies, including an investigation into Coinbase.

“From the SEC’s public statements and enforcement activity in the crypto industry, it seems like the SEC has already made up its mind to deny our petition. But they haven’t told the public yet. So the action Coinbase filed today simply asks the court to ask the SEC to share its decision,” the company’s chief legal officer Paul Grewal wrote in a blog post about the filing.

Eugene Scalia, son of former Supreme Court Justice Antonin Scalia and former secretary of labor, a cabinet-level position, is one of the outside counsels representing Coinbase in their petition. Scalia, currently a partner at the law firm Gibson Dunn, has won several suits against financial regulators, including a case against the Financial Stability Oversight Council that ended with the revoking of insurance company MetLife’s “too big to fail” regulatory status.

If the SEC declines to make a new rule, Coinbase can file another lawsuit in an attempt to make a federal court force them to do so.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Colin Wilhelm

Go to Source

Author: Oliver Knight

Go to Source

Author: Krisztian Sandor