Go to Source

Author: Jack Schickler

Binance.US, the American affiliate of the world’s largest crypto exchange, has partnered with web3 domain name provider Unstoppable Domains to offer branded .BinanceUS addresses on Polygon.

The .BinanceUS domain names will be made available exclusively through the exchange’s app in the coming weeks, Unstoppable Domains said Wednesday. For the first time, Unstoppable will also issue two-digit domain names for BinanceUS customers, such as 14.BinanceUS or 23.BinanceUS. It already also offers two-letter domain names.

“People can sign up for the .BinanceUS waitlist immediately and we expect to start launching the domains in the coming weeks,” Sandy Carter, chief operating officer and head of business development at Unstoppable Domains told The Block. “We don’t have a specific date as of now, but we’ll keep the community posted.”

What are web3 domain names?

Web3 domain names are registered on a blockchain network, making them decentralized and resistant to censorship. They simplify the process of sending and receiving cryptocurrencies, as users can leverage a human-readable web3 domain name (like yogita.crypto) instead of a long hexadecimal wallet address.

With .BinanceUS domains, the exchange’s customers will be able to buy, sell and send cryptocurrencies within its app. Meanwhile, Unstoppable Domains customers will be able to use Binance.US to withdraw crypto to any Unstoppable domain, including their .crypto and .nft domains.

There are more than 3.4 million web3 domains minted with Unstoppable and any of them can be used on Binance.US.

Founded in 2018, Unstoppable Domains is a billion-dollar company backed by investors, including Pantera Capital and Coinbase Ventures. Its closest competitor, Ethereum Name Service (ENS), provides .eth domain names — like vitalik.eth — and has minted over 2.7 million domains.

.BinanceUS domain names on Polygon

While unlike ENS mints all its domain names on Ethereum, Unstoppable Domains uses Polygon. Given gas fees are involved on Ethereum, ENS names can be costly. Unstoppable’s domain names have no gas or renewal fees, according to its website.

As for .BinanceUS domain names, they will be able to purchase for as little as $10, Carter said. While Unstoppable domains are minted on Polygon, any self-custodied Unstoppable domain can be bridged to Ethereum if preferred, according to Carter.

“This is the first time Binance.US is launching a digital identity to their community,” Nandini Maheshwari, vice president of business development at Binance.US, told The Block. “.BinanceUS domains will simplify the crypto experience for our community and enable users to take ownership of their digital identities.”

Binance.US, however, is not the first company Unstoppable has partnered with for branded domains. It also works with Polygon Labs and Blockchain.com to offer .polygon and .blockchain domain names, Carter said.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Glenn Williams, Nick Baker

Go to Source

Author: Tracy Wang

Go to Source

Author: Stephen Alpher

Go to Source

Author: Eliza Gkritsi

Go to Source

Author: Danny Nelson

Crypto futures traders going short suffered heavy losses on Wednesday as prices jumped. Over $60 million in short positions were liquidated in the past four hours.

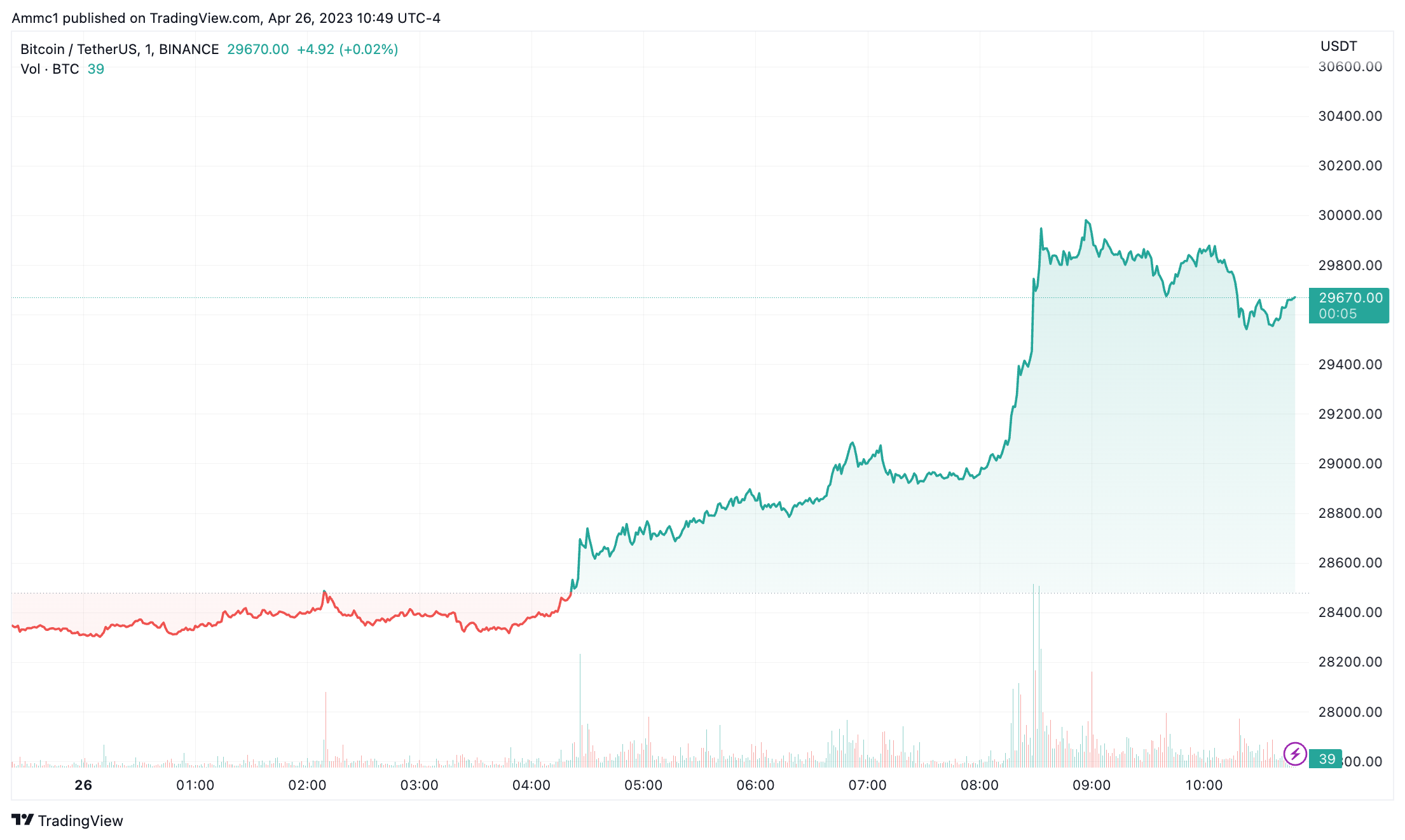

Bitcoin was trading near $29,700 just before 11 a.m. EDT, up about 4.8% since midnight, according to Binance data via TradingView. The broader crypto market traded higher, in line with the leading cryptocurrency by market cap. Ether is up 7% over the past day, Binance’s BNB gained 3.5%, and Cardano’s ADA gained nearly 9%. The rapid increase in price has been attributed to increasing U.S. banking woes.

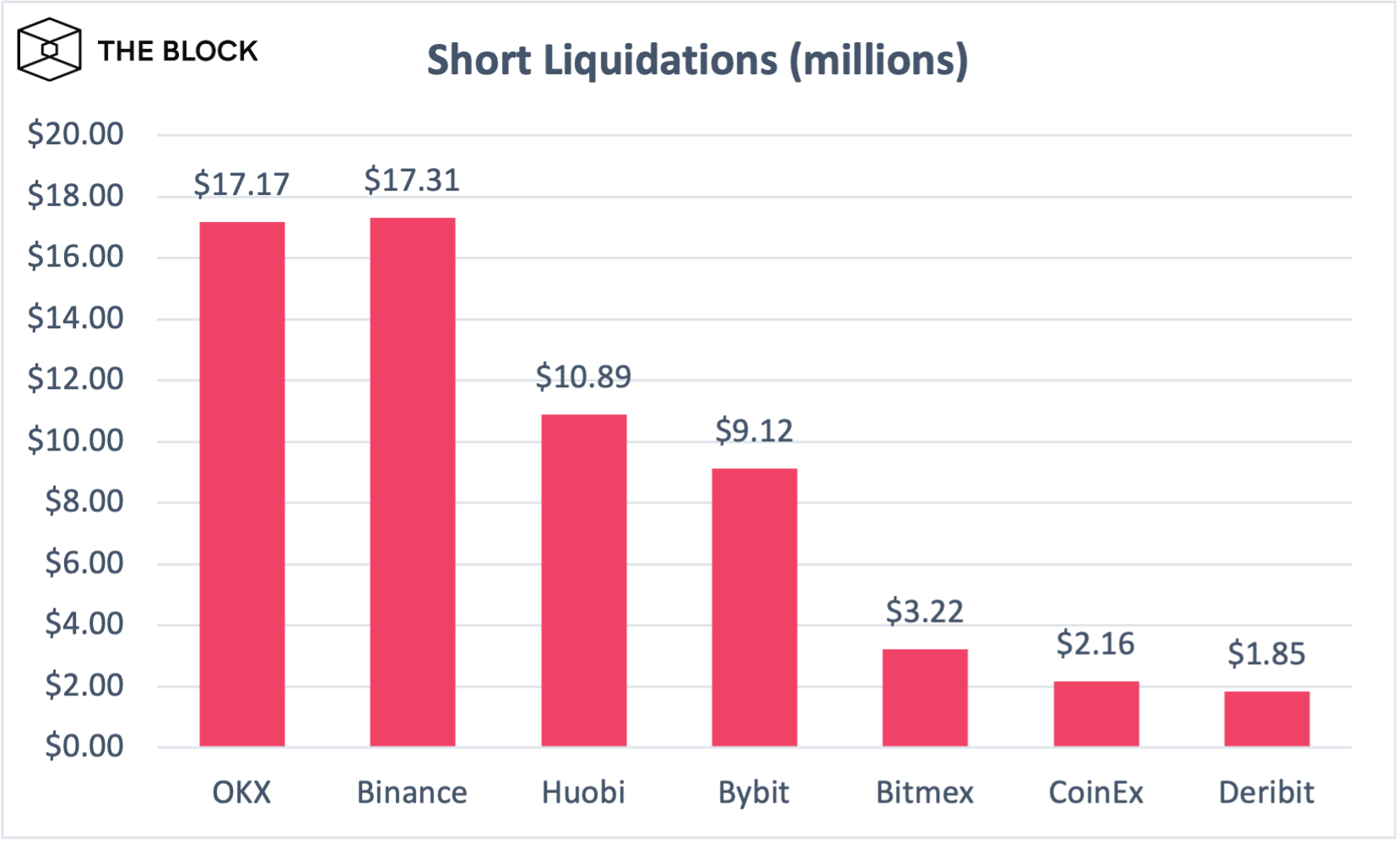

The movement hit short traders, with $62 million in short liquidations. Binance and OKX experienced most of the volume, with over $17 million each.

Short liquidations in the past four hours. Source: Coinglass

Short positions across derivatives exchanges saw the largest liquidations this year just two weeks ago. Around $240 million in shorts were liquidated on April 14, according to Coinglass data via The Block. In the past 24 hours, nearly $150 million in shorts have been liquidated.

Crypto stocks, such as Coinbase and MicroStrategy, were also in the green — up 2.5% and 7.6%, respectively.

Banking woes, bitcoin gains

The upward price action “closely resembles the market dynamics observed during Silicon Valley Bank’s collapse, namely, a bitcoin-led crypto rally as expectations for future rate hikes reverted sharply lower as more cracks in the regional banking system emerged,” GSR’s Matt Kunke told The Block.

“Only this time, the narrative shift stemmed from a larger-than-expected decline in First Republic deposits, which turned the balance sheet upside down and will be extremely difficult to recover from.”

The bank saw $72 billion in outflows during the quarter. It’s advisers are lining up potential purchasers, according to CNBC, asking other U.S. banks to purchase bonds (at a loss) in the bank to prop it up. On March 17, JPMorgan and other major U.S. banks deposited $30 billion at First Republic in an attempt to steady the ship. The bank needed much more, considering net outflows were still above $70 billion despite this injection.

BTCUSD price action, source: TradingView

Banking issues in the U.S. acted as a catalyst for bitcoin’s last rally and a return to the cryptocurrency’s core use case, Standard Chartered said this week. Bernstein analysts argued today that it has re-emerged as a “safe haven asset” during recent banking issues.

“As second-order effects of deposit runs continue (credit freeze, margin pressures, asset quality issues), we expect the banking sector to start revealing cracks, pushing the Fed to debase the dollar sooner. Bitcoin’s correlation with gold has shot up (safe haven asset), and the correlation with equities is down, mean-reverting after an elevated correlation over calendar years 2020 to 2022,” analysts at the bank wrote.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam Morgan McCarthy

Go to Source

Author: Noelle Acheson

Go to Source

Author: Sandali Handagama