Binance CEO Changpeng Zhao expressed surprise that dogecoin had not yet faded away and said Tesla boss Elon Musk might have played a role in extending the memecoin’s lifespan.

“One memecoin that really surprised me was actually dogecoin. It has had a super long-lasting power. I thought it would have disappeared a long time ago. But Elon Musk latched onto it and extended its life maybe,” Zhao, commonly known as CZ, said in a Twitter Spaces “ask me anything” session on Wednesday.

Crypto markets have been hit by a renewed bout of memecoin speculation in recent weeks, led by the likes of pepe and ladys. The exchange boss said he doesn’t understand the appeal and is not a memecoin or NFT holder as he prefers tokens with utility.

“It is what it is,” Zhao said. “Right now it seems to be popular. But having said that I do think there’s very high risk.”

Still, Zhao said he’s not against memecoins. Binance, in fact, lists them, having recently supported pepe, he added. “We tend to follow what our users are active at,” Zhao said.

Elon Musk endorsing and pumping Dogecoin

Dogecoin was one of the first ever memecoins, created in 2013. It was initially developed as a joke by software engineers Billy Markus and Jackson Palmer. The token is styled on the popular “doge” internet meme, which features a shiba inu dog with captions written in broken English.

Musk has been a vocal supporter of dogecoin and continues to tweet about the memecoin. He first tweeted about the token in 2019, saying: “Dogecoin might be my fav cryptocurrency. It’s pretty cool.” In 2021, Musk posted a picture based on the movie “Lion King” which showed him holding up a shiba inu.

The billionaire owns dogecoin, along with bitcoin and ether, according to his tweets from last year. Musk even bought some dogecoin for his youngest son, X Æ A-Xii, in 2021. Last year, Tesla began allowing customers to buy select merchandise items using dogecoin. The carmaker also holds the memecoin along with bitcoin. As recently as last month, Musk temporarily replaced the blue Twitter bird icon with an image of the doge dog.

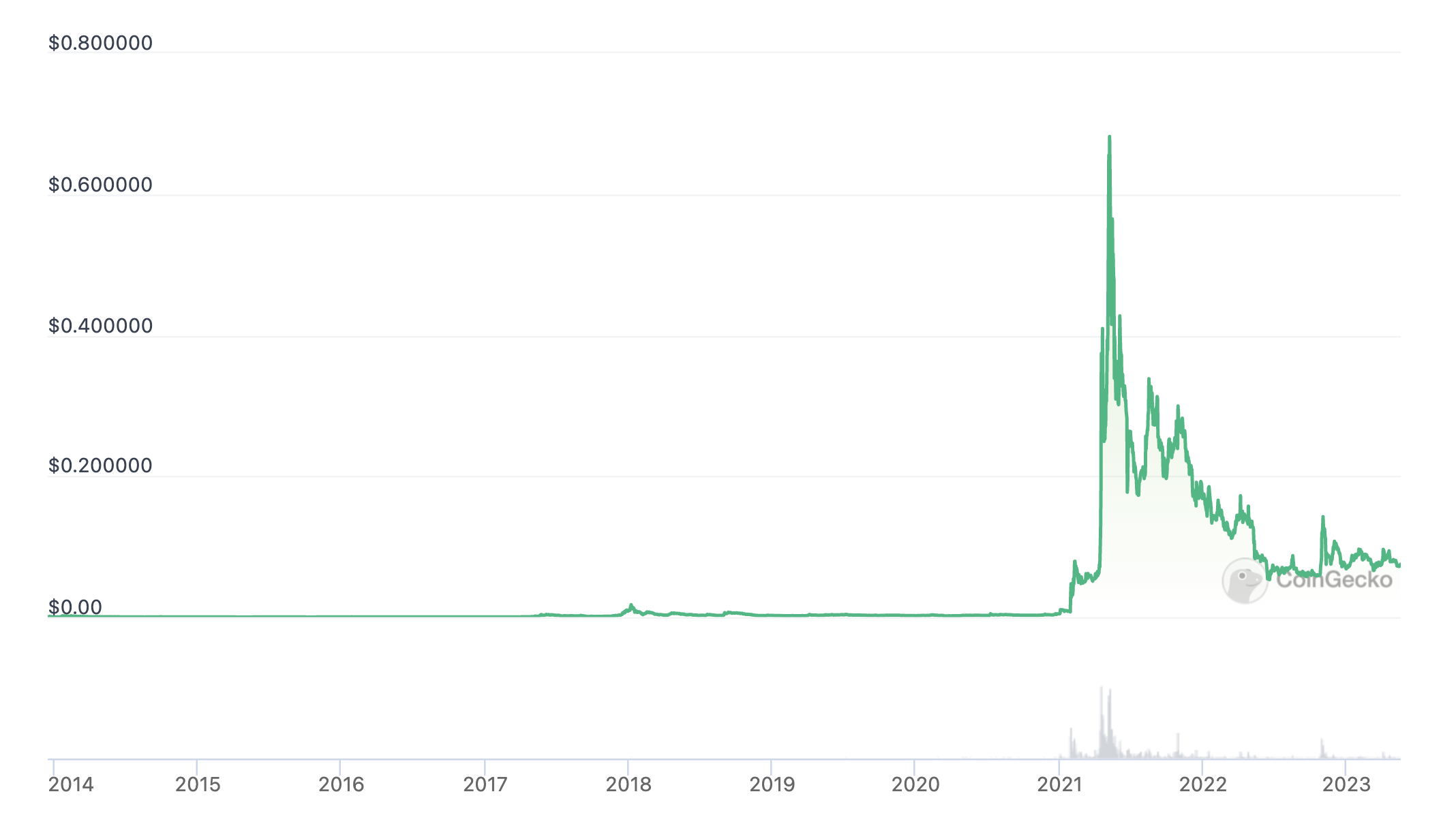

Musk’s tweets about dogecoin have sent the token’s price jumping on many occasions. Dogecoin is currently the ninth largest cryptocurrency in the world, with a market capitalization of over $10 billion, according to CoinGecko data. It is currently trading at around $0.07.

Binance’s Zhao, however, personally prefers “tokens with a utility,” he said in the AMA session. He said a token’s “utility value is probably the strongest value.” Zhao only holds bitcoin and Binance’s native token BNB, according to his Twitter bio.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri