Go to Source

Author: Jack Schickler

Go to Source

Author: Shaurya Malwa

Go to Source

Author: Omkar Godbole

Avalanche, a proof-of-stake blockchain developed by Ava Labs, activated the Cortina upgrade on its mainnet, implementing changes to help optimize the network for developers.

Cortina upgraded to the latest version of Avalanche Go v1.10.0, the node implementation for the Avalanche network, at around 11 a.m. ET yesterday.

The Cortina upgrade included migrating the X-Chain to run the Snowman++ consensus, which means that the entire network has been migrated to a single consensus engine. This change is crucial for integrating Avalanche Warp Messaging (AWM) as well as enabling complex X-Chain transactions.

Avalanche’s different chains

The Avalanche X-Chain, or Exchange Chain, is one of the three primary chains within the platform, alongside the P-Chain (Platform Chain) and C-Chain (Contract Chain). The X-Chain is specifically designed for creating and managing native Avalanche assets.

Additionally, the upgrade involved changes to the C-Chain, the smart contract layer compatible with the Ethereum Virtual Machine. Cortina increased the C-Chain block gas limit from 8 million to 15 million gas to accommodate the deployment of more complex dApps on the network. The gas target, a specific amount of gas that the network aims to consume within a given time window, will be kept at 15 million gas per 10 seconds.

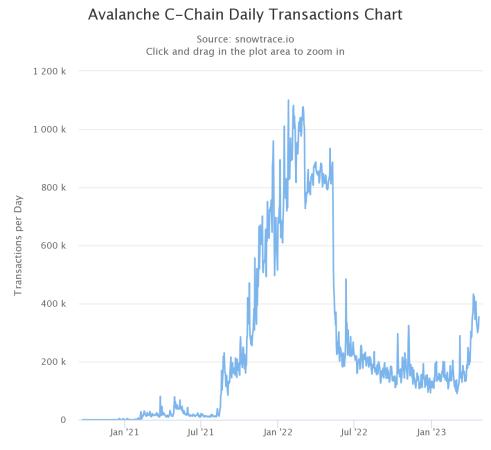

The upgrade comes at a time when the C-Chain, where the bulk of activity takes place, is seeing a resurgence. Daily transactions have more than tripled year to date after a period of significant decline at the end of 2022, data from the Avalanche block explorer SnowTrace shows.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Vishal Chawla

Go to Source

Author: Shaurya Malwa

Go to Source

Author: Ian Allison

Crypto prices rose overnight and into the early hours of Wednesday morning. The bump in price coincided with issues at another U.S. bank, this time First Republic.

Bitcoin was trading at $28,330 by 3:30 a.m. EDT, up 3.7% over the past day, according to Binance data via TradingView. The price of bitcoin climbed back above $28,000 after slipping below this level over the weekend. Ether gained 2.2% in the same period.

The bump in crypto prices yesterday coincided with yet more U.S. banking strife. First Republic saw $102 billion in deposit outflows during the first quarter of the year, $72 billion more than expected. The lender’s woes have revived broader banking worries, according to Swissquote.

Banking issues in the U.S. kickstarted bitcoin’s most recent rally to above $30,000 and were the catalyst for a return to the cryptocurrency’s core use case, Standard Chartered said this week. The bank declare that the “crypto winter is over” — and it isn’t alone in its prediction. Matrixport’s Markus Thielen said the price of bitcoin may reach $45,000 by year-end.

BTCUSD chart from TradingView

Following its latest upgrade, JPMorgan analysts said that ether could face further selling pressure.

“Binance initiated Ethereum withdrawals this week where participants can redeem for ETH with their BETH holdings at a 1:1 ratio,” the bank wrote. Despite Binance withdrawals taking up to 15 days to be fulfilled, they could “put further pressure on ETH over the coming weeks.” Liquid staking protocol Lido Finance plans to enable ether withdrawals at some point in May, JPMorgan analysts noted.

Binance announced its own liquid staking token on Monday, which will go live Thursday.

Shorts wiped out in the latest market move

Futures traders going long suffered upward of $700 million in liquidations during the crypto market’s recent dip, the recent bump resulted in shorts suffering a similar fate.

About $77 million in short positions across derivatives exchanges were liquidated in the past 24 hours, according to data via Coinglass. Most of the shorts happened across Binance, OKX, and Bybit — $21 million, $14.9 million, and $12 million, respectively.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

Go to Source

Author: Jack Schickler

Episode 40 of Season 5 of The Scoop was recorded with The Block’s Frank Chaparro, Christiana Sciaudone, and Nathan Crooks.

Listen below, and subscribe to The Scoop on Apple, Spotify, Google Podcasts, Stitcher, or wherever you listen to podcasts. Please send feedback and revision requests to podcast@theblock.co.

Despite Argentina grappling with an annual inflation rate surpassing 100% and enduring strict capital controls, many citizens still opt to trade currency via illicit “cuevas” and maintain bundles of near-worthless cash, rather than embracing the potential benefits of cryptocurrencies.

In this episode, The Block’s Nathan Crooks breaks down his research into why crypto adoption in Argentina is not more pervasive, and The Block editor and Argentinian resident Christiana Sciaudone shares her local perspective on the Argentinian currency crisis.

During this episode, Chaparro, Crooks, and Sciaudone also discuss:

- Why Argentina has multiple exchange rates for U.S. dollars

- How locals think about different cryptocurrencies

- Crypto businesses building in Argentina

This episode is brought to you by our sponsors Circle and CleanSpark.

About Circle

Circle is a global financial technology company helping money move at internet speed. Our mission is to raise global economic prosperity through the frictionless exchange of value. Visit circle.com/Scoop to learn more.

About CleanSpark

CleanSpark (NASDAQ: CLSK) is America’s Bitcoin Miner™. Visit cleanspark.com/theblock to learn more about the CleanSpark way.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Davis Quinton and Frank Chaparro

Go to Source

Author: Shaurya Malwa