Go to Source

Author: Jamie Crawley

Usage of Ethereum Virtual Machine (EVM)-compatible blockchains hit a new all-time high last week, thanks to consistently high gas fees on Ethereum.

Daily new unique addresses of EVM-compatible blockchains, including BNB Chain, Polygon and Avalanche, peaked at 6.77 million on April 25, according to The Block’s Data Dashboard. The previous record was 6.74 million in 2021.

“Ethereum gas fees are up significantly since the start of the year, leading to growth in EVM-compatible chains,” said Kevin Peng, research analyst at The Block. “EVM-compatible chains provide a consistent experience for users and developers familiar with Ethereum. Growth in these chains can be a proxy for interest in an Ethereum-like user experience on-chain.”

Average Ethereum transaction fees, known as gas fees, have increased by over 250% since the beginning of the year to around $9 per transaction from about $2.50 per transaction in December, according to The Block’s Data Dashboard.

As The Block reported recently, a surge in memecoins trading has led to increased usage of Ethereum-based decentralized exchanges, adding to the upward pressure on gas fees.

BNB Chain and Polygon leading

EVM-compatible chains have lower transaction costs than Ethereum while benefiting from the security and network effects of the larger Ethereum ecosystem. BNB Chain and Polygon, in particular, saw increased usage last week due to their growing ecosystems, according to The Block’s Data Dashboard.

“This surge is driven by new contracts created on BNB Chain. In many cases, projects implement solutions such as gasless, meta transactions, relayer contracts etc., all with the purpose of optimizing gas fees, and sometimes improving the end-user experience. In such a case, we would see new contracts being created specifically for minting, claiming etc. — and it is these new contracts that have led to this spike,” Arnaud Bauer, solution architect at BNB Chain, told The Block.

“Some instances that we saw this time were from 1inch, CyberConnect and XEN-related contracts being the bulk of it,” Bauer added.

Ethereum Layer 2s growing too

Ethereum Layer 2 networks, especially Optimism and Arbitrum, have also grown in usage this year. Daily new unique addresses on both optimistic rollups-based chains have increased since the start of the year, according to The Block’s Data Dashboard.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Go to Source

Author: Omkar Godbole

Druk Holding & Investments (DHI), the commercial arm of Bhutan’s government, and Jihan Wu’s crypto mining company Bitdeer Technologies are seeking to jointly raise up to $500 million for a crypto mining fund.

The fundraising process is expected to begin at the end of this month, the two entities announced Wednesday. Singapore-based Bitdeer will serve as the general partner of the fund and DHI will act as a strategic limited partner.

“The partnership with Bitdeer to launch a carbon-free digital asset mining datacenter represents an investment in a more connected and sustainable domestic economy, helping ensure we are at the forefront of global innovation,” Ujjwal Deep Dahal, CEO of DHI, said in the announcement.

Bhutan has been mining bitcoin for years

Bhutan, a Himalayan kingdom with a population of less than a million people, has been quietly mining bitcoin for the past few years, Forbes reported Friday. DHI, specifically, entered the mining space when the price of bitcoin was around $5,000, Dahal told the local newspaper The Bhutanese last week. Bitcoin is currently trading at around $28,600.

DHI had also borrowed millions of dollars in digital assets from two now-bankrupt crypto lenders BlockFi and Celsius and those dues have been settled, according to Dahal’s comments to The Bhutanese.

DHI’s new partnership with Bitdeer shows Bhutan remains interested in crypto despite recent market turmoil. The project is expected to create local jobs and generate foreign-currency-denominated revenue for Bhutan and its people.

Bitdeer’s Bhutan plans

Bitdeer, a spinoff from Bitmain Technology, a Chinese bitcoin mining-chip manufacturing giant co-founded by Wu, listed on Nasdaq last month through a reverse merger with a SPAC.

The company expects to set up a 100-megawatt mining operation in Bhutan, with construction expected to begin in the second quarter of the year and complete in the third quarter, according to a recent regulatory filing.

Bitdeer is also exploring other sites for the construction of its mining data centers with an initial focus on North America, North Europe, Central Asia and Southeast Asia, per the filing.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri

Ark Invest purchased stock in crypto exchange Coinbase for the second consecutive day, buying roughly $7.5 million of shares.

Yesterday, Ark’s Innovation exchange-traded fund added 112,949 shares, worth nearly $5.8 million at current prices. At the same time, the American investment management firm’s Next Generation Internet ETF added 20,313 shares, worth more than $1 million, while its Fintech Innovation ETF added 13,875 shares, worth over $712,000. Information regarding the purchases comes by way of a trade notification shared today.

Only the day before, Ark Invest purchased roughly $8.4 million in Coinbase stock. The firm had then added 129,604 Coinbase shares to its Innovation ETF. It had also added 23,456 shares to its Next Generation Internet ETF and 15,809 shares to its Fintech Innovation ETF.

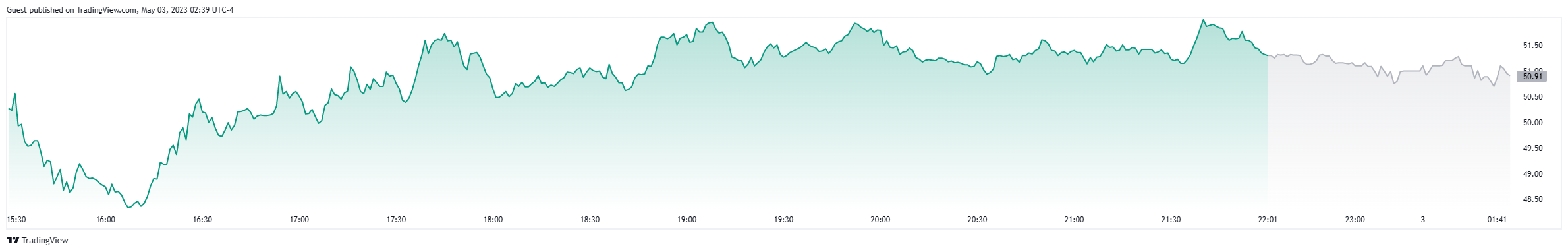

Coinbase’s share price is currently above $51 after seeing a year-to-date increase of over 50%.

Coinbase’s stock price is up more than 2% over its most recent trading. Source: TradingView

Regular buyers (and sometimes sellers) of Coinbase stock, the Cathie Wood-led investment firm also bought nearly $8.6 million in Coinbase stock late last month. That purchase occurred on the same day, April 25, that the publicly traded centralized crypto exchange announced it would be suing the U.S. Securities and Exchange Commission. At the time, Ark’s Innovation ETF purchased 122,083 shares in the company, its Next Generation Internet ETF added 20,327 shares and its Fintech Innovation ETF bought 14,633 shares.

On the same day, The Block also reported that Ark Invest teamed up with 21Shares in another attempt to get a spot bitcoin ETF approved — a result both companies failed to receive from the SEC approval on their previous two applications. The pair’s first attempt came back in 2021, while a second filing was made last May. The SEC rejected the most recent application in January.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James

Go to Source

Author: Shaurya Malwa

Binance USD activity has dropped massively since regulators spotlighted the leading crypto exchange’s dollar-pegged stablecoin.

The number of Binance USD sending and receiving addresses reached fresh two-year lows today, according to data firm Glassnode, which tracked both metrics using a seven-day moving average.

The number of Binance USD receiving addresses has reached a two-year low. Source: Glassnode / Twitter

Binance USD, a stablecoin often known by its ticker BUSD, is a joint project between crypto exchange Binance and financial services provider Paxos.

The decline in Binance USD activity follows Paxos’ receipt of a Wells notice from the U.S. Securities and Exchange Commission in February. The regulator listed BUSD as an unregistered security — a decision Paxos “categorically” disagreed with.

The following month, Binance CEO Changpeng Zhao announced that his exchange would convert the roughly $1 billion remaining from its Industry Recovery Initiative funds to bitcoin, ether and BNB. The crypto assets were to be purchased with Binance USD.

The exchange has also been delisting some Binance USD pairs — such as perpetual contracts for STEPN’s, Near Protocol’s and Avalanche’s native crypto assets.

As Binance USD retreats, tether’s dominance is intensifying

Binance USD once accounted for over $23 billion in stablecoin supply, according to The Block’s data — a figure that has fallen to just over $6 billion today.

Tether’s USDT, meanwhile, currently accounts for more than $82 billion — roughly $50 billion more than second-placed USDC, which is issued by Circle.

By far the dominant dollar-pegged stablecoin in the crypto industry, tether continues to mint new tokens at a relatively rapid pace.

When specifically looking at Ethereum’s stablecoin supply, the total USDT adds up to over 36 billion tokens. USDC accounts for less than 29 billion tokens. Binance USD — as noted previously — totals just over six billion tokens.

The supply of USDT has, some argue, historically helped signal the direction in which the price of bitcoin — or the crypto market as a whole — will trend.

“Generally, Tether issues new USDT when they see and anticipate higher demand for it,” Simon Cousaert, a research director at The Block, explained last month. “This indicates new cash is coming into the system — generally used to buy bitcoin, ether and other cryptocurrencies.”

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Adam James

A new survey produced by Greenfield Capital, the European crypto investor, names Lisbon, Berlin and Paris within a list of the world’s top ten crypto hubs.

Lisbon topped the list of crypto-friendly locations, with half the survey’s respondents listing the Portuguese capital when asked to name three hubs.

Jascha Samadi, co-founder and partner at Greenfield, said in an interview that early-stage crypto outfits are “looking at the world in terms of: what are the risks in my venture?” There is a “clear indication” that startups are now favoring Europe and in particular Lisbon, he added.

The results come amid significant concerns over the viability of the United States as a base for crypto firms, as regulators stateside pile the pressure on both startups and their banking partners.

MiCA seekers

The venture capital firm surveyed 68 founders of crypto projects with a European presence earlier this year on a range of topics.

Of those, 70% identified regulation as the most significant development to watch for the sector over this year. According to the survey, the Markets in Crypto Assets regulatory regime — which was officially passed by lawmakers in April — and the clarity it offers are seen by founders as advantages rather than an obstacle.

“MiCA’s not perfect,” Samadi said, but it offers significant benefits, including “clarity and a clear framework” for centralized companies. “MiCA does tell you a little bit about the thinking of regulators, which is understanding and acknowledging what they don’t yet know well enough, which is DeFi.”

European protocols appear to be reaping the benefits of optimism within the sector locally. An index featured in Greenfield’s survey found that 42 protocols with a strong footprint in Europe boasted 1,300 monthly developers collectively in the first quarter, over 300 more than at the end of last year, based on GitHub data. That is the largest quarterly increase since the tracking began in January 2020 — and it comes despite a punishing year for crypto firms.

Greenfield has raised three funds since 2018. It closed its most recent, a $160 million fund, in November 2021. Samadi said the number of European investments made in that latest fund has “increased massively” compared to previous funds, accounting for up to 70% of its bets.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Ryan Weeks

Go to Source

Author: Parikshit Mishra

MoonPay, the Miami-based crypto payments firm, continues to expand its services with the launch of a retail-facing app.

The app, which has been in testing with 15,000 early access users since March, is now widely available on Apple and Google app stores, according to an announcement this morning.

The app will give users a way to manage multiple crypto wallets and hundreds of different tokens, something MoonPay sees strong demand for among its users, 55% of whom have transacted with three or more wallets.

The app is another departure from MoonPay’s core business model of providing on and off-ramp payments infrastructure for consumer-facing businesses in the crypto space. Since late 2021, MoonPay has also been aggressively expanding into the NFT market — with new products including a concierge service for brokering big-ticket purchases and a platform that helps big brands orchestrate their own NFT drops.

Ivan Soto-Wright, co-founder and CEO of MoonPay, said in a statement that the new app is designed “to provide our millions of customers with a new way to engage with their cryptocurrencies and digital assets and provide the foundation for our leading brand partners and creators to continue their adoption within the web3 ecosystem.”

MoonPay today works with more than 500 partners, including wallets, exchanges and commercial brands.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Ryan Weeks