Go to Source

Author: Sandali Handagama

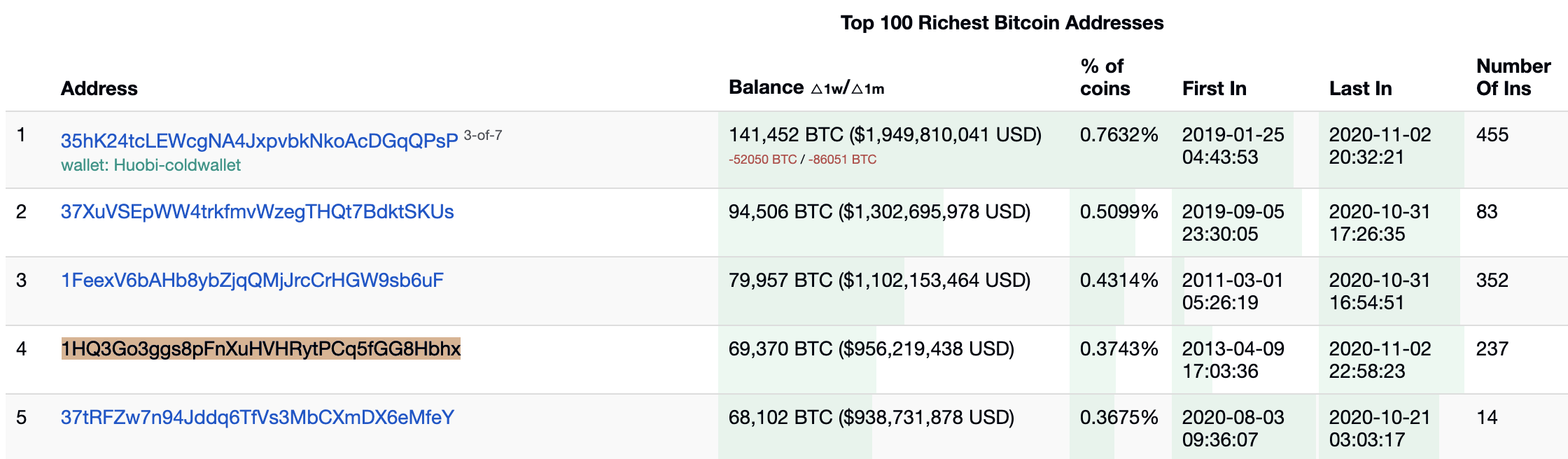

69,369 bitcoins, worth approximately $955 million, just moved out of wallet address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx, the fourth-largest bitcoin wallet according to BitInfoCharts.

This is the first outflow activity of the wallet since April 2015. Vice previously reported that the address has been passed among hacker circles in an attempt to crack the wallet and access the bitcoins inside.

This piece has been updated with a link to the 2015 outflow from the wallet

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: The Block

69,369 bitcoins, worth approximately $955 million, just moved out of wallet address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx, the fourth-largest bitcoin wallet according to BitInfoCharts.

This is the first outflow activity of the wallet since April 2014. Vice previously reported that the address has been passed among hacker circles in an attempt to crack the wallet and access the bitcoins inside.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: The Block

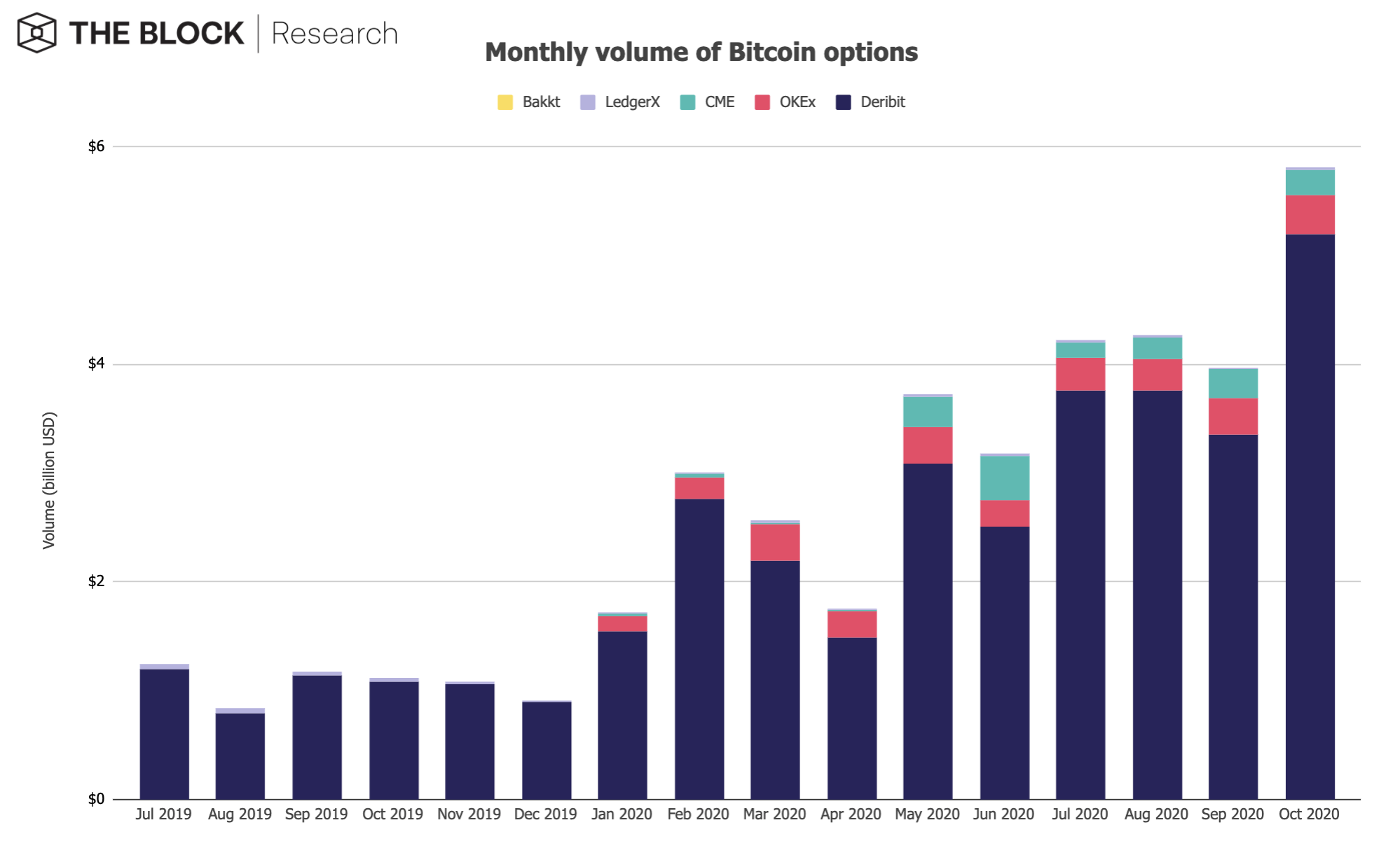

Bitcoin options interests reach new heights in October, according to data compiled by The Block Research.

The aggregated open interest of bitcoin options reached an all-time high of $2.4 billion by the end of October, a month-over-month increase of 54.7%. On October 29, the open interest of Bitcoin options hit a new daily all-time high of $2.6 billion.

Source: skew, The Block Research

The monthly volume of bitcoin options reached a new all-time high as well. It increased by 46.4% on a month-over-month basis from $3.9 billion to $5.8 billion.

Source: skew, The Block Research

Deribit continues to maintain its dominance in the bitcoin options market, making up 89.5% of last month’s volume.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: The Block

Go to Source

Author: Brady Dale

Go to Source

Author: Nathaniel Whittemore

The 2020 U.S. election has been a boon for decentralized prediction markets, according to data compiled by The Block Research.

On Augur, open interest recently passed $4 million, primarily driven by Catnip.exchange, a simple end-user interface for Augur’s U.S. election market. According to The Block researcher Mika Honkasalo, open interest on Augur has been steadily increasing by over $1 million or 25% daily, leading up to election day.

Polymarket, a popular newcomer in the prediction markets space, also benefited from the U.S. election, with its election-related markets receiving over $3.5M in trading volume — roughly 91% of total volume on the platform.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: The Block

Go to Source

Author: Zack Voell

Quick Take

- ‘Fiat Freeway’ is a weekly column on the latest updates for central bank digital currencies (CBDCs) and Stablecoins.

- This week’s column looks at recent developments with the European Central Bank’s ‘digital euro’ initiative.

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Mike Rogers

Quick Take

- This research piece is a compilation of different metrics across projects — including stablecoins, lending, DEXs, derivatives, privacy solutions, and more

- In October 2020, most DeFi related metrics were slightly down compared to September. E.g. DEX volumes decreased by 26.3%

- Due to 2020 election betting markets, the fastest growing sector in decentralized finance have recently been prediction markets

This research piece is available to

members of The Block Genesis.

You can continue reading

this Genesis research on The Block.

Go to Source

Author: Mika Honkasalo