Crypto exchanges have been under pressure recently, with a broader liquidity slump and pull back from large trading firms pulling back from the market.

But the volume slump that’s plagued venues like Coinbase and Binance has not befallen their decentralized counterparts to the same extent. Indeed, whilst the seven day moving average for centralized crypto exchanges hit their lowest level of the year this week, decentralized exchange volumes are on track this month to come in at the same level as April.

Meanwhile, The Block’s DEX to CEX ratio — which tracks the volumes of decentralized exchanges relative to centralized venues — is at an all-time high, hitting over 20% for the first time.

Traders flocking to DEXes

One Crypto Twitter personality, @BasedKarbon, points to memecoin mania to explain the switch in preference toward DEXes.

“The limited number of market participants went back to DEX trading amid Memecoin mania,” he noted in a direct message to The Block.

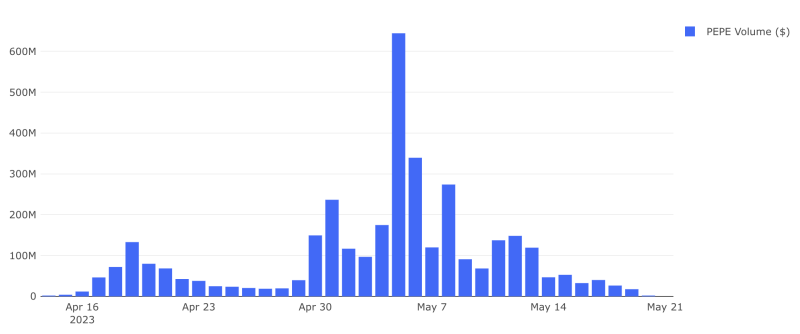

Indeed, centralized exchanges were slow to list memecoins like Pepe. Coinbase, for instance, still does not support trading in the token, while Binance took several weeks to list the crypto after it became a market zeitgeist. But traders didn’t wait around for these listings, having already turned to DEXes — with Pepe volumes on Ethereum-based DEXes surging above $600 million on May 5.

Some centralized exchanges are, however, trying to get in on the memecoin action. Justin Sun, owner of Poloniex and and advisor to Huobi, told The Block that his teams are quickly listing as many memecoins as possible.

“The memecoin narrative has contributed a lot of the revenue on Huobi Exchange,” Sun said. “The top ten tokens, at least four of them are the most tradable assets on Huobi, like four of them are our memecoins.” Sun has also said he plans to start trading memecoins in his personal wallet — although it’s hard to see among all the random tokens being sent there by onlookers.

With reporting from David Quinton.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro