Go to Source

Author: Omkar Godbole

Go to Source

Author: Camomile Shumba

Go to Source

Author: Shaurya Malwa

Go to Source

Author: Sam Reynolds

Go to Source

Author: Sam Reynolds

Go to Source

Author: Jocelyn Yang

Go to Source

Author: Nikhilesh De

Asset manager Grayscale has filed documents with the U.S. Securities and Exchange Commission for three new ETFs that aim to expand its offerings in the digital asset space.

The registration statement for the Grayscale Ethereum Futures ETF, Grayscale Global Bitcoin Composite ETF and Grayscale Privacy ETF was sent in conjunction with the creation of Grayscale Funds Trust, a Delaware statutory trust structure, that will allow the firm to independently manage its 1940 Act products.

“We are putting the necessary foundations in place so Grayscale can continue creating and managing regulated, future-forward products,” Grayscale CEO Michael Sonnenshein said in a statement.

The move comes while Grayscale has been involved in a lengthy dispute with the SEC after the regulator rejected its proposal to convert its flagship GBTC fund into a spot bitcoin ETF. The company has said it expects a final ruling in the court case by the fall.

While the new registration statement has been filed with the SEC, Grayscale said it has not yet become effective. The Ethereum Futures fund and the Bitcoin Composite ETFs will not invest in digital assets directly.

Grayscale Ethereum Futures

“The Fund seeks to achieve its investment objective primarily through actively-managed exposure to ethereum futures contracts,” Grayscale said in the filing, referencing the Ethereum Futures fund that will “seek to purchase a number of Ether Futures so that the total notional value (i.e., the total value of an underlying asset) of the ether underlying the Ether Futures held by the Fund is approximately 100% of the net assets of the Fund.”

The Bitcoin Composite ETF will seek investment results that track the performance of the Indxx Global Bitcoin Composite Index.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Nathan Crooks

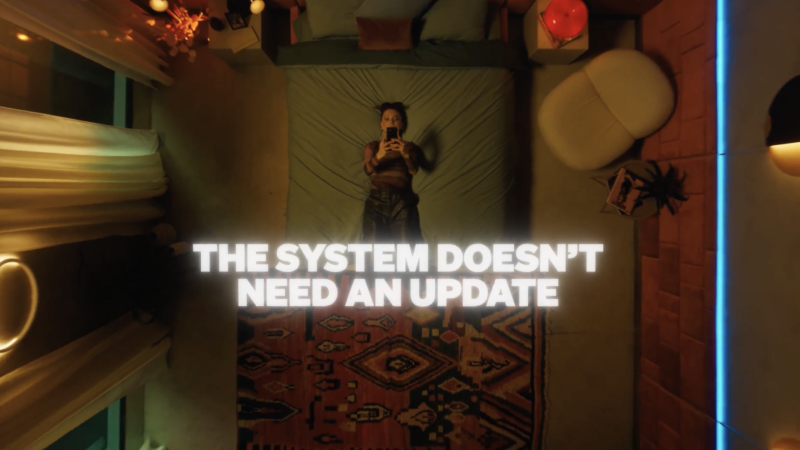

Cryptocurrency trading platform OKX is taking a shot at rival Coinbase with its latest advertising campaign.

While Coinbase declared only a couple months ago in an ad campaign, “It’s time to update the system.” OKX is now saying scratch that, positing instead, “The System Needs a Rewrite.”

Ever since the high-profile collapse of crypto exchange FTX amid various other scandals and liquidity crises, top platforms like Binance, Coinbase and OKX have attempted to cast themselves as the safe option for investors. Trading volumes have also dropped, leading to increased competition for customers.

OKX’s newest marketing campaign.

OKX wants to “change everything”

Rebuking a “broken” system and the “broken” ways of doing business, OKX’s latest 60-second commercial asks the question: “Why don’t we change everything?”

After months of confusion and chaos, key cryptocurrencies like bitcoin and ethereum have rebounded significantly. In recent days, however, memecoins like pepe have dominated headlines, spurring at least some trading volume.

OKX’s new marketing campaign represents a decisive pivot from last year’s self-referential promotion which begged the question, “What Is OKX?”

Despite crypto’s tarnished name, OKX has succeeded in maintaining partnerships with well-known brands like Manchester City Football Club and McLaren’s Formula 1 racing team.

Coinbase advertisement from March.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: RT Watson

Go to Source

Author: Jesse Hamilton