More than 30 major Japanese firms, including banks, are set to trial a common, private digital currency next year to improve payments.

Japanese crypto exchange DeCurret, a member of the group, announced the news on Thursday. Other members of the initiative include the top three Japanese banks — MUFG, Sumitomo Mitsui, and Mizuho — as well as several other financial and retail companies.

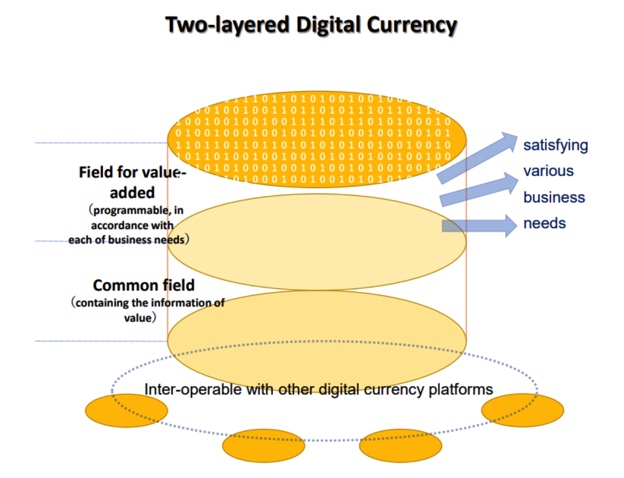

Together, they all plan to test a “two-layered digital currency” model that has a common area, the core function of a blockchain-based digital currency, and an additional area, which implements business logic and smart contracts, to maximize programmability. This model would contribute to the development of the Japanese economy, according to the group.

“This ‘two-layered’ digital currency will not conflict with existing digital payment instruments (e.g., electronic money, credit, and debit cards), centralized payment infrastructure (e.g., the Zengin system), or studies on CBDCs [central bank digital currencies],” said the group. “Rather, the two-layered digital currency will be able to enhance inter-operability of these payment platforms through ‘bridging’ them.”

Other group members include Japanese telecommunications giant NTT, Accenture Japan, Daiwa Securities Group, and Nomura Holdings. Observers of the initiative include government agencies of the country, such as the Bank of Japan and the Financial Services Agency.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Go to Source

Author: Yogita Khatri