Go to Source

Author: Colin Harper

Go to Source

Author: Kevin Reynolds

Go to Source

Author: William Foxley

Go to Source

Author: Kevin Reynolds

Shayne Coplan thinks information markets are the future, and with the recent influx in volume to his platform Polymarket, it seems they are quickly becoming the present.

In recent weeks, the prediction market platform has done millions in volume with its various election markets, which span from the U.S. presidential election to state calls. The platform’s “Will Trump win market?” has surpassed $8 million in volume.

As the U.S. presidential election grew ever-tighter on November 3 and 4, many crypto-minds noted that Polymarket’s odds more accurately reflected the outcomes compared to traditional models like Nate Silver’s FiveThirtyEight.

Coplan says he has no doubt in the growing future of prediction markets, and on this week’s episode of The Scoop, he laid out why he believes markets are the most reliable source of sentiment data. He also touched on:

- How he went from early Ethereum adopter to founder of a company

- Why he believes markets are superior to polls, and how prediction platforms can change the way information is interpreted

- Where Polymarket sits on the sliding scale of decentralization and what that means for compliance

- How Polymarket’s second version is lowering the barrier to entry and what tools are making adoption easier

- What’s next for Polymarket after the U.S. presidential election resolves.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

The Department of Justice (DOJ) has seized $24 million in crypto after a request from the Brazilian government.

The funds are allegedly tied to a crypto investment scheme that defrauded more than $200 million from tens of thousands of Brazilians.

Brazil issued the seizure of crypto funds held in the U.S. by Marcos Antonio Fagundes, who is facing multiple charges in Brazil, including illegally operating a financial institution, securities violations and money laundering.

Fagundes allegedly operated a scheme that offered investments in cryptocurrencies over the Internet and in person. The defendants allegedly solicited these investments in Brazilian reals or crypto and promised to invest the cash into cryptocurrencies for a return.

The Brazilian government contends very little was invested and those targeted saw very little return. The government contends Fagundes and his partners made false and inconsistent promises about the offered investment plans and expected returns.

The U.S. seized Fagundes’ U.S.-based holdings as part of the Treaty between the United States of America and the Federative Republic of Brazil on Mutual Legal Assistance in Criminal Matters, according to a Wednesday press statement.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Aislinn Keely

Go to Source

Author: Daniel Cawrey

As voters across the U.S. cast their ballots for their future president, CME Group’s bitcoin futures market revved up, according to data shared with The Block.

The market, which launched in 2017, saw overnight trading in the contract hit 6,700 (the equivalent of 33,500 bitcoin in value) — 75% higher relative to the average figure for the year.

Ahead of the election, the number of large reportable open interest holders — institutional investors who hold an open position of at least five contracts — increased to 102, a 20% increase over October.

As noted by my colleague Ryan Todd, the number of large open interest holders in CME’s bitcoin futures is impressive relative to other products.

Here’s Todd in a past column explaining the significance of CME’s having what was then 74 large open interest holders for its bitcoin futures:

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro

Go to Source

Author: Kevin Reynolds

The nail-biter of a 2020 U.S. presidential election is one for the history book — and it’s technically not even over.

Fueling the intensity of the battle were nascent new crypto-native prediction markets, including Polymarket and FTX, which both offer a spot for traders to place bets on whether President Donald Trump or former Vice President Joe Biden will be the one to clinch an electoral victory.

Volumes for these markets surged over the course of the last several trading days ahead of the election. Polymarket, which offers information markets for the election as a whole and well as for specific state results, saw cumulative volumes for its Trump market jump above $8 million, as per data compiled by The Block.

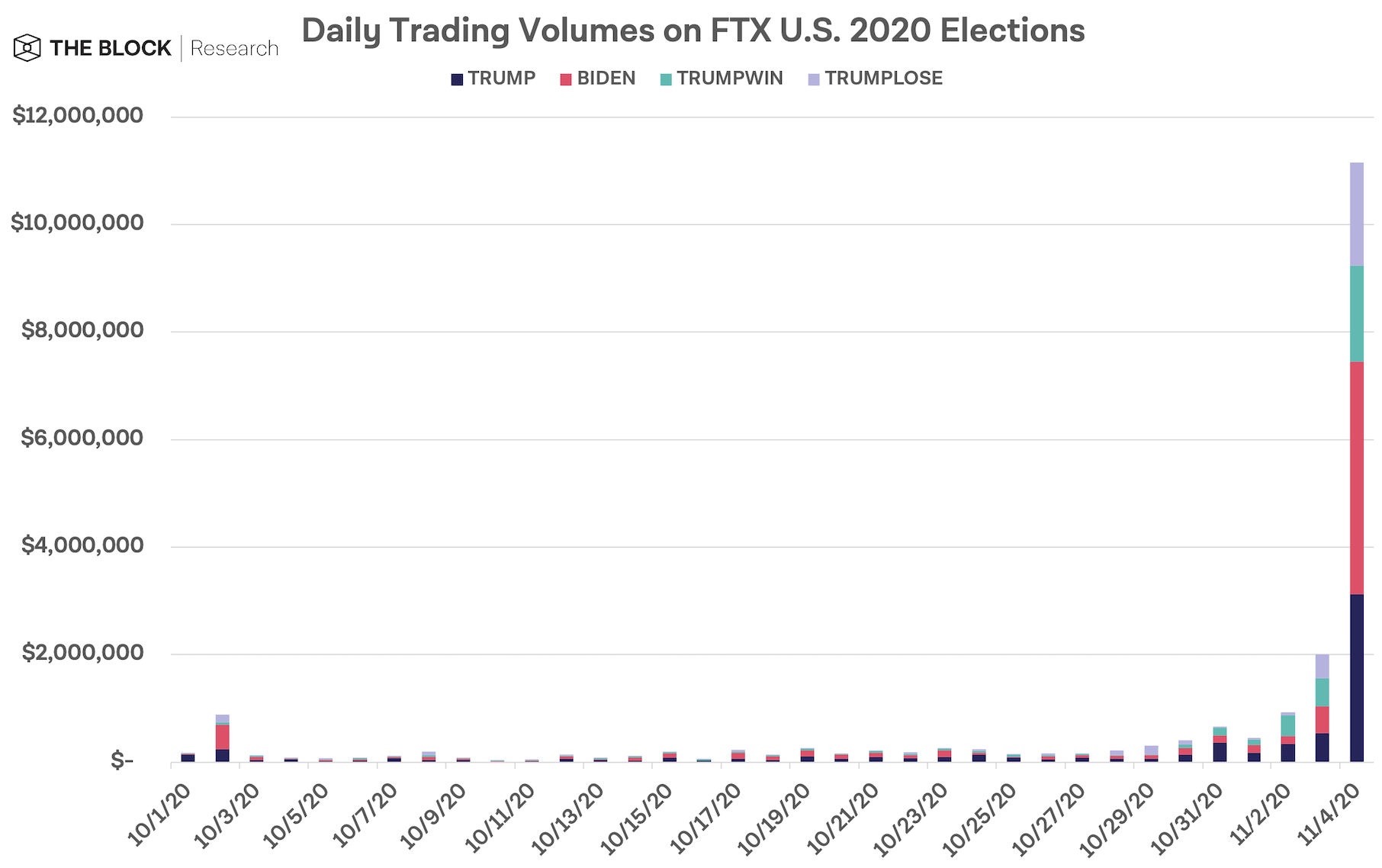

Daily volumes for the FTX U.S. 2020 election — which spans contracts tied to both Trump and Biden — soared above $10 million on November 4, according to data pulled from TradingView.

Traders engaging with this market naturally have to pay a fee to participate. For FTX, specifically, the addition of the political market added an additional revenue stream for the Hong Kong-based firm, a high-up source at the company told The Block.

The source, who declined to speak on the record, said that the company was still dealing with limited data given the official election results are still pending.

Still, the person estimates that when all is said and done, the firm could rake in approximately $1 million in fees from its election-related trading products.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Frank Chaparro