Go to Source

Author: Jocelyn Yang

Go to Source

Author: Qichao Hu

BlockFi plans to liquidate its lending platform and distribute funds to creditors, according to a bankruptcy court filing.

The expected move follows an unsuccessful effort to generate funds to repay creditors by selling the BlockFi platform, court papers say. Lawyers for the bankrupt crypto lender wrote that “given recent regulatory developments, among other things, there may be a lack of meaningful value to be generated from a sale.”

“Therefore, finalizing and consummating a transaction for the BlockFi Platform would not result in an expedient and value-maximizing transaction for the benefit of the Debtors’ creditors,” BlockFi’s lawyers wrote. “Accordingly, the Debtors are proceeding with the Self-Liquidation Transaction whereby the Debtors will distribute their assets to creditors in accordance with the terms of the Plan, followed by a Wind Down of their affairs.”

BlockFi filed for bankruptcy protection last November after the collapse of FTX. Since then, it has been working to sell off valuable parts of its business operations, including its cryptocurrency mine.

The filing, dated May 12, suggested BlockFi could still pursue “an alternative transaction providing for the sale of all, or substantially all, of the Debtors’ assets.” The bankruptcy court must now approve the plan before it moves forward.

The Wall Street Journal first reported the liquidation plan news.

The full court filing can be found below:

Blockfi Filing by MichaelPatrickMcSweeney on Scribd

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Michael McSweeney

Go to Source

Author: Cam Thompson

Go to Source

Author: Aoyon Ashraf

Go to Source

Author: Brandy Betz

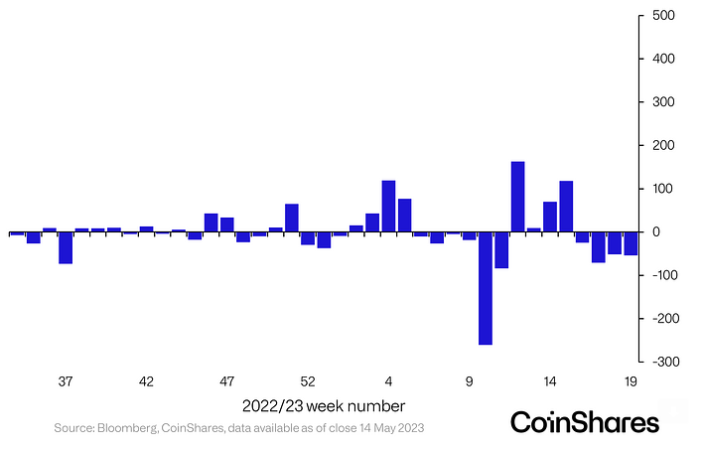

Digital asset investment products saw a fourth consecutive week of outflows totaling $54 million, led as usual by bitcoin, while eight altcoin assets saw inflows.

That suggests “investors are becoming more adventurous,” CoinShares said in its weekly fund flow report.

The most notable inflows were to cardano, tron and sandbox. Binance was the only altcoin to see outflows.

Bitcoin and ether prices were down about 3% for the week. Traditional market indices, including the Nasdaq and S&P 500, were also lower.

Bitcoin saw outflows totaling $38 million, representing 80% of all outflows for the week. “When combined with short-bitcoin outflows they highlight that the recent investor activity has almost solely been focused on the asset,” the firm said.

The outflows were focused primarily in Europe, while 84% of the outflows in the U.S. were from investors selling out of short positions.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Christiana Loureiro

Go to Source

Author: Jamie Crawley

Go to Source

Author: Shaurya Malwa

Binance CEO Changpeng Zhao unfollowed Tesla and SpaceX boss Elon Musk on Twitter, according to a Sunday notification from Big Crypto Alert.

It is unclear why Zhao, commonly known as CZ, has chosen to unfollow Musk. A Binance spokesperson declined to comment on the move, but said Binance’s $500 million investment that it made in Twitter last year remains intact.

Zhao unfollowing Musk on Twitter caught the attention of crypto enthusiasts, raising questions and sparking speculation. A Twitter user that goes by Lucra speculated Zhao unfollowed Musk because Twitter recently partnered with eToro instead of Binance, “even though it was CZ who helped fund his acquisition of Twitter.” Last month, eToro announced a deal with Twitter that enables the social media giant’s users to see real-time prices for a wide range of stocks, crypto and other assets, as well as offering the option to invest through eToro.

Musk doesn’t follow Zhao on Twitter, but it isn’t clear if that has always been the case.

Binance’s $500 million investment in Twitter remains intact

Binance invested $500 million in Twitter last October, aiding Musk’s $44 billion acquisition of the social media site.

“We’re excited to be able to help Elon realize a new vision for Twitter,” Zhao said at the time. “We aim to play a role in bringing social media and web3 together in order to broaden the use and adoption of crypto and blockchain technology.”

Last week, Musk named Linda Yaccarino as Twitter’s new CEO. He said he would transition to other roles, including product design and new technology, while the former head of advertising at NBCUniversal led the business.

Together, they aim to transform Twitter into Musk’s sought-after “everything app,” dubbed X.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri