Go to Source

Author: Bradley Keoun

Go to Source

Author: Sam Reynolds

Three Arrows Capital co-founder Kyle Davies said that karma is guiding him to give back to his creditors.

Davies, in a lengthy Twitter Spaces event on Monday, said he’d use the new OPNX crypto trading platform he co-founded with Mark Lamb to “donate” funds back to 3AC creditors, if they get in early.

“We’ve set up the first ever shadow recovery process,” Davies explained. “This SRP is a way for Su and I to donate to creditors which are early and supporting. If there are some that don’t want to deal with us, then they don’t have to.”

“And also this is entirely separate from the liquidation,” he added. “Teneo is the liquidator. They will sell the firm’s assets and distribute it to creditors separately. But we have a number of creditors who were early that are whole or more already. And we have this process where we will donate over time. Again, entirely voluntary. This is something that we want to do. And it’s only for people who wanted to participate. If they don’t want to, they don’t have to. But if they do, and they want to get involved, and the supported us before and the want to support us in the future, then by all means…”

More OPNX questions

“Are you trying to get people to buy a security?” Bitcoiner Simon Dixon chimed in asking.

“No no no,” Davis insisted. “Su and I are donating future earnings to this process. There’s no token here.”

“There’s no tradable asset here?” crypto trader Ran Neuer asked.

“No, not at all. There’s no token here.” Davies said. “When thinking about life philosophies with Mark and Su, one of the things we really believe in is karma and something greater than all of us. For some people, that can be religion, philosophy, but we have this in common that there’s something greater. And so we very much believe that if we do good and we say, to creditors who lost money, they have a way to make more back. If we do bad and they do well, then that’s great. And that’s good karma, or whatever you want to call it.”

Three Arrows Capital filed for Chapter 15 bankruptcy protection on July 1, 2022. Court filings revealed that the firm owed $3.5 billion to 27 crypto firms, and liquidators are seeking to obtain $1.3 billion in funds from Davies and Su personally.

(With reporting assistance from Sarah Wynn.)

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov

Go to Source

Author: Cam Thompson

Weekly inflows into crypto asset management products were strong for the second week in a row, with CoinShares reporting $125 million coming into the industry last week.

That brought total inflows into such products to $334 million over the past two weeks, according to the European asset manager.

Source: CoinShares

Bitcoin investment products accounted for the vast majority of inflows, with more than 98% of the funds tied to the largest cryptocurrency by market capitalization.

Short-bitcoin investment products, meanwhile, witnessed outflows of $0.9 million.

The past two weeks of inflows marked a swift turnaround for the sector, which up until the middle of June saw several weeks of outflows. The shift has been underpinned by a wider rally in the market that kicked off after a flurry of filings for new spot exchange traded funds that are now awaiting review by the U.S. Securities and Exchange Commission.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

The number of large holders in CME’s bitcoin futures market has been surging over recent weeks, according to data compiled by The Block.

The number of holders who maintain a futures position of at least 25 bitcoin increased from a recent low of 94 during the week of May 30 to 121 in the week of June 27, according to data provided to the U.S. Commodities Futures Trading Commission. That’s just shy of a peak of 122 reached at the end of March.

The increase in CME’s market has been underpinned by a broader rally in crypto, which kicked off after asset manager BlackRock filed for a spot bitcoin exchange traded fund on June 15.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Bored Ape Yacht Club has long been considered the marquee brand in non-fungible tokens with nearly $3 billion in sales since early 2021.

But the decline of the collection’s floor price — the lowest registered selling price for one of the NFTs — hit a somber milestone on Sunday when it fell to about 27 ETH (roughly $53,000), according to NFT Floor Price. That’s the the lowest point since August 2021.

While many NFT watchers have taken to Twitter to speculate about what’s happening with Bored Apes, the simplest explanation might also be the best, argues The Block Research analyst Brad Kay.

“Prices in any market are set by the marginal buyer and seller, and in the current scenario, there appears to be a scarcity of buyers,” said Kay, who added that larger holders of Bored Apes dumping the tokens can also negatively impact price.

Bored Ape liquidity

One major Bored Ape holder known as Machi Big Brother — or Jeffrey Huang in real life — has been making waves recently by selling a large number of the NFTs on the Blur marketplace in an apparent effort to score bonus tokens the marketplace offers traders.

Blur token incentives aside, the NFT market is, by many measures, weak and lacking liquidity, which has in turn driven prices down. Across the board pricing for top-shelf collections like Doodles, Azuki and CryptoPunks have suffered.

“Liquidity merely amplifies reality. If there is no demand for your JPEG, price goes down until there is,” posted Twitter user @0xak_, a self-proclaimed NFT enthusiast with more than 11,000 followers on the social media platform.

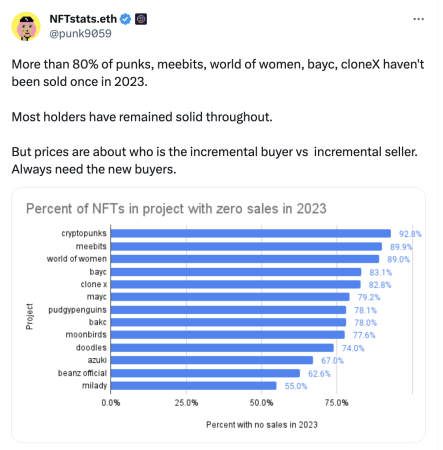

NFT statistician and market watcher NFTstats.eth, or @punk9059, also took to Twitter over the weekend to publish data that provided some insight into the market’s lack of liquidity. Using a chart to demonstrate, NFTstats.eth said that “more than 80%” of NFTs in top collections like Bored Apes and CryptoPunks “haven’t been sold once in 2023.”

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: RT Watson

Go to Source

Author: Eliza Gkritsi, Rosie Perper

Ola, a privacy-focused web3 startup, raised $3 million in seed funding.

Web3.com Ventures and Foresight Ventures co-led the round. Additional support came from Token Metrics Ventures, LD Capital, Catcher VC and others.

Ola experiments with a hybrid zero knowledge rollup called “ZK-ZKVM” that aims to offer optional privacy in the crypto industry.

“Our ultimate goal is to make privacy a fundamental right in the digital age, especially for web3 users,” Ola CEO Ocean Chen said in a statement. “With Ola’s full-featured ZK-ZKVM, developers can harness the potential of privacy-centric applications that prioritize user control and data protection.”

Ola is currently not available to the public. It intends to launch a beta testnet in the third quarter and release a public testnet by the end of 2023.

© 2023 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: MK Manoylov

Go to Source

Author: Elizabeth Napolitano