Now that Binance, the world’s biggest crypto exchange, and its CEO Changpeng Zhao are being sued by the Commodity Futures Trading Commission over unregistered trading activity in the United States, one might expect the business to steer clear of venture investments in the region. But Binance is nothing if not a risk-taker.

“It doesn’t really touch Labs in any way that I can think of,” Yibo Ling, chief business officer at Binance, said of U.S. regulatory pressure affecting its Binance Labs venture arm, in a wide-ranging interview with The Block. “It’s not differentially impacting us. If there are good projects anywhere, we’re interested in having a conversation.”

As of the first quarter, Binance Labs had amassed $9 billion in assets, up from $7.5 billion in August of last year, according to a spokesperson. Its money is invested in over 200 projects from more than 25 countries in six continents. Of those, 50 have been incubated by Binance Labs.

On paper, the venture business has generated significant returns. Binance’s spokesperson said the outfit has delivered a theoretical return of more than 10 times what it has invested. Yet Binance seemingly has no plans to sell. “We’re buying and holding, that’s been the strategy over the past few years. With maybe a handful of exceptions, we haven’t exited,” Ling said.

If realized, those returns would accrue primarily to Binance itself, since the bulk of the capital it invests comes from the exchange giant’s profits. There is also a $500 million fund with external capital in the mix that closed in June last year. DST Global Partners and Breyer Capital contributed alongside private equity funds, family offices and corporations, according to a blog post published at the time.

Binance Labs doing fewer deals

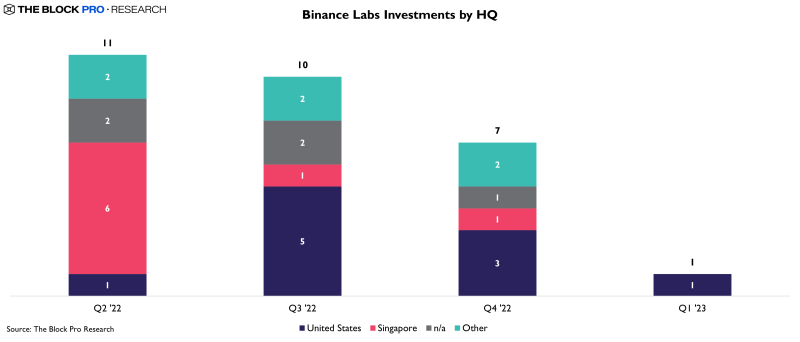

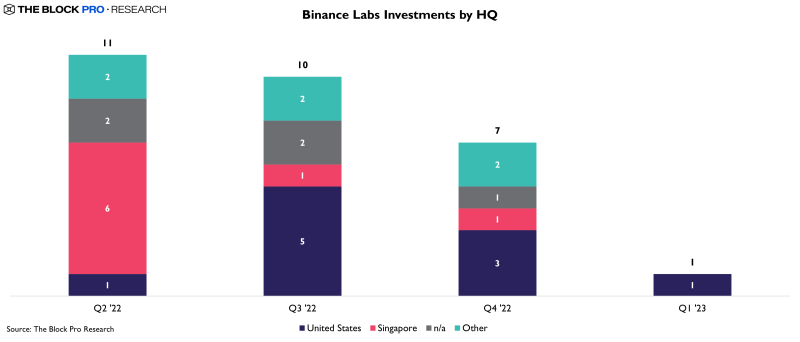

Despite Ling’s bravado, the publicly available data suggests that Binance Labs has made fewer deals in the U.S. this year. The chart below, compiled by The Block Research, shows how the firm’s announced investments have declined.

In the second quarter, Binance Labs has so far invested in three firms: Thailand-based metaverse startup Playbux, Korean blockchain game developer Gomble, and Gameta, a web3 gaming platform based in the British Virgin Islands, according to The Block’s deals dashboard.

Binance Labs team structure

The Binance Labs team remains surprisingly lean despite the size of its portfolio, with just a dozen or so dedicated staff, according to Ling. The structure of the team is not entirely clear. Binance’s spokesperson declined to share an organization chart, citing internal policy.

Yi He, a co-founder of Binance alongside Zhao, took the reins as head of Binance Labs in August 2022, taking on responsibility for global strategy and day-to-day operations, according to a blog post published at the time. Yi has a lot to juggle. She continues to lead and support other parts of Binance’s business, including customer service, institutional business, marketing, Binance C2C and Binance Wealth Management.

The decision to add Binance Labs to Yi’s already full plate followed a string of executive departures. In June 2022, The Block revealed that Bill Qian, the former head of Binance Labs, and executive director Nicole Zhang were on their way out. Peter Huo, a former executive director at Binance Labs, also left the unit last year, according to his LinkedIn profile. Jeffrey Ma, an M&A director at Binance, departed in March 2022, per his LinkedIn. He and Huo now work together at a business named Whampoa Digital. Huo and Ma did not immediately respond to requests for comment.

In addition to bringing in Yi last year, Binance hired Natalie Luu, previously head of ecosystem at Terraform Labs, as vice president of investments and head of incubation in March, according to her LinkedIn profile. LinkedIn also suggests that Michael Siu and Alex Odagiu, both former bankers, have each served as investment directors at Binance Labs for a year or more, while Kevin Poh, a former regulator at the Monetary Authority of Singapore, is involved in both M&A and ventures. Luu, Siu, Odagiu and Poh did not respond to requests for comment.

Ling’s role at Binance Labs

In his role as chief business officer, Ling leads M&A and investments at Binance Labs, as well as business development for Binance, according to the firm’s spokesperson. Before joining Binance Labs, Ling was chief financial officer and before that head of corporate development at Bird and Uber, respectively.

Though lean, being affiliated with the largest global crypto exchange — and its roughly 8,000 employees — gives Binance Labs access to a deep reservoir of resources and expertise.

“The Binance brand itself certainly affords us certain opportunities,” Ling said. “The expertise that we bring is much more considerable than a handful of investment professionals.” As well as the exchange’s resources, Ling pointed to Trust Wallet, CoinMarketCap, NodeReal and Binance Oracle as examples of outfits within the Binance ecosystem — the first two brought in via acquisition — that can offer additional technical expertise to Binance Labs’ startups.

In Ling’s view, the businesses Binance Labs incubates and invests in are better able to tailor their products to industry needs.

“How are these new primitives being built? Where is talent flocking to? Where are new thematic elements popping up? And we can help orchestrate a little bit, provide suggestions and guidance to our portfolio companies,” Ling said. “This ecosystem is just so dynamic that having folks in the flow of what’s changing and what’s happening, not yesterday, not the day before but today, I think is quite valuable.”

Rising tides and firewalls

A business of Binance’s behemoth size must be cautious about how its many moving parts fit together. Sam Bankman-Fried’s collapsed crypto empire — at the heart of which resided the exchange FTX and the venture-capital-come-trading-firm Alameda Research — offers a painfully fresh example of how failures of segregation can lead to catastrophe.

Ling is acutely aware of the risks. “In terms of the specific ecosystem support, the listing is separated from what we do,” he said. “The listing piece we certainly keep very, very segregated from the Labs and BNB pieces because of all the reasons you can imagine. But clearly sometimes there will be overlap. The listing focus is on good projects and whether that’s something that Labs has invested in or not, or that BNB is associated with, is frankly from their perspective not material.”

BNB is a cryptocurrency issued by Binance that serves as the native token of BNB Chain, the Layer 1 blockchain formerly known as Binance Smart Chain. Binance Labs has a mandate, through its investments, to bolster activity on BNB Chain.

It runs two incubation programs, biannually. One — the “Most Valuable Builder Program” — is specifically focused on projects building tools on top of BNB Chain. Participants in the accelerator can expect investment, coaching and network support. 1,500 projects applied to participate in the most recent program, according to a Binance Labs blog post. 53% of those projects came from North America and Europe, with 36% were based in Asia Pacific. The chart below highlights the geographical focus of the accelerator, again with the caveat that it is based on publicly available information and may not encapsulate all participants. Details of the Q1 23 cohort are not yet available.

The second incubation program is chain-agnostic, working with startups regardless of what blockchain they choose to develop on. BNB Chain also runs its own investment initiatives to try to foster more activity on the network.

Ling sees Binance Labs’ overarching mission as engorging the entire crypto market — and Binance’s exchange with it.

“Our thinking with Binance Labs is very much this notion that a rising tide lifts all boats,” he said. “We think that the value of that core business is going to dramatically increase as the web3 ecosystem continues to develop — so our role is to help seed that ecosystem and help it mature.”

Tough times

Sadly for Ling, the crypto tide has been going out for at least a year. The collapses of major projects and companies — including but not limited to Terra, Three Arrows Capital, Celsius, BlockFi and FTX — coupled with a broader downturn in macroeconomic conditions, plummeting crypto prices and a broad correction in tech valuations, have all served to severely shake the confidence of retail and institutional investors alike.

The valuations of blue-chip startups in the crypto space have fallen commensurately. The Block revealed in March that shares in companies like Blockchain.com, OpenSea and ConsenSys are trading at steep discounts on secondary market platforms.

Among the venture investors who remain committed to the crypto market, many have styled the past year as a kind of cleansing. Ling agrees.

“These types of moments are not necessarily unhealthy for tech or for web3,” Ling said. “It’s a moment that, number one, washes out some projects that may not have been meant for this world over the long term… I think that it’s allowing a lot of talent to flow from I would say less productive long-term things to more productive long-term things. It’s adding a lot of labor liquidity to the market.”

Binance’s Industry Recovery Initiative

Late last year, many crypto projects were desperately short of liquidity of the more traditional kind. Many had funds stuck in the centralized businesses that had abruptly shuttered — leaving them with shortfalls.

In response, in November, Binance Labs spearheaded a so-called “Industry Recovery Initiative” — to which it committed an initial $1 billion. Jump Crypto, Polygon Ventures, DWF Labs, Aptos Labs, Animoca Brands, GSR, Kronos and Brooker Group also contributed, among others. Its mandate was, according to a blog post, to support promising projects that, “through no fault of their own, are facing significant, short term, financial difficulties.” Hundreds of projects applied for aid through the program.

So far, the IRI has funded 14 applicants, with another 50 to 60 still in the review process, according to Ling. Six months on from its inception, Ling already feels the industry is showing signs of returning to health.

“There are just less companies in need of help. We’re seeing less applications coming in as well, which is a pretty good sign,” he said. “We’re able to deploy against that initiative, but we’re frankly seeing a lot less need for it at the moment.”

How to spend it

In general, Binance’s Zhao appears to enjoy thrusting the company into the role of white knight to an ailing industry — but with a pragmatism that sometimes sees support withdrawn as circumstances change.

In April 2022, days after North Korean hackers stole $540 million in crypto from the sidechain that supports Axie Infinity, Binance Labs rode to the rescue by announcing that it would lead a $150 million investment in Axie Infinity developer Sky Mavis. The plan was to use the funds, alongside Sky Mavis’s own capital, to reimburse victims of the hack. It was seen as a crucial intervention. But a few months later, The Block revealed that Binance had significantly reduced the size of its investment, such that it was no longer the lead investor in the round. A Binance spokesperson said at the time that Sky Mavis had recovered funds and could therefore cover users’ losses “without significant investment from Binance.”

More so than ever, Binance is in a position to consolidate its power through acquisitions — a major focus for Ling and Binance Labs. The company recently re-entered the South Korean crypto market by acquiring a majority stake in Gopax, a local player. Late last year, Binance acquired Sakura Exchange BitCoin to pave the way for its expansion into the Japanese market.

“We’ve had a number of investments of that type over the last few years, and that isn’t primarily focused on returns and lifting all tides. That is much more about fitting strategic elements into our business, or with our business, that help improve the overall Binance exchange,” Ling said.

There are some more outlandish deals in the mix, too, such as the proposed Forbes deal — which is still up in the air — and the investment in Elon Musk’s Twitter takeover. But the focus is on what Ling describes as “strategic” deals.

In terms of timing, Ling admits that “plenty of people would view this as a moment of opportunity,” but adds that Binance wants to be judicious about “how we spread out our resources.”

“It is not necessarily super straightforward to project the future.”

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.