I found myself in Argentina this April for the first time in over 10 years, stepping into a mess that felt very familiar — high inflation, capital controls and nearly worthless cash that was weirdly hard to find. The country has all the right ingredients to become the crypto paradise that only a Bitcoin maximalist can dream about, and yet most people I encountered were spending lots of time and effort to obtain the quickly depreciating local fiat.

Just before the Easter long weekend, lines poured out of banks and Western Union offices in Buenos Aires, as hundreds and thousands of Argentines and tourists tried to get their hands on peso bank notes, some well-worn, some crispy and new in a telltale sign of rapid money printing. Friends had implored me to bring some U.S. dollars to change in the street and warned me not to use my American credit cards, lest I be charged at the official exchange rate.

“Relax,” I told them, almost dismissively. “I get it.”

I was once a foreign correspondent in Venezuela, you see, and spent six years covering the hyperinflation, devalued currency, multiple exchange rates and endless lines that dominated daily life at the height of the man-made economic crisis that began in the early 2010s.

What always perplexed me then started to flummox me again in an instant case of déjà vu. I just couldn’t grasp why people wanted this worthless stuff, when there are so many better options, including crypto. Things that Venezuela lacked back then — reliable internet, mass smartphone adoption and basic security in the street to be able to use it — exist in Buenos Aires today. The place, and the time, is perfect for crypto. And yet I didn’t see that much of it.

What the data shows

There is data that points to increasing use of crypto in Argentina. Nearly 51% of Argentine consumers have purchased it, according to a survey conducted by Americas Market Intelligence in April 2022. That was up from only about 12% that was seen in a similar poll conducted toward the end of 2021.

A whopping 27% of Argentine consumers buy crypto regularly, the survey also found, with the top reasons for the purchases including investment, protection from inflation and the avoidance of government controls.

The country, however, fell to the number 13 spot on Chainalysis’ 2022 global ranking of crypto adoption. A year earlier, it had come in at number 10. In Latin America, only Brazil scores higher. Argentina has the 3rd largest GDP in Latin America that translates to the 27th largest economy in the world, coming just after Ireland and Israel, according to the World Bank.

“One welcome byproduct of Argentina’s long-standing economic instability is that it has become one of the most active communities in blockchain in all of Latin America,” Chainalysis said in the report.

Binance and Mastercard offer a card

Companies do seem to paying attention. Binance and Mastercard last year launched the Binance Card in Argentina “to bridge the gap between cryptocurrencies and everyday purchases.” The exchange earlier this month said it had launched peso on and off ramps through a local partner that will let Binance users convert pesos into crypto.

Marcos Zocaro, an accountant and spokesperson for the Bitcoin Argentina NGO that has worked to promote the use of cryptocurrency and decentralized technology in the country since 2013, told me that Argentina was making strides in adoption. He said that over 1 million Argentines were already using pre-paid debt cards that had exposure to cryptocurrency, pointing to both the high inflation and currency controls.

Despite all that, I didn’t see much of it when I was there, and I kept wondering why it still seemed a bit obscure. If there ever was a use case for adoption of crypto by the masses, it’s Argentina in 2023, and the fact that it isn’t everywhere holds important lessons for the industry.

But first, let’s backtrack just a bit.

A math lesson

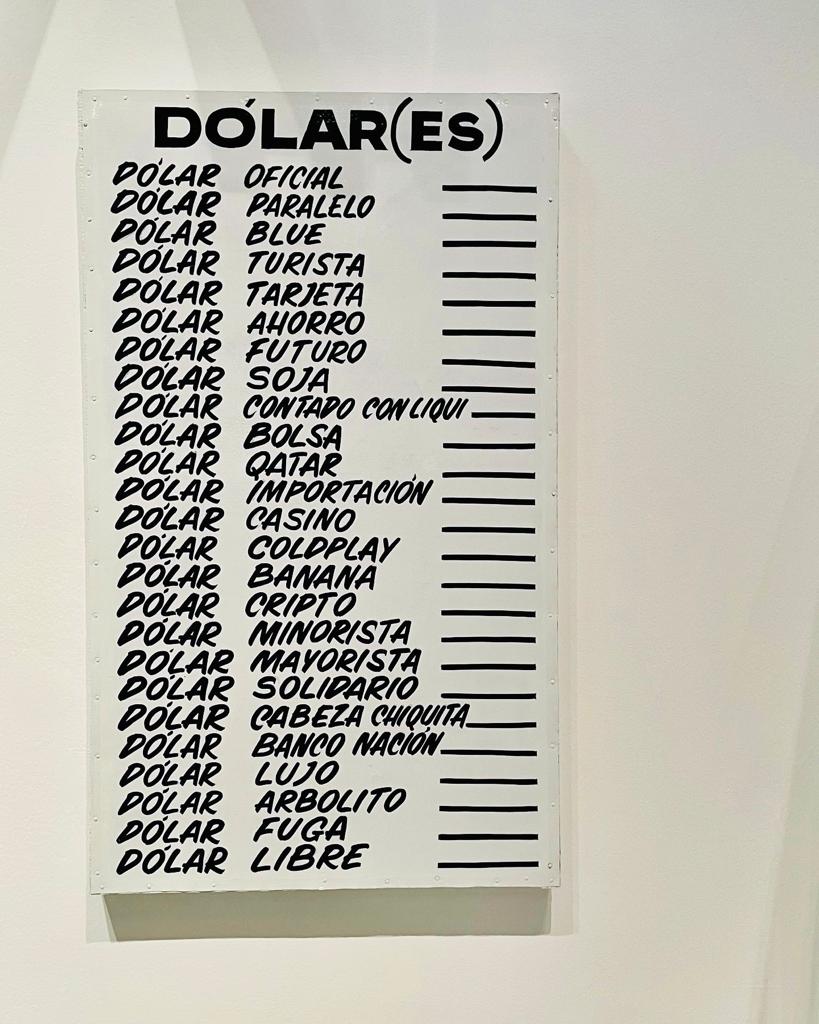

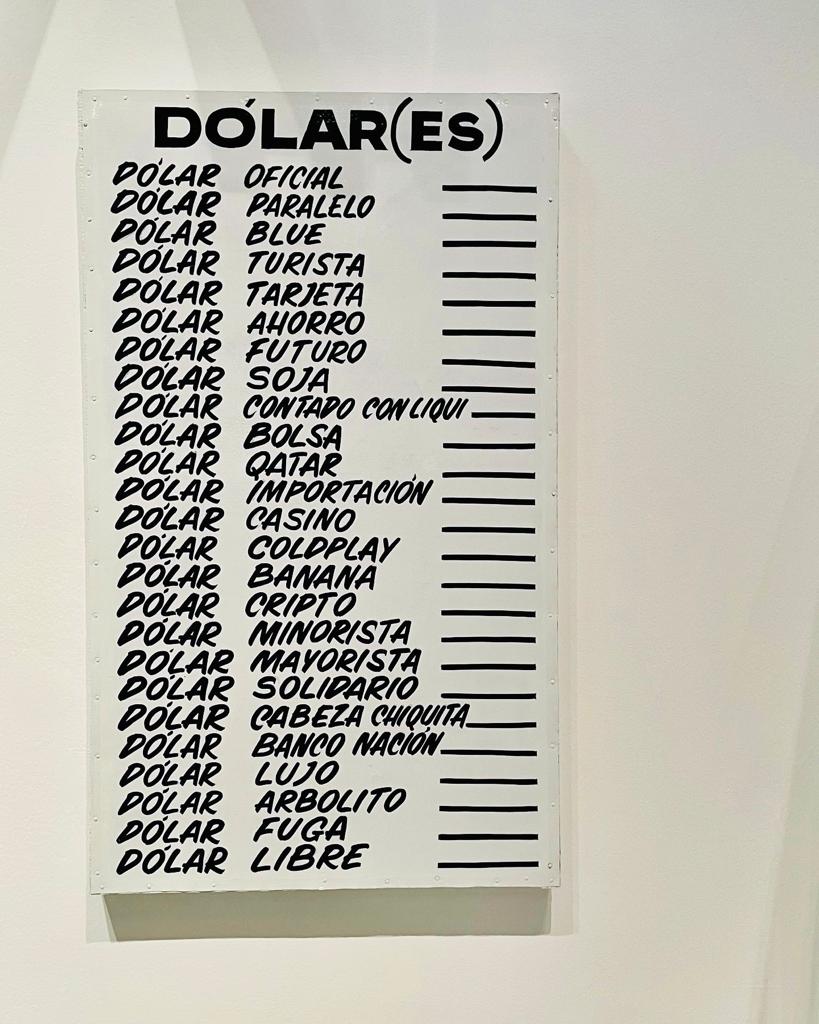

A recent exhibit at the Malba museum in Buenos Aires that references multiple exchange rates over Argentine economic history.

One U.S. dollar currently gets you about 220 Argentine pesos, but that’s only if you’re stupid. On the streets in early April, it got you just under 400 pesos at what they call the “blue” rate, and yes, I was happy to learn that late last year they introduced the so-called MEP rate for foreign credit cards that got me about 370 pesos per dollar. The point is that it’s really complicated. A 20,000-peso dinner could cost you $90 or $54 or $50, depending on how and where you got your pesos.

I was told the easiest way for me to get some pesos in my pocket would be to use Western Union, which had access to what seemed to be the best rate available anywhere. I filled out everything online and headed to the nearest office in the hip Palermo Soho district of the city, only to be told that there was no cash. I went to the next closest office, where there was no cash, and then to the next, next closest office, where there was also no cash. Frustrated tourists roamed like zombies up and down the street, in search of another office, anxiously checking their smartphones. The story was the same at each one. One of the attendants behind the window shrugged her shoulders and told me to come back Monday. I gave up and decided to press my luck with the foreign credit card rate, which I wasn’t sure would even work.

That Monday, I didn’t feel like waiting in the lines that snaked outside of every Western Union office that I saw, so I linked up with my friend Alejandra who took me to one of the city’s famous “cuevas,” or caves, where black-market, or “blue” transactions are carried out with ease. She pressed a buzzer on an unmarked door on an ordinary residential street, and it clicked open into a little entrance that was about the size of a closet. “Wait here,” she said, pointing to four small seats that looked like they’d been lifted straight from a hospital waiting room. There was one large picture on the wall of the Financial District of New York City. She ducked around the corner, out of direct view from the door, where a curly-haired man stood behind a glass window.

She changed $400, which got her about 156,000 pesos – about 390 per dollar (just two weeks later, that rate was more than 450 pesos per dollar) – in a huge wad that she started stuffing into her purse and pockets. The largest currency note at the moment is only 1,000 pesos, worth just under $2.04 as of today, which means you have to carry a lot of the stuff around for everyday purchases.

Inflation crosses 100%, again

The country’s annual inflation rate, meanwhile, had just crossed 100% again, and taxi drivers and shoppers all complained about the rising cost of just about everything.

“This is crazy,” I told Alejandra. “It’s just like Venezuela was when things started to get bad. Have you ever used crypto?”

“Crypto,” she said with a long pause as she dragged on a cigarette and shot me a very suspicious look. “No. That crypto, no. What, really, is crypto? Here, you need cash.”

Argentine peso bank notes.

Argentine peso bank notes.

Crypto Argentina

Zocaro, the Bitcoin Argentina spokesperson, said that things in the country started to pickup around 2020.

“People want to protect their purchasing power,” he said in an interview. “From around 2020, many people started to buy bitcoin and stablecoins. The crypto market has grown in Argentina, grown a lot. Many people need to send funds abroad to family and friends, or pay for goods from abroad, and with the all the international restrictions, many have started to use crypto. It’s easily accessible and transmissible. It’s serving, in many cases, as a way to protect value.”

Unlike those mysterious “cuevas” for the hard to find fiat, Zocaro said that crypto was completely legal in Argentina. Some provinces, such as Mendoza, have adopted measures that let people pay taxes in crypto, he said, adding that Argentines tended to prefer bitcoin, ether and stablecoins.

“First off, going to the ‘cuevas’ for dollars is illegal,” he said. “Buying crypto, on the other hand, is completely legal. People are also starting to notice U.S. dollar inflation and are looking to bitcoin as a possible replacement.”

More than 30% of small, retail-sized crypto transaction volume comes from the sale of stablecoins, according to Chainalysis. That’s compared to 26% in Brazil and 18% in Mexico.

Chainalysis said that three stablecoins including USDT, USDC and USDD have become popular in Argentina, especially because there are no purchase limits.

A Binance-themed “Cryptostation” in Buenos Aires.

Market growth

Julian Colombo, the Argentina country CEO for the Bitso crypto exchange that focuses on Latin America, said that Argentines are increasingly using crypto, even if it’s not visible everywhere. He said the two main uses in the country are to protect savings from inflation and international money transfers amid local laws that make it hard to access U.S. dollars.

“It’s unsecure, because you have to go with your backpack full of pesos to exchange them for dollars on the street,” he said, referring to the illegal “cueva” exchanges houses. “People tend to have friends who trade in cuevas and they go together. It’s a very painful process. That’s why, since 2020 or so, since the beginning of the pandemic, people are relying a lot on the use of crypto for having dollars on their digital wallets. The use of stablecoins made that possible.”

Out of Bitso’s six million clients, one million are from Argentina, and the demand for USD stablecoins has been increasing exponentially, Colombo said, adding that the number of users in the country has increased 40% over the past year.

Data compiled by The Block shows that Bitso volume for Argentine-peso trading pairs peaked in 2021, with its USD/ARS pair rising in popularity recently.

“People don’t want to have pesos, and they can’t buy dollars in other places,” Colombo said. “The most preferred currencies for Argentinians are, not in any particular order, USD stablecoins, bitcoin and ether.”

While many older Argentines still prefer to hold physical U.S. dollars, younger, more urban people are starting to prefer USD stablecoins. “They don’t have to handle cash, and they can do it through their phones,” Colombo said, adding that two-thirds of the company’s users in the country are under 35 years old.

Bitso has access to a national system that uses QR codes for small retail payments, and when customers link it to a stablecoin wallet, purchases in pesos are instantly converted using a “crypto dollar” rate that’s very close to the “blue” rate, Colombo added.

Colombo assured me that had I set up a Bitso account and funded it with stablecoins, I would have had no problem using it for local purchases. And he said I’d probably have gotten a better rate than the MEP credit card rate I’d ended up using. So long, Western Union…

Ponzi fears

As helpful as crypto could be to Argentines looking to transfer funds and protect their savings, mainstream adoption may be suffering because of a lot of the hyperbole that surrounds it. And all the volatility doesn’t help, either.

Mariana Radisic Koliren, the founder of Buenos Aires-based tour agency Lunfarda Travel, has been willing to accept crypto for over a year, but she said no one has yet to try. She said that there had still not been widespread adoption of cryptocurrency because many people in the country don’t have the technical literacy needed to really use it.

“People who are using crypto are from the upper middle classes,” she said. “They have access to information and foreign currency.” And while Argentines are used to volatility, the crypto ups and downs have scared many people away as they seek out stability to preserve their savings.

“A lot of people are scared, and those fears are justified,” she said. “It’s not a good safeguard if you don’t have financial literacy. If you don’t know about finances, crypto can be an ocean full of Ponzis.”

Still, Radisic Koliren thinks crypto will ultimately help the country. “It’s a technology that is going to liberate us from the banks. In Argentina, the banking system is nefarious, and we’ve already seen the banks in the past walk away with all our money,” she said. “So while there isn’t a lot of confidence in crypto, there is a huge mistrust in the banks that is justified. I view crypto as a way to carry out international transactions without paying ridiculous fees and to manage my money without having to ask permission.”

“I’d like people to pay me in crypto so that I wouldn’t have to pay the banks or PayPal money that is mine, from my work,” she said, adding that she had a wallet with MetaMask ready to go to receive payments. If receiving payments in crypto, she said she’d prefer to receive stablecoins.

“It’s a matter of time,” she said. “No one was using crypto here five years ago, but now I have a lot of friends who have their debit cards linked to crypto. But it won’t go from 0 to 100, especially when there are stupid things each week like Elon Musk posting that dog photo. People need to see that this is something serious and stable.”

She was referencing the frequent tweets by billionaire Elon Musk related to the dogecoin memecoin that can wildly influence its price and have prompted some to accuse him of market manipulation.

“We’re living in system that is very unsafe and unstable, and we’re looking for monetary security,” she said, adding that she has savings in bitcoin and ether. “Right now, crypto isn’t able to provide that.”

Cold wallets and vineyards

Rita, a winemaker in Mendoza who didn’t want to use her last name for security reasons, said that inflation has been starting to affect her industry with price uncertainty but that she hasn’t seen any demand for crypto transactions from either suppliers or clients yet. She, however, has been buying bitcoin since 2020 for her personal savings.

“I don’t touch it,” she said. “I buy the dips.” She said that most Argentines still preferred old fashioned greenbacks because of the relative security.

“There are so many lies in crypto,” she said. “Robert Kiyosaki, he’s the guru, he says to buy crypto, gold and silver. But then Elon Musk comes and says something, and people sell, and the prices goes down. It goes down a lot.”

Rita said she checks the Binance app on her phone constantly for the latest prices, but she’s never sold. She transfers any bitcoin she buys into a cold wallet she keeps offline.

“I’m going to be a millionaire someday,” she said, chuckling. “It’s going to go up. I’m betting long term. It’s an investment for the future. I’m still buying.”

Reporter’s note: Are you using crypto in Argentina? Or Venezuela? Or anywhere else, for that matter? I’d love to hear about it. My DM’s are open.

(With reporting assistance from Adam Morgan McCarthy.)

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.