Coinbase’s stock price has been on a tear since BlackRock’s surprise spot bitcoin ETF filing, but the enthusiasm underpinning the rally may be short lived, according to one analyst who covers the company.

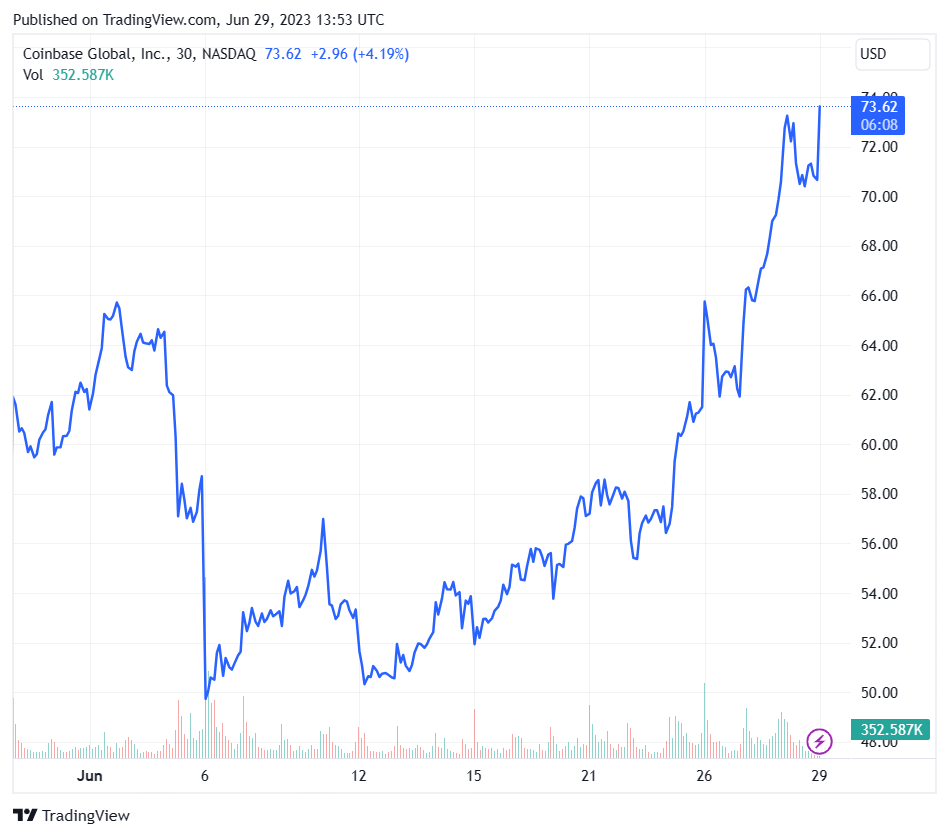

The company’s stock has appreciated from around $52 per share on June 15 to $71 per share at the time of writing, paring all losses since the US Securities and Exchange Commission announced its lawsuit against the exchange earlier this month.

A chart showing the Coinbase stock price. Image: TradingView.

The rally is underpinned by a broader comeback in the crypto market kicked off by a flurry of ETF filings from companies ranging from asset management firm WisdomTree to crypto-native firms like Bitwise.

Still, Berenberg Capital Markets’ Mark Palmer said in a note to clients that the enthusiasm around COIN “may prove short-lived.”

The analyst, who has a hold rating for the stock with a $39 price target, said “investors looking at COIN as a play on increasing engagement by institutions with the digital asset ecosystem should first consider the risks the company is facing that could give rise to negative headlines in the near future that would trigger a reversal of the stock’s recent gains.”

Coinbase’s staking rewards program

Berenberg pointed to the likelihood of decreased revenues from a potential cease and desist orders on Coinbase’s staking rewards program. Coinbase is up against as July 4 deadline across several jurisdictions in the US to mollify regulatory concerns around its staking program.

In Palmer’s view, the downside risk of staking revenue losses is larger than the upside of Coinbase’s partnership with BlackRock.

The analysis, however, does not consider the breadth of Coinbase’s ETF relationships. The firm is playing a key role in the ETF race, participating in surveillance sharing agreements as well as custody relationships for several issuers on their funds, according to sources at the firm. It will also serve as a custody provider for BlackRock’s fund.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro